For many NRIs, India is like light from a distant galaxy.. they see the version of it that existed when they left, not the one that’s evolved since…

— Nishchay (@agNishchay) May 27, 2025

Back in my day… yes sir, that day was two governments and one Jio launch ago…

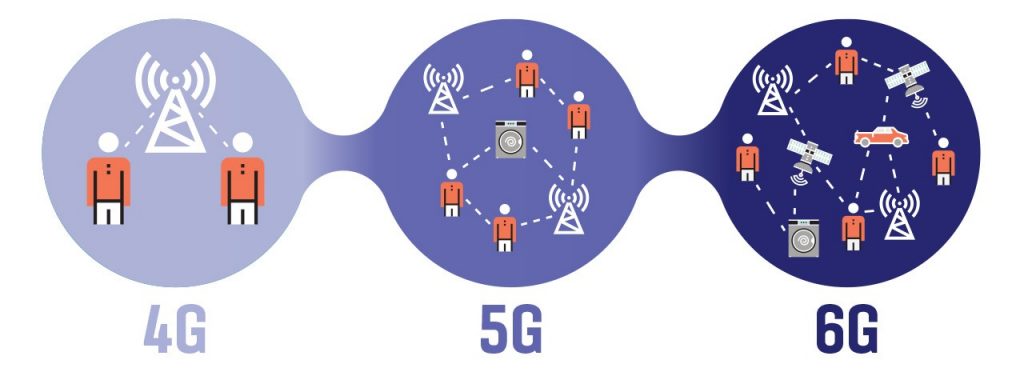

5G Penetration in India

India has made significant strides in 5G deployment, with over 435,000 5G base stations established nationwide by March 2024, reflecting rapid infrastructure growth. By the end of 2024, India achieved approximately 95% population coverage with 5G mid-band networks, driven by large-scale deployments from telecom operators like Reliance Jio and Airtel. However, despite this infrastructure expansion, India's 5G market penetration remains relatively low, with less than 20% of mobile users on 5G networks as of Q2 2024, according to GSMA Intelligence. This places India at rank 33 out of 39 countries in the 5G Connectivity Index, trailing behind leading markets. Challenges include device affordability, with limited availability of sub-₹10,000 5G phones hindering adoption among users still on 2G and 4G networks.

Comparison with China

China leads globally in 5G deployment and penetration. By 2024, China had over 70% of the world’s 5G base stations and 80% of 5G-connected devices, with market penetration exceeding 40%. This is significantly higher than India’s sub-20% penetration. China’s dominance is supported by substantial government investment, streamlined spectrum management, and strong domestic equipment manufacturers like Huawei and ZTE. In contrast, India’s rollout, while rapid, faces challenges like lower consumer adoption and reliance on foreign equipment, though indigenous efforts like the 5Gi standard are emerging. China’s 5G network also covers a broader range of urban and rural areas, with 356 cities having 5G availability by 2023, compared to India’s 419 cities, though India’s coverage is more recent and less mature.

India’s Progress Toward 6G

India is in the early stages of 6G development, with commercial deployment expected around 2030, aligning with global timelines. The Bharat 6G Vision, unveiled by Prime Minister Narendra Modi, outlines India’s ambition to lead in 6G technology, targeting at least 10% of global 6G patents by 2030. However, 6G is still in the research phase globally, with standardization efforts starting in 2023–2026 and evaluations planned for 2028. India’s 6G efforts focus on leveraging its 5G infrastructure, with upgrades planned to ensure compatibility with future 6G standards. The International Telecommunication Union (ITU) has supported India’s call for ubiquitous 6G coverage, aiming for affordable connectivity in rural and remote areas.

Native Research and Deployment in 6G

India is actively fostering indigenous 6G research through the Bharat 6G Vision, emphasizing collaboration between academia, industry, and government. Key initiatives include:

- Research Partnerships: Jio Platforms has partnered with Finland’s University of Oulu for 6G research and standardization. Ericsson collaborates with IIT Madras’s Centre for Responsible AI (CeRAI) to align with India’s 6G goals.

- Indigenous Standards: The success of the 5Gi standard, merged with global 5G standards by 3GPP, demonstrates India’s growing influence in global telecom standards.

- Talent and Ecosystem Development: India is investing in state-of-the-art research facilities, incentives for startups, and talent development to build a robust 6G ecosystem. However, funding remains a challenge, with India’s FY25 telecom R&D budget at ₹1,100 crore (0.03% of GDP), significantly lower than China’s $1.55 trillion allocation. Experts suggest tapping into the ₹83,468 crore Universal Services Obligation Fund (USOF) to boost 6G research.

India’s Potential to Export 6G to the US, Europe, and Africa

India’s ability to export 6G technology depends on its success in R&D, patent acquisition, and infrastructure readiness. Here’s an analysis for each market:

- United States:

- Feasibility: India’s ambition to secure 10% of 6G patents and its collaboration with the US through initiatives like iCET (Initiative on Critical and Emerging Technologies) signal potential for technology partnerships. However, the US is investing heavily in 6G (e.g., $2.5 billion with Japan) and has its own Next G Alliance, making it a competitive market. India’s lack of significant 6G patent filings as of 2021 and reliance on foreign equipment could limit its export potential.

- Timeline: Exporting 6G to the US by 2030 is unlikely due to the US’s advanced domestic efforts and security concerns over foreign tech (e.g., bans on Huawei). India might contribute niche solutions or software by 2035, provided it ramps up IP development and aligns with US standards.

- Europe:

- Feasibility: Europe lags in 5G deployment compared to India and China, with only 45% mid-band coverage by 2024. India’s cost-effective manufacturing and software expertise could position it to supply 6G solutions, especially if it aligns with European standards via 3GPP. However, Europe’s preference for Nokia and Ericsson and concerns over non-European suppliers may pose barriers.

- Timeline: India could potentially export 6G components or software to Europe by 2032–2035, leveraging its growing influence in global standards and partnerships with European institutions like the University of Oulu.

- Africa:

- Feasibility: Africa has low 5G penetration (10–15% mid-band coverage by 2024), making it a promising market for affordable 6G solutions. India’s experience with 5Gi for rural coverage and its focus on cost-sensitive markets align well with Africa’s needs. India’s telecom giants like Jio and Airtel could partner with African operators to deploy 6G, especially with ITU’s support for affordable connectivity.

- Timeline: India is well-positioned to export 6G technology to Africa by 2030–2032, potentially earlier than to the US or Europe, due to less competition and alignment with Africa’s connectivity goals.

Challenges and Outlook

India’s 6G ambitions face significant hurdles, including:

- Funding: The modest R&D budget compared to China and the US limits India’s ability to compete in patent filings and infrastructure upgrades.

- Infrastructure: Upgrading existing 4G/5G networks for 6G requires substantial investment, with high operational costs for energy and maintenance.

- Global Competition: China’s lead in 6G patents and early satellite tests (e.g., the 2020 6G satellite launch) and the US’s strategic alliances pose challenges.

Despite these, India’s strengths in software, affordable manufacturing, and global partnerships position it as a potential 6G leader. Achieving 10% of global patents and leveraging initiatives like iCET could enable India to export niche 6G technologies (e.g., AI-driven network optimization) to markets like Africa by 2030–2032, with Europe following by 2032–2035. The US market, however, may remain challenging due to its advanced domestic efforts and security policies, with exports unlikely before 2035.

Summary Timeline:

- Africa: 2030–2032

- Europe: 2032–2035

- US: 2035 or later

India’s success hinges on increased R&D funding, global standardization contributions, and strategic partnerships to overcome infrastructure and competitive challenges.

The Democratic party industrialized America under FDR, led us to win WWII, established the minimum wage, social security, Medicare, Medicaid, affordable care, signed civil rights & voting rights and is pushing for universal childcare & healthcare.

— Ro Khanna (@RoKhanna) May 27, 2025

We are not "weak and woke."

No comments:

Post a Comment