“Facebook Is Offline in West Texas”

A short story by a confused New Yorker

When I first moved from New York City to Midland, Texas, I thought I had accidentally stepped into an old sepia photograph that refused to update. The air was so dry it crackled like vinyl, and the land stretched so far that I started to suspect the horizon was on some kind of performance-enhancing drug. You don’t see distances like that in New York. In the city, you’re lucky if you can see past the next food cart. Here, you could see forever—which, for a New Yorker, is frankly unsettling.

The first culture shock hit before I’d even unpacked: Facebook. Back home, Facebook was practically an Olympic sport—everyone friended everyone, sometimes twice by accident. But in Midland, Facebook was offline. No, seriously—people treated it like a church bulletin that only existed once you’d earned your pew. You don’t send a friend request unless you’ve shared at least two briskets, one sunset, and a secret. People formed groups in person first. They’d barbecue, drink, laugh under the Milky Way (which I thought was a myth invented by Hershey’s), and then—only then—would someone say, “You know, maybe we should make a Facebook group.”

In New York, that would’ve been backwards. We’d start a Facebook group first, then spend the next six months avoiding actually meeting.

The second shock came around 11 PM my first night, when I decided to get a late bite. In Manhattan, 11 PM is basically lunchtime for insomniacs. You can get sushi, Ethiopian, or a lobster roll served out of an old ambulance if you walk three blocks. In Midland, I walked three blocks in every direction, and all I found were locked doors, sleeping tumbleweeds, and one raccoon who looked offended that I was interrupting his shift.

I finally stumbled into a gas station, half delirious, and grabbed a granola bar that looked like it had survived three presidencies. The clerk—kind, quiet, wearing a belt buckle the size of my apartment—said, “Y’all just get in?” I nodded. “Welcome,” he said. “It’s real peaceful here.”

Peaceful. That word hung in the air like a church bell. In New York, peace is something you pay $2,800 a month for and still hear sirens through.

Then there was the hat incident.

In the city, I wore hats. Not cowboy hats, obviously—more like “artsy fedora meets existential dread.” But in Midland, I thought, when in Rome, etc. So I bought a broad-brimmed cowboy hat. It was a good hat—wide enough to throw shade on Wall Street.

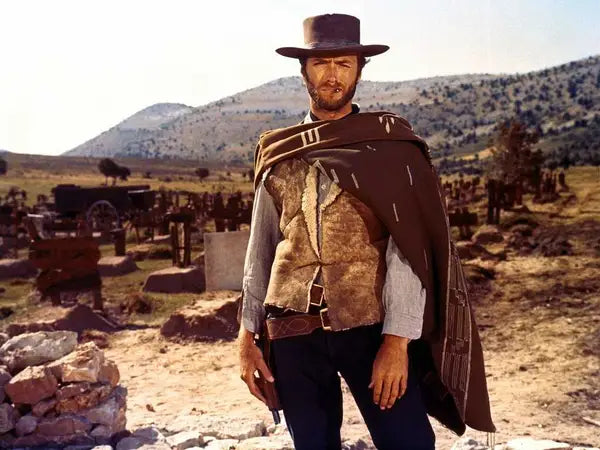

Turns out, no one wears hats anymore in Midland. The whole cowboy aesthetic, apparently, had retired sometime around the Bush administration. I walked into a diner, feeling like Clint Eastwood, and everyone looked at me like I’d just time-traveled from a spaghetti western. A waitress even asked, “You in a play, honey?”

I muttered something about "East Coast fashion" and ate my chicken-fried steak in silence, trying to remember if it was possible to resign from one’s hat mid-meal.

Then there’s the driving. Lord, the driving.

In New York, we measure travel in subway stops or emotional trauma. In Midland, distance is measured in hours. I met a guy who said, “Gonna go have coffee with my cousin. She’s about four hours up.” I blinked. “You mean… flight?”

He laughed. “Nah, just a quick drive.”

They think nothing of it. Four hours one way, four hours back. Eight hours total—for coffee. In New York, that’s two state lines, three toll booths, and an existential crisis. Here, it’s a morning errand.

And the roads—straight as truth and just as lonely. You can drive for twenty minutes without seeing another car, just the occasional oil rig bobbing its head like it’s agreeing with something only God said.

The landscape is a whole other story.

The Hudson Valley has its fiery autumns—red, gold, and orange leaves falling like confetti after a Broadway finale. West Texas, though? It’s always Fall here. The grass is permanently yellow, the trees are introverts, and the sunsets could make poets quit their jobs out of humility. The sky doesn’t end; it just forgets to.

At night, you can actually see stars. Stars! In New York, the only stars are Yelp reviews. Here, they spill across the sky like someone shook glitter over a black canvas. The first night I saw them, I nearly called 911. I thought something had exploded.

And then there’s religion.

Back in New York, I knew maybe two people who went to church—and one of them went ironically. In Midland, it’s the opposite. Nine out of ten people go to church, and the tenth one is just late. On Sundays, the whole town moves in slow motion, everyone dressed neatly, smiling at strangers like they’ve all agreed to be extras in a small-town Hallmark movie.

I went once. The pastor asked where I was from. I said, “New York.”

He paused. “We’ll pray for you.”

So here I am: a New Yorker in West Texas, a man of sidewalks in a land of sky. I’m learning to drive four hours for coffee, to earn my Facebook friends by attending barbecues, and to stop expecting the city to wake up after 9 PM.

Every night, I step outside, hat in hand, look up at the Milky Way, and laugh.

Because in New York, we say the city never sleeps. But out here, the stars never do.