Key Points

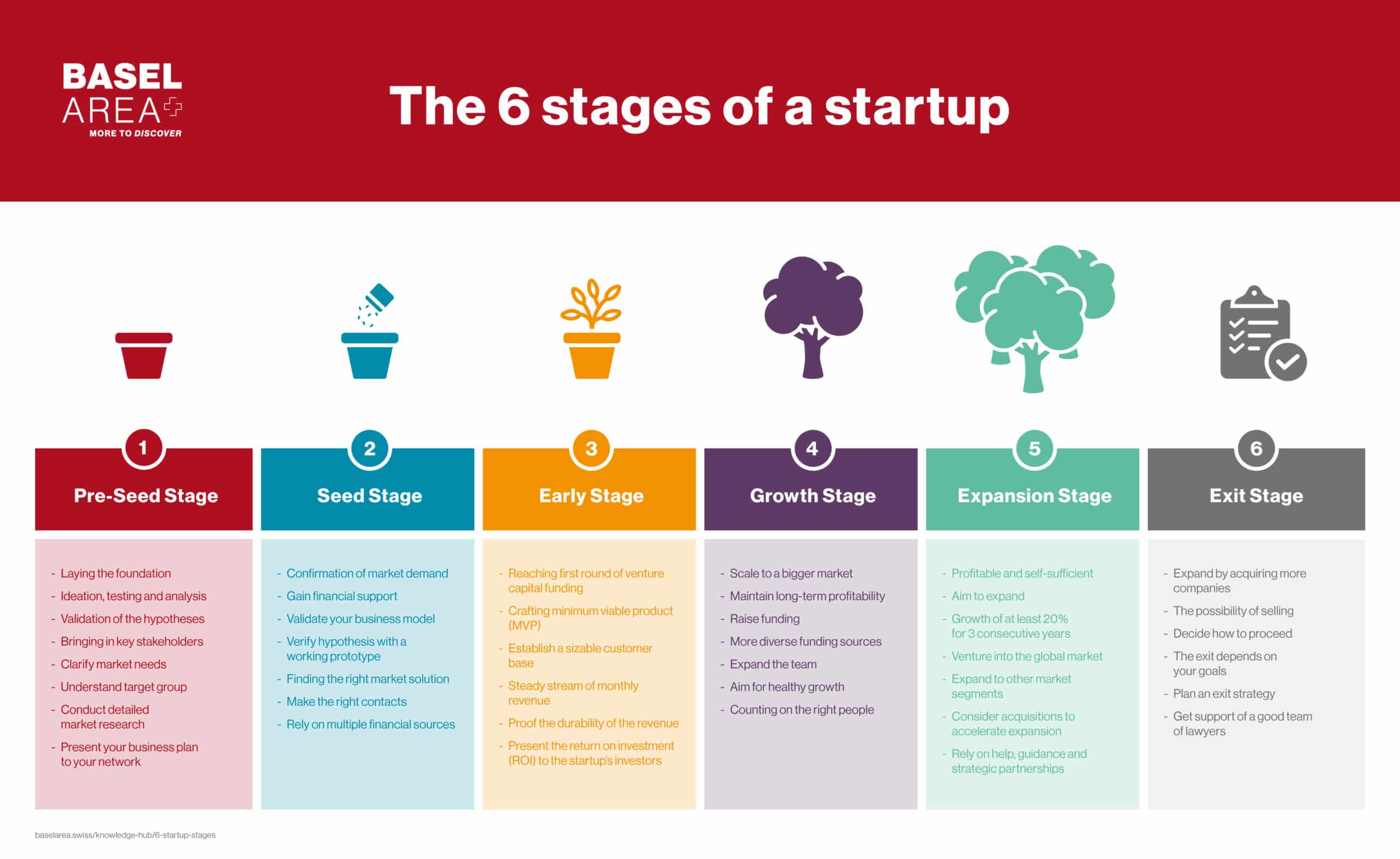

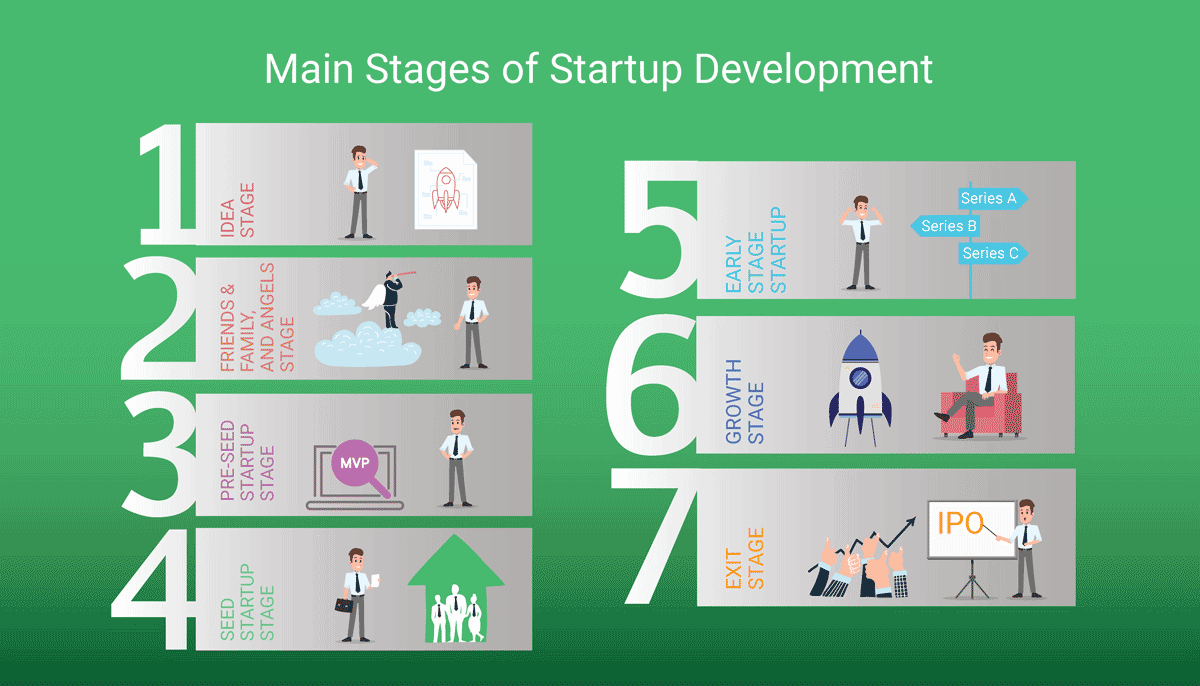

- Tech startups typically progress through stages like Pre-seed, Seed, Series A, Growth, Late Stage, and Exit, each with unique challenges.

- Research suggests early stages face high failure rates due to market need validation and cash flow issues.

- It seems likely that funding and scaling are major hurdles at later stages, with significant variation by industry.

Stages and Challenges Overview

Tech startups generally follow a lifecycle with distinct phases, each presenting specific challenges:

- Pre-seed Stage: Focuses on idea validation and market research, often self-funded. Challenges include gauging market demand and limited resources, with 35% failing due to no market need.

- Seed Stage: Involves developing an MVP and securing initial funding. Challenges include funding acquisition and cash flow, with 80% failing due to financial issues. Median seed round is $3.5M.

- Series A: Scaling with venture capital, needing proven growth. Challenges include demonstrating traction, with less than 10% of seed startups succeeding. Median pre-money valuation is $40M.

- Growth Stage (Series B/C): Expanding operations, preparing for IPO. Challenges include scaling operations and sustaining growth, with median valuations of $116M (Series B) and $130M (Series C).

- Late Stage: Established, considering further expansion or exit. Challenges include sustaining success and deciding on next steps, with only 5% reaching Series D.

- Exit Stage: Going public (IPO) or selling, with complex implications. Challenges include valuation and transition, often rare to reach.

Funding and Financing Options

Each stage has typical financing options, from self-funding and angel investors in early stages to venture capital and private equity later, aiding in navigating these challenges.

Survey Note: Detailed Analysis of Tech Startup Stages and Challenges

Tech startups represent a dynamic and high-risk segment of the entrepreneurial landscape, characterized by innovation and rapid growth potential. This analysis delineates the various stages a tech startup typically undergoes, from inception to exit, and elucidates the unique challenges at each phase, drawing on recent data and industry insights as of May 2025. The discussion aims to provide a comprehensive understanding for founders, investors, and stakeholders, highlighting the complexities and opportunities at each juncture.

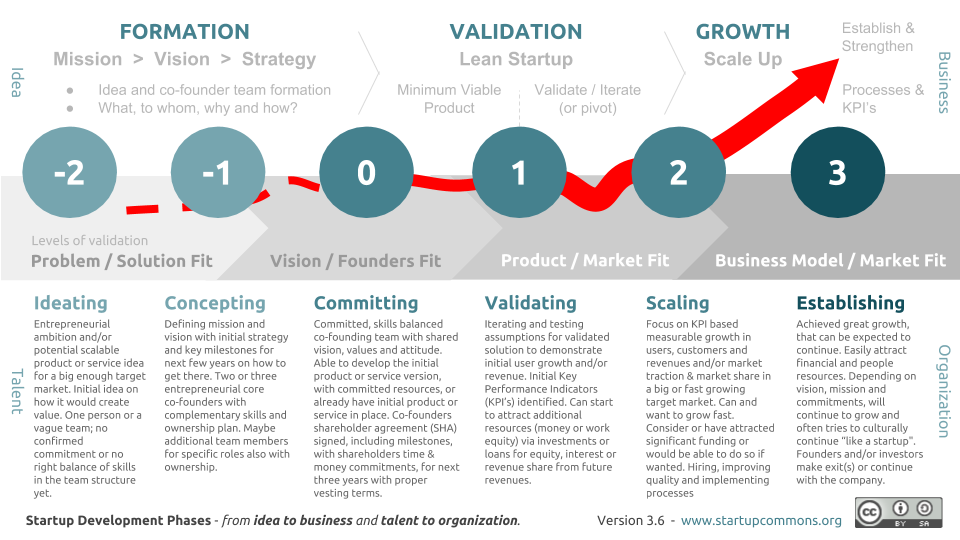

Stages of a Tech Startup

The lifecycle of a tech startup can be segmented into several key stages, each marked by distinct objectives and activities. The following breakdown, informed by multiple authoritative sources, offers a detailed progression:

1. Pre-seed Stage (Idea/Concept Phase):

- Description: This initial phase involves validating the business idea, conducting market research, and defining the target audience. Founders often rely on personal savings or "friends and family" funding to kickstart operations.

- Activities: Identifying customer needs, validating the problem, preparing legal documents, and seeking initial support.

- Challenges: A significant hurdle is gauging market demand, with research indicating 35% of startups fail at this stage due to a lack of market need (Embroker (https://www.embroker.com/blog/startup-stages/)). Other challenges include differentiating from competitors and operating with limited resources and expertise, which can strain early efforts.

2. Seed Stage:

- Description: Here, the focus shifts to building a foundation by developing a minimum viable product (MVP) and starting equity funding. This stage is critical for validating the initial value hypothesis.

- Activities: Testing the MVP, raising money from incubators, crowdfunding, or angel investors, and ensuring product-market fit. Insurance, such as D&O, is often considered to mitigate risks.

- Challenges: Securing funding is a major obstacle, with a median seed round of $3.5M and pre-money valuation of $14.8M in Q1 2024 (Embroker(https://www.embroker.com/blog/startup-stages/)). Cash flow issues are prevalent, with 80% of startups failing at this stage due to financial constraints. Iterations to find the right solution can also risk non-validation, potentially requiring a pivot.

3. Series A:

- Description: This stage marks the first venture capital financing, aimed at scaling the business and optimizing offerings. It requires demonstrating a proven growth track to attract investors.

- Activities: Creating a pitch deck, getting a business valuation, and securing D&O insurance to protect against liabilities.

- Challenges: Less than 10% of seed startups successfully raise Series A funding, highlighting the difficulty in proving traction (Embroker (https://www.embroker.com/blog/startup-stages/)). The median pre-money valuation for Series A was $40M in Q2 2024, adding pressure to meet investor expectations and ensure the MVP meets customer needs while expanding audiences.

4. Growth Stage (Series B/C):

- Description: Focused on expanding operations, scaling the business, and preparing for an initial public offering (IPO), this stage involves securing major investments to fuel growth.

- Activities: Securing larger venture capital (VC) rounds, expanding the team, exploring new markets, and preparing financial reporting for potential public scrutiny.

- Challenges: Scaling can be tricky, with risks of overextending leading to failure. The median Series B valuation was $116M, and Series C was $130M in 2024, indicating significant financial stakes (Embroker (https://www.embroker.com/blog/startup-stages/)). Adjusting to new sectors or demands and securing funding for changes are additional hurdles, with a high failure rate noted in industry reports.

5. Late Stage (Expansion/Scaleup):

- Description: At this point, the startup is established and profitable, considering further expansion or Series D funding. Goals include internationalization, entering new sectors, and significant hiring.

- Activities: Final VC rounds (Series D, with only ~5% reaching this stage), deciding on new products, locales, or acquisitions, and forming agreements with large companies for infrastructure.

- Challenges: Sustaining growth is critical, with challenges in seeking new markets and managing international expansion. The evidence leans toward this being a rare stage, requiring high potential and strength, with only about 5% moving to Series D (Embroker (https://www.embroker.com/blog/startup-stages/)).

6. Exit Stage:

- Description: The final stage involves deciding to go public via an IPO or sell/merge, benefiting from the company's value. This is an optional phase, often seen as the culmination of successful growth.

- Activities: Considering IPO implications, exploring sale or merger options, and ensuring a smooth transition for stakeholders.

- Challenges: Reaching this stage is rare, with complex implications of going public, such as market volatility and valuation disputes. Deciding to sell involves navigating negotiations and ensuring shareholder value, as exemplified by private companies like Cargill, with $177B revenue in 2023 (Embroker (https://www.embroker.com/blog/startup-stages/)).

Detailed Challenges and Statistics

Each stage presents unique challenges, often exacerbated by high failure rates, particularly in the early phases. The following table summarizes key challenges and statistics, drawn from recent industry analyses:

These statistics underscore the high-risk nature of tech startups, with 90% overall failure rate noted, emphasizing the need for robust market validation and financial management (Embroker (https://www.embroker.com/blog/startup-stages/)).

Financing Options and Industry Context

Financing options vary by stage, reflecting the evolving needs of the startup. Early stages often rely on bootstrapping, public aid, and angel investors, while later stages leverage venture capitals and private equity. For instance, the construction industry saw over $1.3 billion USD invested in 2020, highlighting sector-specific trends (Cemex Ventures (https://www.cemexventures.com/startup-stages-phases/)). Scaleups, defined by over 20% annual growth in employees or turnover for the last three years, face unique expansion challenges, often requiring strategic partnerships with large companies for infrastructure.

Conclusion

Understanding the stages and challenges of a tech startup is crucial for navigating the entrepreneurial journey. From validating ideas in the Pre-seed stage to deciding on exits, each phase demands strategic planning and resource management. The high failure rates, particularly in early stages, underscore the importance of market fit and financial stability, while later stages require balancing growth with sustainability. This analysis, grounded in recent data, provides a roadmap for founders and stakeholders to anticipate and address these challenges effectively.

Key Citations

- What Are the 8 Stages of a Startup A Complete Guide (https://www.indeed.com/career-advice/career-development/startup-growth-stages)

- What are the three stages of a startup (https://www.svb.com/startup-insights/startup-growth/what-are-the-three-stages-of-a-startup/)

- The stages of a startup (https://www.embroker.com/blog/startup-stages/)

- What Are The Six Startup Stages (https://www.cemexventures.com/startup-stages-phases/)

I’ve been a founder for ten years, and an investor for the last two. Having been on both sides of the table, I wish more people spoke openly about two truths that haven’t changed over the years. First-entrepreneurship is still scary. Second-raising money won’t save you from that…

— Dilip Kumar (@kmr_dilip) May 6, 2025

No comments:

Post a Comment