I have been following the universal, wireless broadband vision furiously at this blog over the months. First Wimax, then xMax, but someone has come up with an idea that goes over the curve for its simplicity and practicability. And I read about that in the news earlier today, and only an hour earlier I ended up doing a technorati search on

my Nepal blog, and it appeared that some Rebecca Mackinnon has been linking to my blog posts quite a lot, and from a

respectable, experimental Harvard blog too. So I googled her, found her email address and emailed her to say thanks: all that helps the movement back there, I said. Then I proceeded to read a little of her,

and bam, there she was, she sits on the board of this hot company.

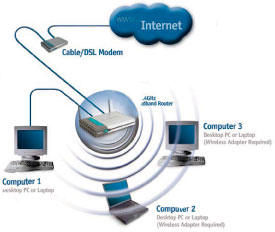

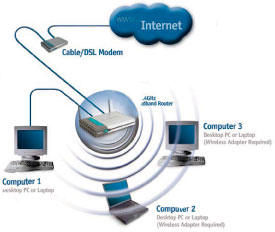

My friend Martin Varsavsky has just made an exciting announcement: his new Wifi startup, FON, has received investment and backing from Google , Skype, Sequoia Capital, and Index Ventures. ........ (Disclosure: I am a member of FON's U.S. board of advisors) ......... Three months after Martin launched FON on his blog, the $21.7 million dollars worth of funding shows tremendous support for FON's vision: a global community of people who share WiFi connections, known as "Foneros" in a tribute to the company's Spanish origins.

Wow. This is quite circuitous, don't you think?

RConversation

RConversation: Microsoft takes down Chinese blogger

Techjournalism News :

Rebecca MacKinnon

North Korea zone

Rebecca MacKinnon - Berkman Center for Internet & Society

North Korea zone

IT Conversations: Newbies - Bloggercon III

Blogging, Journalism and Credibility

CJR Daily: Rebecca MacKinnon, Pretend Tourist No More

FON In The News

Speakeasy: No deal with FON, despite what FON says Seattle Post Intelligencer

Google, Skype Make Wi-Fi FON Red Herring

FON Raises $22 Million for Open Wi-Fi Access Sharing Converge Network Digest

FON Raises $21.7M Light Reading

Fon takes Freenet cue for WiFi hot spot plan Globe and Mail, Canada

02/07/06 1:45 AM Update. I just saw someone on the FON Board who I have met personally when the guy was running for New York City Public Advocate. We had a brief conversation at the MeetUp.com headquarters hosted by Scott, the CEO. (Social Networking: Where The Internet Comes Down From The Clouds, MeetUp, LinkUp)

Andew Rasiej is the Founder and current Chairman of MOUSE. He has also served on the New York City Board of Education’s task force on technology and has spearheaded several innovative projects that support efforts to bridge the "Digital Divide" in public education. He truly believes in the need for WiFi as a way to empower citizens to do more then connect to the internet and read email.

Andew Rasiej is the Founder and current Chairman of MOUSE. He has also served on the New York City Board of Education’s task force on technology and has spearheaded several innovative projects that support efforts to bridge the "Digital Divide" in public education. He truly believes in the need for WiFi as a way to empower citizens to do more then connect to the internet and read email. Rebecca MacKinnon was one of CNN’s youngest Bureau Chiefs (China, fluent in Chinese), named as a Global Leaders of Tomorrow by the World Economic Forum. She left CNN and became a fellow at Harvard’s Berkmen Center and founded Global Voices with Ethan Zuckerman.

Rebecca MacKinnon was one of CNN’s youngest Bureau Chiefs (China, fluent in Chinese), named as a Global Leaders of Tomorrow by the World Economic Forum. She left CNN and became a fellow at Harvard’s Berkmen Center and founded Global Voices with Ethan Zuckerman.

2:33 AM Update:

2:33 AM Update: Browsing around I bumped into this: WiFi Phone. In the works. It's all coming together: the chips are falling in place. The Skype people have funded FON, and Netgear is to carry Skype. The dots are connecting. (

Internet Phones, Video Blogging, Nano)