How to win Ukraine’s long war After doing well early in the war, Ukraine is losing ground. What next? ........ Ukraine won the short war. Mobile and resourceful, its troops inflicted terrible losses and confounded Russian plans to take Kyiv. Now comes the long war. It will drain weapons, lives and money until one side loses the will to fight on. So far, this is a war that Russia is winning. ........... Ukrainian leaders say they are outgunned and lack ammunition. Their government reckons as many as 200 of its troops are dying each day. ........ Fortunately for Ukraine, that is not the end. The Russian advance is slow and costly. With nato-calibre weapons, fresh tactics and enough financial aid, Ukraine has every chance of forcing back Russia’s armies. Even if lost territory will be hard to retake, Ukraine can demonstrate the futility of Vladimir Putin’s campaign and emerge as a democratic, Westward-looking state. But to do so it needs enduring support. .......... The Russian economy is much larger than Ukraine’s and in far better shape. In pursuit of victory, Russia is willing to terrorise and demoralise the Ukrainians by committing war crimes, as it did by striking a shopping mall in Kremenchuk this week. If needs be, Mr Putin will impose grievous suffering on his own people. ........ In 2020, before sanctions, the economies of nato were more than ten times bigger than Russia’s. .......... Mr Putin’s generals will continue to have more weapons, but the sophisticated nato systems now arriving have longer range and greater accuracy. By adopting tactics devised in the cold war, when nato too was outnumbered by the Red Army, Ukraine should be able to destroy Russian command posts and supply depots. ........ Ukraine scored a success on June 30th, when it used nato weapons to drive Russian forces off Snake Island, a strategic prize in the Black Sea. It should aim to impose a “hurting stalemate”, in which it takes back similarly symbolically important territory, such as the city of Kherson, imposing a heavy price on Russia. ........... If Russia starts to lose ground on the battlefield, dissent and infighting may spread in the Kremlin. Western intelligence services believe that Mr Putin is being kept in the dark by his subordinates. ......... The West can raise the cost to Russia of a long war by continuing to press sanctions, which threaten lasting harm to Russia’s economy. It can split Russia’s elites from Mr Putin by welcoming dissenters from business and politics, and encouraging them to see that their country should not throw away its future on a pointless and costly campaign. ......... At a summit on June 23rd, the European Union awarded Ukraine candidate status, promising a deep level of engagement over the next decade. At another summit in Germany this week, the g7 affirmed and strengthened sanctions against Russia. And at a third in Madrid, nato acknowledged the Russian threat by substantially increasing its presence on the alliance’s eastern front. ........ the global costs of a long war will grow. Mr Putin has been blockading exports of grains and sunflower oil from Ukraine’s ports, which will cause unrest and starvation in poorer importing countries. He seems to be trying to create gas shortages in the eu this winter by preventing members from building stocks over the summer. If unity falls apart over energy, as eu states hoard gas, it will disintegrate over Ukraine, too. To complicate matters further, nato members worry that if Ukraine gains the upper hand, Mr Putin will escalate. That could draw them into a catastrophic war with Russia. ........... You can see where Mr Putin is heading. He will take as much of Ukraine as he can, declare victory and then call on Western nations to impose his terms on Ukraine. In exchange, he will spare the rest of the world from ruin, hunger, cold and the threat of nuclear Armageddon. ............ He will fight tomorrow with whatever weapons work for him today. That means resorting to war crimes and nuclear threats, starving the world and freezing Europe. .........

The best way to prevent the next war is to defeat him in this one.

......... To prevail means marshalling resources and shoring up Ukraine as a viable, sovereign, Western-leaning country—an outcome that its defiant people crave. Ukraine and its backers have the men, money and materiel to overcome Mr Putin. Do they all have the will? .What to do when Slack cuts no slack Consider "vulnerable honesty" with chatty colleagues. For example, saying, "I love that you are including me, I am just not up to socializing."

Boris Johnson has brexited

— Paul Griffiths (@paul_griffiths) July 7, 2022

As a founder, the range of emotions you can feel in single day is actually pretty insane.

— isa watson (@isadwatson) July 7, 2022

Most founders spend too much time building and not enough time promoting

— Toby 🏠 (@tobydoyhowell) July 7, 2022

Major web companies do user research and keep their findings private – even though companies with similar products could benefit from collaborating.

— g.mirror.xyz 🪞🍎 (@strangechances) July 8, 2022

An open source journal of user research could accelerate web3 UX improvement. This would be great to see as a Mirror publication.

Mirror has great design.

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

Japan’s longest-serving post-war prime minister has been assassinated. In May he spoke to The Economist, discussing the country’s foreign and security policy—and his legacy https://t.co/ENhzxfMpwA

— The Economist (@TheEconomist) July 8, 2022

No, it’s dual, high performance terminals, which are important for maintaining the connection in choppy seas & heavy storms.

— Elon Musk (@elonmusk) July 7, 2022

Still obv premium pricing, but way cheaper & faster than alternatives.

SpaceX was paying $150k/month for a much worse connection to our ships!

Sandra Lindsay, the New York critical care nurse who was the first American vaccinated against Covid-19 outside of a clinical trial, was presented with the Presidential Medal of Freedom on Thursday. She was one of 17 people awarded by President Biden. https://t.co/XxXw6r0k5p pic.twitter.com/XfI76agaga

— The New York Times (@nytimes) July 7, 2022

— Rubina Bajwa (@BajwaRubina24) July 8, 2022

North Korean leader Kim Jong-un called an unprecedented meeting during the first week of July aiming to boost “monolithic” party rule, according to state media reports. pic.twitter.com/Q4RkHJvYcY

— South China Morning Post (@SCMPNews) July 8, 2022

"she's an overperformer. we're all very proud. now back to earnings."

— Aubrey Strobel (@aubreystrobel) July 8, 2022

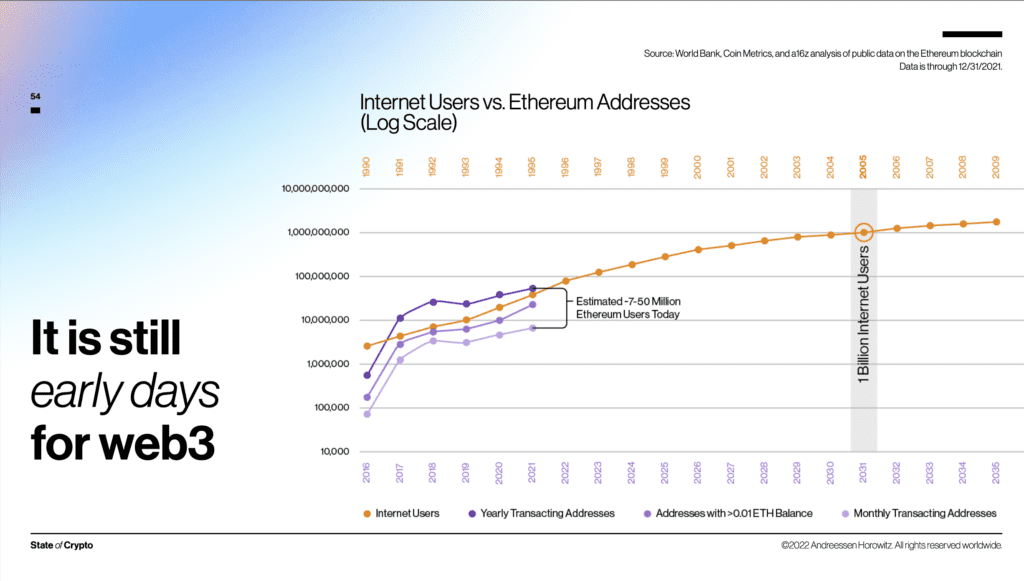

In 30 years, we’ll look back at these early days of web3 the same way we now reminisce about screeching dial-up sounds, AOL and Geocities—full of nostalgia, laughing at our own naïveté, and inspired by how far technology continues to take us

— cantino.eth (@chriscantino) July 7, 2022

How to hit your first 10k followers on Twitter:

— Alex Friedman 🤠 (@heyalexfriedman) July 7, 2022

• tweet every day

• tweet a mixture of one-liners, questions and threads

• pick 10 people with 5-10k followers and 5 people with 25-50k followers, set alerts and reply to them consistently

• introduce you and your value often

Starlink for boats! https://t.co/BQujU8Ngna

— Elon Musk (@elonmusk) July 7, 2022

There is no narrative that you have to be young to start a successful startup. Countless studies show founders older in age are more successful.

— Andrew Gazdecki (@agazdecki) July 7, 2022

Just do you and realize it's never too late or too early to start a company.

Overwhelmed? Take a break.

— Jason Strimpel 🚢 (@jasonstrimpel) July 8, 2022

So cool to get a rainbow and lightning in one shot! pic.twitter.com/lJTeDNrMSG

— Mark Rapien (@MarkRapien) July 7, 2022

my twitter nowadays: 90% quarter-life crisis, 10% cybersecurity

— meg west (@cybersecmeg) July 7, 2022

🥲

Woke up this AM to news of Reddit building an NFT platform on @0xPolygon.

— Colin Butler (@RealCryptoColin) July 7, 2022

Went to lunch and came back to news that Robinhood has integrated $MATIC support.

Do devs ever sleep? Or do they only ship?

If you gained nothing by dealing with someone, what can you lose by leaving them alone? Your peace is priceless 💯

— Steve Harvey (@IAmSteveHarvey) July 7, 2022

I've worked with more than 10 web3 companies as a product designer and a consultant since 2018.

— Lili ✰ ツ (@lililashka) July 7, 2022

Here are the most useful UX &HCI lessons I've learned.

A thread 🧵 👇🏻

0/

— Lili ✰ ツ (@lililashka) July 7, 2022

HCI/UX (Human Computer Interaction/User Experience) is an interdisciplinary study that is crucial to the mass adoption of web3 but largely overlooked.

It encompasses psychology, design, computer science, and behavioral science. The role of HCI in (de)finance is unexplored.

4/ ELI5

— Lili ✰ ツ (@lililashka) July 7, 2022

Explain Like I am 5 should always be your north star especially when designing a complex product especially in defi and other investment related.

I might get on that list myself soon ..... You are like the "Intel inside" of Web 3.

— Paramendra Kumar Bhagat (@paramendra) July 7, 2022

Off to trade Crypto full time. pic.twitter.com/1Nz0faBDso

— Charlie (@btc_charlie) July 7, 2022

A few months ago, I got a promotion at #Meta with a $50K raise.

— Jonea Gordon | Tech Lawyer (@lastnamegordon_) July 7, 2022

I immediately updated my resume b/c I knew I was worth more than that.

I landed a job at #Google that increased my compensation by over $150K.

THREAD #BlackTechTwitter #TechTwitter

Tech is one of the few industries where women and BIPOC can be compensated fairly without going to war with their colleagues and bosses.

— Jonea Gordon | Tech Lawyer (@lastnamegordon_) July 7, 2022

That kind of stress will take years off of your life. (Google: Racism as a public health issue.)

#bitcoin back over 22k!

— Lark Davis (@TheCryptoLark) July 8, 2022

the quickest path to burning out as an engineering leader is to internalize the idea that you must be constantly available, unblock everything, are held accountable for every task, and have to weigh in on every decision.

— Vaidehi Joshi (@vaidehijoshi) July 7, 2022

leaders who do these things are exhausted, over-extended, and often ineffective.

— Vaidehi Joshi (@vaidehijoshi) July 7, 2022

and this approach certainly does NOT scale as you take on more responsibilities, inherit more reports, and start to operate in the organization at a higher strategic level.

i'm starting to see how being responsible for a team (and it's happiness, culture, and productivity) doesn't mean that you need to be directly involved in every little aspect of the team's day-to-day.

— Vaidehi Joshi (@vaidehijoshi) July 7, 2022

i think i now understand just how much of an engineering leader's role is to ✨empower✨ the people on the team and set a strong enough foundation so that so that the team is not reliant on you for the little things.

— Vaidehi Joshi (@vaidehijoshi) July 7, 2022

you want to be a conduit within the system, not the clog.

ok hear me out, a blockchain for emotions to also be transparent, owned by the user, and validated by a community

— david phelps (🐮,🐮)(🃏,🃏) (@divine_economy) July 7, 2022

#Vlog | Road under water, residents use rafting boat to reach homes

— NDTV (@ndtv) July 8, 2022

NDTV's Sreeja MS reports from Udupi#KarnatakaRains pic.twitter.com/MnQ8u8yKn4

I ran across this study that looked at how your body reacts to different emotions.

— David Morris (@wdmorrisjr) July 7, 2022

Specifically, where in your body you feel things.

They produced this heat map.

Yellow is high activation. Blue is low.

Fascinating visual. What stands out to you? pic.twitter.com/SYKVBrvbbd

This bear market is probably your last chance to get one whole #bitcoin!

— Lark Davis (@TheCryptoLark) July 8, 2022

You had me at the extravagant murder of slavers. I love that genre 😊 https://t.co/AiiS8qrjwO

— Khadijah A. Robinson (@dijadontneedya) July 7, 2022

Check DM please.

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

If something you own was -96% but has now rallied +25% - congrats! - you are now -95%. 😥

— Compound248 (@compound248) July 7, 2022

Sorry $PTON... pic.twitter.com/ThRH1mfscH

Nine years ago today @PanteraCapital launched the first cryptocurrency fund in the United States.

— Dan Morehead (@dan_pantera) July 7, 2022

That fund is up 27,790%.

I wanted to share the original logic I wrote to investors in 2013 – as it is equally compelling to me today: pic.twitter.com/2mlB7L6DaU

New: we've obtained the code the FBI used to backdoor an encrypted messaging app, and we're publishing parts of it today. Code shows app created a 'ghost' contact that hid itself from users contact lists and silently received every message. More findings: https://t.co/iNE1HR9CuF

— Joseph Cox (@josephfcox) July 7, 2022

NEW - 🇸🇳 President of Senegal meets with the CEO of the worlds biggest #bitcoin and crypto exchange 🤝 pic.twitter.com/v58ppfHJsH

— Bitcoin Magazine (@BitcoinMagazine) July 7, 2022

This is what a normal day in @0xPolygon looks like:

— Narb (@NarbTrading) July 7, 2022

- Reddit NFT marketplace on Polygon

- Robinhood deposits/withdrawals$MATIC pic.twitter.com/7UFGwh6ueo

The meme winner is... 🥁

— bugcrowd (@Bugcrowd) July 7, 2022

🎉 @0xRh1d0Y 🎉 #BugBounty #HackingMemes pic.twitter.com/wCcHRykCl7

Hard work disguises itself as luck. The harder you work, the luckier you get

— lilly (@lillysharples) July 8, 2022

pretty soon twitter, facebook, reddit, instagram, etc will allow you to showcase the *same* NFTs, minted/bought completely outside of their apps.

— 𝗻𝗶𝗿.𝗲𝘁𝗵 🪬 (@nir_III) July 8, 2022

do you get how rare it is for these platforms to share content this way?

if that's not a win for web3 composability idk what is

"We are a city of second chances, but the truth is we have to draw a line with people who choose hate, violence, and a life of crime." -Brooke Jenkins, San Francisco's new district attorney. https://t.co/6vle4OTqoy pic.twitter.com/VAur4hdMlM

— Kristofer Noceda (@krisnoceda) July 8, 2022

3 Signs You Have High Emotional Intelligence:

— Mark Manson (@IAmMarkManson) July 7, 2022

1. You're able to act despite your emotions, not because of them.

2. You're able to have difficult conversations, disagreeing with others without hating them.

3. You understand that negative emotions can be healthy and helpful.

"Polygon is just a sidechain"

— Ryan Wyatt (@Fwiz) July 7, 2022

to

"Polygon has a sidechain, supernets, and the most advanced ZK tech on the horizon and is working with every large web2 company in the world, by a large margin, as well as the defacto home for web3 gaming, which continues to innovate and evolve." https://t.co/mV84LrKtPZ

Who can relate? 😅 pic.twitter.com/1dhgO6pUS3

— Buitengebieden (@buitengebieden) July 7, 2022

The proudest mother I ever did see… 😍 pic.twitter.com/sM5qIFDLHv

— Puppies 🐶 (@PuppiesIover) July 7, 2022

Horrible news of a brutal assassination of former Prime Minister of Japan Shinzo Abe. I am extending my deepest condolences to his family and the people of Japan at this difficult time. This heinous act of violence has no excuse.

— Володимир Зеленський (@ZelenskyyUa) July 8, 2022

Please credit me for the Intel metaphor. :) https://t.co/DuqzncKnSz

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

My project.

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

Does every city have police helicopters flying fast at a low height - way too often! Or is it just Los Angeles?

— Samantha Ettus (@samanthaettus) July 7, 2022

Took 80k out of my daughter's college fund to long Solana at 220. Hurts me every time I look at her. I thought I could make it 300k and move our family from Chicago. She still thinks I have the money and that I can send her to the same college as her friends.

— Coinfessions (@coinfessions) July 8, 2022

Not a vacation. Just Chicago. pic.twitter.com/maixAwpTsi

— Ezra Galston (@EzraMoGee) July 8, 2022

Adoption. https://t.co/Rr3wF6PheQ

— CZ 🔶 Binance (@cz_binance) July 8, 2022

Total #crypto market cap back above 1 trillion... again...

— Lark Davis (@TheCryptoLark) July 8, 2022

Raspberry Pi Pico W review: the Pi's tiny sibling gets a wireless upgrade https://t.co/SwtMDg8m8q by @sbisson

— ZDNet (@ZDNet) July 8, 2022

BREAKING: Police say the suspect has confessed, telling them he killed the former Prime Minister Abe because he was 'dissatisfied' with him. pic.twitter.com/FmXgimDwVs

— BNN Newsroom (@BNNBreaking) July 8, 2022

Amusing some crypto people think plutocratic cabals with a few whales holding majority supply dictating governance is "decentralized"

— shitposter polynya (@epolynya) July 8, 2022

Meanwhile, democracies where billions of people participate, continue improving & evolving over centuries, are somehow "centralized" & "evil"

Rihanna is America’s youngest self-made female billionaire.

— Degentraland (@Degentraland) July 7, 2022

And Chris Brown couldn’t sell out an NFT project.

Once upon a time, VCs and startups used to meet in this SF area known as South Park. Journalists came by to get the scoop. Now it’s a ghost town surrounded by for lease signs pic.twitter.com/rJvgx6khGk

— Katie Roof (@Katie_Roof) July 7, 2022

Over time, I've noticed most of us fall into one of three categories:

— Gale Wilkinson @Vitalize (@galeforceVC) July 6, 2022

💡ideas/strategy people

🦾doers

⚖️combos

Founders + the first 5-10 startup hires will be combos, and then doers can really help to accelerate.

Ideas/strategy people tend to do best in corporate roles.

I went from 0 to 60,000 LinkedIn followers in 6 weeks.

— Zain Kahn (@heykahn) July 7, 2022

Here's my entire playbook ― for free:

4. How to go viral:

— Zain Kahn (@heykahn) July 7, 2022

• Post 5 times a week.

• Post between 8am - 10am.

• Befriend accounts with 1k-10k followers and share your posts with them. If the content is high quality and they engage with it, your content is almost certain to go viral.

In case you missed it: I’ve officially started at @OpenSea as the VP of Eng this week. A wrote a bit about why I made the jump here, https://t.co/SzEuQ6nXsN https://t.co/nrd4NYVK4V

— Marko Iskander (@markoiskander) July 8, 2022

On Leaving GitHub and Joining OpenSea I only vaguely remember the early days where we reviewed code on a projector and took notes on a notepad. Then came GitHub and I fell in love with a product for the first time in my life. ........ GitHub’s come a long way from the early days when I joined – figuring out the right solution for management structure and growing the team to almost 300. ......... OpenSea’s mission speaks to me, and the team is made up of some of the most genuine people you’ll meet. Their commitment to the cause is like no other. I’m excited by their work to build a creator-first marketplace where makers have unlimited freedom to bring their work to life how they see fit, and share it with people however they want. ........... They say

a bear market is for the builders

. It’s an opportunity to focus on what matters most – what’s critical for a successful community and is pushing the NFT ecosystem forward. ....... Let creativity reign and the best work rise unhindered by a system meant to extract all profits from builders and overcharge their communities.Margaret Hamilton, NASA's lead developer for Apollo program, stands next to all the code she wrote by hand that took humanity to the moon in 1969 pic.twitter.com/mRXwZZVo60

— Latest in space (@latestinspace) July 7, 2022

Amazing thread by Adriane 🧵 . I am a mum and a co-founder of a bootstrapped company as well. Totally agree on the offshore hires at the beginning. Read on👇🏻 https://t.co/Md4qhX6w8R

— Florence Tay (@florencetay_) July 8, 2022

Congrats @BrookeJenkinsSF on being selected as San Francisco’s new DA - we’re behind you 100%! Photo feed: @JennyGShao pic.twitter.com/JXUfVzbn7r

— Charise (@LoraCharise) July 7, 2022

#bitcoin breaking out of the triangle, volume looks decent! pic.twitter.com/O1ij9DL3QS

— Lark Davis (@TheCryptoLark) July 8, 2022

"As your next district attorney, I will restore accountability and consequences to our criminal justice system here in San Francisco," said Brooke Jenkins after Mayor London Breed formally announced her as the new DA. https://t.co/o0gJhrrVpG pic.twitter.com/SRH8FBiXhu

— NBC Bay Area (@nbcbayarea) July 8, 2022

If you’re “done with crypto” because you suffered a loss, you never began in the first place.

— Chris Burniske (@cburniske) July 8, 2022

Sepp Blatter, the former president of FIFA, and Michel Platini, his onetime ally, were cleared of wrongdoing over a secret $2 million payment that prosecutors had labeled a bribe. https://t.co/IvWyuL3U6p

— NYT Sports (@NYTSports) July 8, 2022

So deeply shocked to hear about the past PM of Japan-Shinzo Abe. He was one of the first leaders I met when I became PM. He was deeply committed to his role but also generous & kind. My thoughts are with his wife and the people of Japan. Events like this shake us all to the core.

— Jacinda Ardern (@jacindaardern) July 8, 2022

When you buy something, you pass up other options. For example, if you eat lunch out every weekday, you might not have enough money to buy a video game on the weekend.

— Greenlight (@GreenlightCard) July 7, 2022

seems like most major platforms are partnering with Polygon

— andy (@andy8052) July 7, 2022

why designers and pms can't get along pic.twitter.com/evqRnJ7pTY

— Tareq Ismail (@tareqismail) July 7, 2022

This could be REALLY bad for the price of #Bitcoin!

— Lark Davis (@TheCryptoLark) July 8, 2022

Mt Gox, could release 150,000 #bitcoin into a bear market... YIKES!

Most of these investors are up at least 20X on their BTC, many much more. https://t.co/F1kwSIvPYA

Deeply shocked by the news about former Japanese PM Shinzo Abe.

— Dr. S. Jaishankar (@DrSJaishankar) July 8, 2022

Join so many of his friends and admirers in India in praying for him and his family.

“Oh did I say pre-seed? I meant pre-C!”

— Billy Draper (@Billy_Draper) July 7, 2022

"When will you stop the war?"

— Mikhail Khodorkovsky (English) (@mbk_center) July 8, 2022

audience asks the #WarCriminal, Russia's FM Lavrov at #G20 ... https://t.co/qfhDRKpfws

The most important day of the year for most people is their birthdays.

— Henri Pierre-Jacques (@hpierrejacques) July 8, 2022

Don’t miss an easy opportunity to connect with your network on that day.

It’s the sole reason I check Facebook daily, it’s the only platform that has the majority of my family & friends on it.

Just when I thought I’d seen it all, I open a case where we thought the patient had a lung tumor. Nope. It was a fir seed he inhaled years ago that started to grow 🌲

— Layla Benson (@BaelaLayla) July 6, 2022

I had 3 different 2+ hour meetings yesterday.

— Dave Kline (@dklineii) July 7, 2022

All high-energy creators building new futures.

I met them all on the bird app in the last 6 months.

If you’re not using this platform to attract & engage with like-minded people,

You’re missing the point.

A lot of people are going to miss what’s next for web3 because their worldview has been distorted by what NFT has been in the last 18 months.

— ST (∞, ∞) (@seyitaylor) July 7, 2022

If we do our job well, success will not look like another “bull run” of irrational asset inflation, but this global database in real use

You can do a shitpost with jokes and such, but that's unambitious

— shitposter polynya (@epolynya) July 7, 2022

You could also do serious commentary - but that's not shitposting

The best shitpost is when you're having a laugh, but everyone thinks it's serious, or vice versa

Finding the right balance is high art

Definitely what our country is struggling with right now. https://t.co/j1gvHSOTSw

— Aaron Levie (@levie) July 7, 2022

Those who dump their #crypto bc they don't see immediate results are going to regret it big time.

— Syed Raza Shah, MD (aka Crypto Doctor) (@SyedRazaShah123) July 8, 2022

Results take time to show, but as long as continuous progress is being made, it's inevitable. #BTC #BNB #JASMY

Those who dump their #crypto bc they don't see immediate results are going to regret it big time. Results take time to show.

— Syed Raza Shah, MD (aka Crypto Doctor) (@SyedRazaShah123) June 30, 2022

There’s a good chance that many people bought #crypto bags this week that will forever change their lives. #BTC #BNB #ETH #JASMY pic.twitter.com/2Cm6FMDeXk

It’s always difficult to ‘time the market’ but I think we have bottomed out. Remember:

— Syed Raza Shah, MD (aka Crypto Doctor) (@SyedRazaShah123) June 15, 2022

Bear markets are for buying.

Bull markets are for selling.

If you want to succeed in crypto do the opposite of what the masses are doing! #BTC #BNB #ETH #JASMY pic.twitter.com/BIBJhiyENe

First time I am seeing JASMY. Are you bullish on it?

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

Look at Apple, Amazon, and Microsoft in the early stages of their adoption cycles, they were volatile because they were misunderstood not because they were bad assets. The same is true for #JASMY. It is misunderstood. Future is of Web 3.0 and Internet of Things (IOT) #JASMY #BTC pic.twitter.com/AIQ9s5HoXG

— Syed Raza Shah, MD (aka Crypto Doctor) (@SyedRazaShah123) May 30, 2022

Glad to see Pakistan’s 🇵🇰 State Bank being a part of the financial inclusion meeting for digital economy in El Salvador 🇸🇻 today! Let’s focus on developing Metaverse, Blockchain, Web 3.0 and AI in the region. #BTC #JASMY @BBhuttoZardari @SyedNasirHShah @JamDharejo @sherryrehman https://t.co/1CLADgByLu pic.twitter.com/47DPr82ucm

— Syed Raza Shah, MD (aka Crypto Doctor) (@SyedRazaShah123) May 16, 2022

This is why I love Twitter. I discovered you today. Was there any other way?

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

Put in a word for me internally. I applied to be your Global Head of Social Media. ;)

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

Therapy (paid) of journaling (free). #solution

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

Have you seen the hills fall like this? This is how it falls in our North East. What is the reason, you will tell yourself. as well as solutions. pic.twitter.com/yijHkuK4wS

— Nandan Pratim Sharma Bordoloi (@NANDANPRATIM) June 21, 2022

10 of the best websites you're not using (but should be):

— MATT GRAY (@matt_gray_) June 18, 2022

Bollywood to the rescue, always. https://t.co/jpO4uLDMsy

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

World's Wettest Region performing on Standards#Cherrapunji whopping 972mm in the last 24 hours ending 8:30AM.

— Weatherman Navdeep Dahiya (@navdeepdahiya55) June 17, 2022

Total of 2457.2mm in last 3 days.

This is more than Mumbai's annual Rains and #Delhi's 3 yearly rainfall falling in 3 days.

Extreme's of #Monsoon in #India's Northeast! pic.twitter.com/I9qsfYB4Yk

RT'd to remind myself of my privilege https://t.co/ENDwv9mBRq

— Ananya Mahanta (@AnaMahanta) June 12, 2022

I have compiled the most valuable Airtable with 500+ web3 resources like newsletters, podcasts, companies, job boards, DAOs & communities.

— Ronak Kadhi (@ronakkadhi) June 9, 2022

It can easily sell for $300

Today I'm giving it for free.

Like and retweet this post & I'll DM 📩 you the copy.

Must follow for more

#jugaad to increase Twitter followers.

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

I'm just a girl, standing in front of a Hollywood dialect coach for a movie set in Africa, begging them to please just pick a country, any country, and stick to it.

— natty kasambala (@nattykasambala) July 6, 2022

BREAKING: Reddit just launched an NFT marketplace on Polygon.

— bankless.eth (@BanklessHQ) July 7, 2022

Ignore this, nothing good happens during bear markets.

BREAKING: California just announced that it will manufacture its own insulin.

— Ariel Kelley (@ArielKelley) July 7, 2022

This will make the drug *significantly* more accessible and affordable for millions of residents of our state.

Gas prices have declined 21 days in a row, which means Fox News is about to discover a migrant caravan in about 10 hours.

— Keith Edwards (@keithedwards) July 7, 2022

an Elon baby is the new thiel fellowship

— Cat (@CatOrman1) July 7, 2022

I have a question for you I would like to ask over DM.

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

— Zoe Tillman (@ZoeTillman) January 14, 2022

https://t.co/JhnvfE4ozE @AnaMahanta

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

Shinzo Abe spontaneously died when giving a speech and maybe a firearm was located in the vicinity at the same time but we aren't sure if police were there too so just to be safe we'll write this as if the shooter and gun had nothing to do with it... https://t.co/zpD9yDLxPj

— Khadijah A. Robinson (@dijadontneedya) July 8, 2022

फूटपाथमा मोटरसाइकल राख्ने, निर्माण सामग्री थुप्ऱ्याउने, बाटो ओगटेर वर्कशप र होटल चलाउने, अतिक्रमण गरेर संरचना बनाउनेहरूलाई पनि मकै पोल्नेलाई झैं लछापछार पारेको देखियो भने चैं मानौंला यस्तो कर्म “फूटपाथ ख़ाली गराउन” नै गरिएको हो!

— Madhu Raman Acharya (@MadhuRamanACH) July 8, 2022

नत्र निुखमामाथि प्रहार मात्र!

केबल!!

मेयर बालेन को पहिलो गलती? https://t.co/og1kElMP8Z

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

the success of stuff like nouns and ens—two of the only web3 projects to achieve recurring revenue—might make you think tokens are good sources of revenue.

— david phelps (🐮,🐮)(🃏,🃏) (@divine_economy) July 8, 2022

oh baby baby.

in 99% of crypto projects, tokens are a customer acquisition cost—not revenue at all.

Great!

— Elon Musk (@elonmusk) July 8, 2022

Conditions once experienced only in saunas are rapidly becoming reality for millions.

— Bloomberg Opinion (@opinion) July 8, 2022

After a few hours with humid heat above 35°C, a measure known as the wet-bulb temperature, healthy people with unlimited shade and water will die of heatstroke https://t.co/OY9awmDj5y

The conditions inside people’s homes are often also hazardous because there is nowhere they can go to cool down.

— Bloomberg Opinion (@opinion) July 8, 2022

Even though there’s such a high incidence, the population remains mostly unaware of the risk https://t.co/22WBvUUWmC pic.twitter.com/PX8pyZMxs9

The India Bureau of Meteorology has no publicly available information on wet-bulb temperatures.

— Bloomberg Opinion (@opinion) July 8, 2022

Its heatwave warnings also do not mention the particular danger that comes with the combination of high heat and humidity https://t.co/22WBvUUWmC pic.twitter.com/XrJNCB6EsX

Currently, around 89,000 people are estimated to die every year in India from hot temperatures.

— Bloomberg Opinion (@opinion) July 8, 2022

With 4°C of global warming, heat deaths could rise to 1.5 million a year https://t.co/22WBvUUWmC pic.twitter.com/KLkDFEKjYs

Many of the worst-affected areas are in South Asia, where over a billion people live and less than 10% have access to air-conditioning.

— Bloomberg Opinion (@opinion) July 8, 2022

Many of them work in agriculture or informal jobs where there’s no shelter from extreme daytime heat https://t.co/22WBvUUWmC

Some countries bear very little responsibility for the warming that’s already occurred. India accounts for just 3.7% of historic emissions, a smaller tonnage of carbon dioxide than Germany.

— Bloomberg Opinion (@opinion) July 8, 2022

Pakistan’s burden is just 0.36% of the total, less than Belgium https://t.co/22WBvUUWmC pic.twitter.com/M0qFuyqulP

A scorching heatwave in India has left many concerned that extreme temperatures may be here to stay pic.twitter.com/a7PAxL1r6V

— Bloomberg Quicktake (@Quicktake) April 29, 2022

Hierarchy in startups:

— Naval (@naval) July 8, 2022

Founder > Investor > Manager > Employee > Customer > Founder

Brevity > Eloquence

— Sahil Bloom (@SahilBloom) July 8, 2022

Eloquence may impress, but brevity will close.

99% of cold emails or DMs get deleted or ignored simply because they are too long.

Learn to write short, concise, punchy copy and you’ll always find a way to win.

RIP

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

Japan — 10 gun deaths a year

— Scott Galloway (@profgalloway) July 8, 2022

US — 110 gun deaths per DAY

Not true. That is like saying you can't be religious/spiritual if you are always reading the Bible/Geeta/Koran. The present can be a great offspring into the future.

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

#Germany is pushing #Canada to release a sanctioned turbine. To pump more of #Russian gas through their NS-1. This clearly contradicts the commitments to press on Putin, decrease gas consumption, and adhere to sanctions.

— Inna Sovsun (@InnaSovsun) July 8, 2022

To Seek Only A Military Solution Is Dangerous https://t.co/oizILUfufQ #russia #ukraine #ukrainewar #navalny #ukraineinvasion #zelensky #NFTProject #NFTs #NFT

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

Still life with hose. pic.twitter.com/lDep00zgIX

— Lisa Lucas (@likaluca) July 8, 2022

June @microacquire update!

— Andrew Gazdecki (@agazdecki) July 8, 2022

- 77 acquisitions successfully closed

- $47m million in closed acquisitions

- Average acquisition $611,680

- $2,075,178 in ARR

- 131 LOIs created on platform

- 8,703 new buyers registered

Goal for 2022 is to help 1000+ startups get @microacquire'd! pic.twitter.com/giqg0BjMhY

You have plugged a hole. Many that got micro-acquired might have died without.

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

Hire me to add a new higher level to your business. P/T Consultant.

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

You are one of my favorite people on Twitter. You make sense of many topics tech startup. You know your space.

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

Sold a company sells much better than company died. Note: the quality of the company was/is the exact same.

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

I want indie bands to be able to earn a decent living.

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

The more I build my startup, the less respect I have for people who give me advice on it without building one themselves.

— Dagobert Renouf (@dagorenouf) July 7, 2022

Engineering: sell what we have

— Jason ✨BeKind✨ Lemkin #ДобісаПутіна (@jasonlk) July 8, 2022

Sales: build what I can sell

This, is The Enterprise

This week, a producer actually said to my face, "You need more white representation in your project. You're going to lose the white audience." Should've heard the way I laughed.

— Regina Kim 🇰🇷 (@ReginaKimWrites) July 7, 2022

Plug the hole!

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

Marc Andreessen Is A Dud When It Comes To Politics @pmarca @cdixon @agazdecki https://t.co/Cp8pptITZT

Thanks so much, I really appreciate that!

— Andrew Gazdecki (@agazdecki) July 8, 2022

I was today years old when I learned that Alaska has universal basic income (UBI).

— Kate Irwin (@pixiekate13) July 7, 2022

What's the scrappiest thing you've ever done to build your business?

— Alex Lieberman (@businessbarista) July 8, 2022

reminds me of @airrack breaking into the Super Bowl by carrying a ladder and acting like he's a maintenance person. no one ever questioned them.

— Alex Lieberman (@businessbarista) July 8, 2022

started with $2000 cash advance on credit card - basically all my money I've ever had came from that

— The Crypto Dog🫐 (@TheCryptoDog) July 8, 2022

Let the entire team move into my house, which also served as our offices. This was not a big luxury home, it was my first house I bought in my 20s…just a small 2 bedroom, 1 bath bungalow. Allowed us to keep operating costs low…and zero commute time!

— Jason Starr, Founder/GP at Consumer Ventures (@JasonStarr) July 8, 2022

Validating startup ideas via surveys.

— Denis Shatalin (@Denis__Shatalin) July 8, 2022

If you intend to make money with your product - forget about it.

I had a travel company and we would go to luggage stores and put information about a company inside the Unbought suitcases

— Gilad Berenstein (@giladb87) July 8, 2022

In the early days we would puts cars on the lot without engines and with SOLD signs to make it seem like we had more cars than we really did

— CarDealershipGuy (@GuyDealership) July 8, 2022

Hung out in coffee shops (physically closest) outside of conferences in the city I was at in a given day and pinged attendees I wanted to meet.

— Kalyan Banerjee (@aamikalyan) July 8, 2022

Had no money to attend the conferences.

I put huge ads in the Shanghai newspapers apologizing for the delays in getting customers into our training centers

— Ken Carroll (@ken_carroll) July 8, 2022

It was true that we were full but I, erm, exaggerated a bit

Immediately, the phones started ringing off the hook - which generated more WoM and news reports!

For real though…

— Joseph R. Russo (@JosephRRusso) July 8, 2022

Cold emailed the former @fema director until we set a meeting and validated the entire company concept in 90 minutes. Over coffee.

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

He is actually making fun of the ethnic Indians of southern Nepal that were part of Mughal India.

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

Bill Gates had something that was an uncouth tablet almost a decade before the iPad. It did not catch fire. It had a pen.

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

the sooner you realize that a record deal is a bank loan –– the sooner you'll understand why crypto will disrupt music.

— ASEC ~ Nathan (@__ASEC) July 8, 2022

Successful for how long?

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

Go to the Hare Rama Hare Krishna Mandir, the first such place on the continent. @elonmusk @gchahal @cz_binance @anamitra @ekaurghar @kaylakav @venkateshkr @rileyfinch13 @gjain walk over to the West Side, you might bump into @fredwilson @nihalmehta @thegothamgal @reshmasaujani

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

The Boldest Of Them All: Afore https://t.co/GcBafbPaiA

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

Gifted 1 dozen eggs to our neighbor yesterday. She brought us this today! pic.twitter.com/qFXly4dGKk

— Farmstead Dad (@FarmsteadDad) July 8, 2022

Companies can easily copy your product but they can't easily copy your startup's customer experience.

— Andrew Gazdecki (@agazdecki) July 8, 2022

Success has a thousand fathers.

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

what's something under $200 that's significantly improved your quality of life? keen to try out like 10 of these for a video hehe

— Ali Abdaal (@AliAbdaal) July 8, 2022

Mini fridge surprisingly value additive https://t.co/RiqNBvto0F

— Steph Smith (@stephsmithio) July 8, 2022

Yoga Nidra (aka Non Sleep Deep Rest)

— Renée Fishman JD | Holistic Performance 🚢 (@reneefishman) July 8, 2022

20 min = 3 hours of sleep

Boosts creativity

Regulates the nervous system

In no particular order:

— Tom Bell (@tombell93) July 8, 2022

1. AirPod Pro’s

2. Logitech MX Keys and Master 3

3. Burr coffee grinder (old Bodum one - new one is a lot worse)

4. Kindle

5. Altberg walking boots

6. Osprey hiking bag

7. Leatherman

8. YouTube premium (I’ll do anything to avoid watching ads)

Totally free & life changing 💛

— The Sapna Co l Happiness Advocate (@thesapnaco) July 8, 2022

1. 10 minutes of meditation

2. 3 minutes of gratitude pratice

3. Hanging out with loved ones

4. Reading

5. Long walks in nature

6. Getting enough sleep every night

Often times, it’s the simple things in life that significantly improve life.

Under $200, nothing fancy, compact, light, and I've been doing 45-minute Zone 2 cardio almost every day on it. Life changing. pic.twitter.com/VYu40jklro

— Ray (@therayfdj) July 8, 2022

Headspace anual membership

— Ami (◍•ᴗ•◍) (@ms_warbird) July 8, 2022

Cotton sheets and towels

A confortable chair

A second monitor + keyboard

YouTube premium

And declutter my home of things I didn't really want or need.

An electric tea kettle.

— Roberto Blake 🇺🇸🇵🇦 Creative Entrepreneur (@robertoblake) July 8, 2022

Makes it so convenient!

A mini fridge in my bedroom for cold water and yogurt!

A humidifier.

A spare pair of glasses.

An exercise bike.

A punching bag.

Running shoes.

Good headphones, you can find them for under $200 and they are really useful tbh you can just put headphones on and just get freed of boredom by listening to podcasts songs and audio books and also watching videos this makes the experience better and also you don't disturb anyone

— DzeroDee (@DzeroDee) July 8, 2022

I take it with me everywhere. Totally transformed my water consumption habits. pic.twitter.com/7Ym10goi0f

— Adam Ross (@aross21) July 8, 2022

This isn’t completely going to remain under $200 but,

— Jon Baker (@jonbakerbiz) July 8, 2022

A gym membership.

This will help distill the working on yourself principle.

Change your mindset on gratification and slow it down.

Also improve your mood and fitness level, while instilling higher confidence.

- AirPods

— Morgan (@agmorn) July 8, 2022

- (just a little bit over 200EU) Sony XM3 noise cancelling headphones

- Fountain pens

- Keychron keyboard

- Screenbar / monitor LED light

- Xiaomi bedstand night lamp

- Leuchtturm1917 notebooks

Services:

- tailor 🪡

- dental hygienist twice a year (insured)

Bialetti for quality coffee. pic.twitter.com/gUE8Q7jelL

— Cheet’s Sheets (@CheetSheets) July 8, 2022

A £10 Journal made my life so much more organised and efficient. The act of writing out what I'm going to do has been ridiculously good at ensuring I do said job/activity.

— TotalXclipse (@Total_Xclipse) July 8, 2022

Astronomy binoculars - everyone should see the moon in detail. It’s incredible!

— Prasad Mahes (@prasadmahes) July 8, 2022

Laptop stand. Record player. Used bike. Money clip in front pocket instead of wallet in back pocket. And I just found out that my public library has a free streaming service! ( @Kanopy )

— How To ADU (@howtoadu) July 8, 2022

Not in any particular order

— rohit (@rohittkrr) July 8, 2022

1. Instant pot

2. Electric Toothbrush

3. Memory Pillow

4. Coffee machine

5. Weighted blanket

6. Electric Blanket

7. Diffuser

8. Citrus juicer - for fresh orange juice

AirPods for everyday calls.

— Ian LeBruce (@LeBruce) July 8, 2022

Electric toothbrush for better dental hygiene.

Moleskine notebook for staying organised.

Comfy trainers for work commutes.

Eyedrops for when eyes get dry.

Earplugs for better sleep.

Youtube premium.

— Lakshmanan Raman (@iamlakshmananr) July 8, 2022

Significant impact on education and entertainment

Best answer.

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

@loom just started testing it as a response to potential clients and my close ratio has shot up this week.

— Jonathan Mills Patrick (@jmillspatrick) July 8, 2022

If that holds true long term in a fan.

Bose noise canceling headphones (over $200 tho) help tap into flow state, listening to Hans Zimmer.

— Anytime Mailbox (@AnytimeMailbox) July 8, 2022

Journals - one as a bullet journal, one to brain dump.

— Ros T 💙🇺🇦 (@blaze_ros) July 8, 2022

Air fryer - waited for ages to get one, wasted all that time!

Instant pot - brilliant for fuss free cooking.

Obsessed with the keys on the right. oh ma lawddd

— Steffen Wendt 🔥 (@Dudehere) July 8, 2022

Is he on Twitter? Have him talk to me.

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

According to a report by policy advisory and research firm Startup Genome, Bengaluru's tech ecosystem is currently valued at US$ 105 billion, more than Singapore (US$ 89 billion) and Tokyo (US$ 62 billion). #BrandIndia pic.twitter.com/hOzCr2uf30

— Indira PriyaDharshini (@IndiraP15101990) July 8, 2022

105B going on 1T.

— Paramendra Kumar Bhagat (@paramendra) July 8, 2022

This doesn't get mainstream attention because most tech people representing "Bengaluru vibe" here have good office cafeterias or order ~3X a day.

— Karan Trehan (@karntrehan) June 30, 2022

This isn't possible for all of us. Also is not very healthy.

But if you are able to cook on your own - that's the best.

BREAKING: Elon Musk is terminating his $44B Twitter deal‼️😳 pic.twitter.com/BQW2XRaF74

— RapTV (@Rap) July 8, 2022

Taking a break from Twitter for a few weeks! See you all in August!

— Elizabeth Yin is on a tweet break. (@dunkhippo33) July 8, 2022

I don’t write bugs, I write surprise features

— Matthew Jones (@ExceptionNotFnd) July 7, 2022

An up and coming neighborhood in Nashville called Wedgewood Houston (also an opportunity zone) is quickly becoming the second home for a few big multi-stage VC firms. One block away from the biggest Soho House in North America. Things are happening here.

— Nichole Wischoff (@NWischoff) July 8, 2022

VC thesis: weird folks building weird stuff

— Juan Medina (@AtJuanMedina) July 8, 2022

Twitter has opened 10x more doors for me than going to a top 20 college

— Samuel Spitz ✈️ NYC (7/11 - 7/18) (@samuel_spitz) July 8, 2022

Future wars are all about the drones. Human crews of planes or tanks have no chance.

— Elon Musk (@elonmusk) July 8, 2022

One exception: a purely analog, human-controlled vehicle is far more resilient to EMF weapons.

Elon Musk is no longer buying Twitter because he realized he can get it for free in the App Store

— greg (@greg16676935420) July 8, 2022

Truly grateful to 🇺🇸 President @POTUS, the 🇺🇸 people for continuing effective support of 🇺🇦 in countering Russia's aggression. More #HIMARS, 155mm shells are our priority needs. It is what helps us press on the enemy. We appreciate the 🇺🇸 support! Let's go to victory together!

— Володимир Зеленський (@ZelenskyyUa) July 8, 2022

Imagine if Ford was the only car for the last 100 years.

— Brandon Brooks (@OfficialBBrooks) July 8, 2022

Then imagine out of nowhere BMW, Land Rover & Honda appeared.

Essentially, that’s the period venture capital is in.

It’s been funding Ford (white men) for 60+ years … others are coming.

elon finally pulled out of something

— ali taylor (@_ali_taylor) July 8, 2022

data is the death of story.

— rafa0 (@rafathebuilder) July 8, 2022

story is the life of data.

I'll never lose hope... pic.twitter.com/3SnTndCeDx

— Josh Hemsley (@joshhemsley) July 8, 2022

Great to see you all at #BinanceTurns5 pic.twitter.com/Gwdk1Hd8Ys

— CZ 🔶 Binance (@cz_binance) July 8, 2022

when I was 24 and living in my shitty apartment in the tenderloin & working 4 jobs to survive I made a pact with myself that my all my free time would be spent doing things that intellectually stimulated me. I truly think that’s what radically changed my life for the better.

— Chase👽 (@sheslostheplot) July 8, 2022

यो बर्ष:

— sachin timalsena (@TimalsenaSachin) July 8, 2022

१ नेपाली बिजुली भारत निर्यात

२ नेपाली सिमेन्ट भारत निर्यात

३ कब्बडी - ४ भारतको मल्टीप्लेक्स (PVR) मा बिभिन्न शहरमा प्रदर्शन

हामीलाई लामो समय भारतलाई दुश्मन मान्न सिकाइएको छ जबकी भारत हाम्रो लागि १३० करोडको बजार हुन सक्छ।

यो राम्रो सुरुवात हो।

The banking system, including all debit cards, are currently down in Canada. No one can make payments for anything.

— Jeff Kirdeikis 🔁 (@JeffKirdeikis) July 8, 2022

Maybe this Bitcoin thing has utility after all.

A lot of VCs focus on “swinging for the fences” often against founder’s interests

— Rick Zullo (@Rick_Zullo) July 8, 2022

Ive seen founders drive >100m wealth on smaller exits and others raise tons of 💴 end up w/ nothing

Focus on efficiency (not just $ raised) for the best outcome

This isn’t baseball, it’s business

More HIMARS coming to Ukraine

— Paul Massaro (@apmassaro3) July 8, 2022

Today I met with 1 whale. He showed me @binance account.

— Pushpendra Singh (@pushpendrakum) July 8, 2022

I asked him why r u holding huge bitcoins in this exchange

He replied: This platform is like my hardware wallet & I trust on @cz_binance

He said I am holding 60% busd for dip buying, my dip order is still not executed.

ICYMI: Billionaire Tim Draper Predicts $250k $BTC Price by Early 2023

— Market Meditations (@MrktMeditations) July 8, 2022

Good news for once in San Francisco! https://t.co/W56rya2AAF

— David Sacks (@DavidSacks) July 8, 2022

I note the resignation of the British tribal leader Boris Johnson. The United Kingdom's political stability is of utmost importance to me and the rest of the West African delegation. We stand ready to help the British people transition from this period of grave uncertainty .

— Chris O. Ògúnmọ́dẹdé (@Illustrious_Cee) July 7, 2022

10 newsletters that will teach you more than any $150,000 MBA:

— Alex Banks (@thealexbanks) July 8, 2022

Honest project plan: pic.twitter.com/3fPz4o7h1y

— Janis Ozolins (@OzolinsJanis) July 8, 2022

Saudi Crown Prince's $600 billion dollar hedgefund is buying all your cheap cryptocurrencies and rare nft art

— moon is hearing things (@MoonOverlord) July 8, 2022

I recommend turning notifications up loud for every new paying customer that signs up at your startup.

— Andrew Gazdecki (@agazdecki) July 8, 2022

the hardest thing about startups has nothing to do with startups

— brett goldstein (@thatguybg) July 8, 2022

its managing your own psychology

You get gifted one of these two portfolios that you have to hold until 2030...

— Lark Davis (@TheCryptoLark) July 8, 2022

Option 1

1 #bitcoin

10,000 #cardano

100,000 #dogecoin

Option 2

20 #ethereum

10,000 $matic

1,000 #chainlink

Which do you choose?

When you crush product-market fit pic.twitter.com/2cE2JaPwkR

— Justin Gordon (@justingordon212) July 8, 2022

Modern dictatorship relies on access to the West

— Paul Massaro (@apmassaro3) July 8, 2022

Ukraine wins with more HIMARS

— Paul Massaro (@apmassaro3) July 8, 2022

What are some of the most important problems to solve in the world in the next decade?

— Justin Gordon (@justingordon212) July 8, 2022

Everyone will tell you to build a community, what you really need to build is a tribe.

— Nataraj (@natarajsindam) July 8, 2022

An example from 2020, back when I had 200 followers

— Alex Llull 🕵️♂️ (@AlexLlullTW) July 8, 2022

- I took the tweet below by @jackbutcher

- Quote RT’d summarizing the tweet (value)

He saw it and RT’d it.

In return, I gained +100 new followers, which accounted for 50% of my audience growth in just 1 day. pic.twitter.com/A3srBxb4H2

Eminem just surpassed 3 billion streams on Spotify alone in 2022.

— Eminem Zone (@EminemZone_) July 5, 2022

He hasn't released an album for 2 years 🐐 pic.twitter.com/Xt39EADIzn

"Not Afraid" has now surpassed 700 million streams on Spotify.

— Eminem Stats (@EminemOnStats) July 5, 2022

— It's @Eminem's 10th song to reach this milestone. pic.twitter.com/ahS024BgXu

I still get goosebumps every time Eminem comes out

— Eminem Detroit (@EminemDetroit88) July 5, 2022

pic.twitter.com/99z3YYSxeO

.@Eminem has now charted at least ONE song for 14 consecutive years on the Billboard Hot 100 (2009-2022). pic.twitter.com/htAuVNjOZi

— Eminem Stats (@EminemOnStats) July 5, 2022

.@Eminem's most streamed songs from "Encore" on Spotify:

— Eminem Stats (@EminemOnStats) July 7, 2022

#1. "Mockingbird" — 627M

#2. "Like Toy Soldiers" — 250M

#3. "Just Lose It" — 185M

#4. "Ass Like That" — 143M

#5. "Never Enough" — 65M pic.twitter.com/ZxIASyn2YG

Pregnant Texas Woman Cited for HOV Violation Told Cop Her Fetus Is the Passenger.

— Shomari Stone (@shomaristone) July 9, 2022

The expectant mom's court date is July 20 – about the same time as her due date: @nbcwashington @thenewsoncnbc https://t.co/Q0LxP3HSJE

As inflation rates climb to multi-decade highs across the world, some of the biggest drivers of consumer-price growth have entered a new and welcome phase: Their prices are actually declining.

— The Globe and Mail (@globeandmail) July 8, 2022

@mattlundy33 explains: https://t.co/U0rjGyPPM5

Wholesale gasoline prices are dropping, too, which should trickle over to retail pricing in the coming weeks. Already, the average price of regular unleaded gas in Canada has fallen below $2/L, having peaked at $2.15 a month ago. https://t.co/U0rjGyQnBD pic.twitter.com/veT3MmfEPd

— The Globe and Mail (@globeandmail) July 8, 2022

Policy makers have pinned much of the inflation run-up on supply-chain disruptions related to the pandemic, leading to product shortages, lengthy delivery times and pricier shipping. Of late, those disruptions are easing. https://t.co/U0rjGyPPM5 pic.twitter.com/yRqrrB00EO

— The Globe and Mail (@globeandmail) July 8, 2022

Major Focus of this Year's Kathmandu Metro Budget is on Education, Health, Improved Transportation , Waste Management, River Cleansing, Heritage Protection, Skill Training & Innovation Centre and Disaster Risk Management etc.

— Balen Shah (@ShahBalen) July 9, 2022

बाल्यकालमा बाइस्कोप हेर्ने सौभाग्य तराईमा पाइन्थ्यो। मेलामा बाइस्कोप देखाउने चाचाहरू आउनु हुन्थ्यो। चार आना तिरेर बाइस्कोप हेरिन्थ्यो। pic.twitter.com/7FspWepS0X

— Gajendra S. Budhathoki ♿ (@gbudhathoki) July 9, 2022

I made zero dollars this week, but I…

— Douglas A. Boneparth (@dougboneparth) July 9, 2022

- Ran 6 miles

- Made coffee

- Mowed the lawn

- Cried myself to sleep

If finances are your only measuring stick, you’ll have a sad life.

Remote work without async work hardly improves productivity

— Kilian Poulin (@KilianPoulinTW) July 9, 2022

म मेरो तलबबाट यम बुद्धको सालिक बनाउँछु- मेयर बालेन शाह https://t.co/vRwWJ3O5TV

— Setopati (@setopati) July 9, 2022

Yama Buddha died of suicide. Alok Nembang died of suicide. Mr Mayor, if you want to do something for them, better spend half of that amount on mental health awareness and well being. Save who are alive, statues can wait.

— Shiksha Risal (@RisalShiksha) July 9, 2022

Thanks.

I am about to raise 1M. I am looking for a bridge investment of 100K. Would you guys like to come in? This weekend? https://t.co/GcBafbPaiA @nihalmehta

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

Twitter wasn’t devoid of drama when it had just 25 employees and it certainly isn’t devoid of drama with 7,500 employees. It’s a nail biter that writes itself 🎭

— anamitra (@anamitra) July 9, 2022

My take: https://t.co/6mqUNbw7fF #twitter #trillion

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

The Boldest Of Them All: Afore https://t.co/GcBafbPaiA #venturecapital #preseed #prelaunch #VC #preanything #rocket #moonshot #aforecapital #gauravjain #anamitra

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

People with lots of advice but no follow through pic.twitter.com/1Oa6a1skvZ

— anamitra (@anamitra) June 28, 2022

Steve Jobs said the same thing about Apple. As in, not the iPad, or the Mac, but Apple itself was his best product.

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

Congrats @vibe_bio #YouAreInGoodHands

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

Hello South East Asia 🇸🇬 https://t.co/6gVdiBWFjH

— anamitra (@anamitra) June 21, 2022

You should go get some of that money. You will put it to better use than them.

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

Not true. The idea the Founder is pushing has got to be something they have been building up to perhaps their entire life. And how that idea speaks to the world.

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

I am only seeing the final result. I missed the storm that had been brewing, apparently.

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

Congrats ....... I am toying with the idea of skipping ........ Going straight from the 1M pre-Seed to ..... IPO ...... with massive early revenue.

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

A new standard for Pre Seed that’s befitting of 2022 https://t.co/jhmXDNtxTb thank you @nmasc_ for thoughtfully covering the new fund.

— anamitra (@anamitra) May 4, 2022

The Boldest Of Them All: Afore https://t.co/GcBafbPaiA #venturecapital #preseed #prelaunch #VC #preanything #rocket #moonshot #aforecapital #gauravjain #anamitra

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

If you’re a founder and this sounds good to you, we’d love to hear from you. You can get in touch via our simple application here: https://t.co/esH5ZEzdWA. We’ll get back to you within a week. (7/)

— Afore Capital (@AforeVC) May 4, 2022

Afore Alpha offers founders something better: a $1M investment at a $10M post-money valuation, with no MFNs. It’s the best and most transparent option for “pre-everything” founders raising their first funding. (4/)

— Afore Capital (@AforeVC) May 4, 2022

Announcing $150M Afore Fund III and Afore Alpha, the best in class Pre Seed deal for any founder, anywhere in the world, no matter how early they are. Read on 👇 https://t.co/GSGGRdYTyM

— anamitra (@anamitra) May 4, 2022

Your goal should be a unicorn in every Top 100 city on the planet.

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

USV’s portfolio page includes a blogpost and investment date for every single investment dating back to 2004 in reverse chronological order, just like tweets! https://t.co/F3ELoEu4V8

— anamitra (@anamitra) April 30, 2022

World Cup Soccer.

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

Yep. There is toxicity at Tesla. Corporate Culture matters. It is foundational. It is existential even.

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

These days tweets are all he delivers. All day long!

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

Jack is how I found Afore. #Eureka

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

for example, grateful for @jeremy_navarro7 for modeling how to be a great leader, for @lktong_ for our chats about fulfillment, for @amiyoshimura_ for showing how to support your people, for @emilyhxrrera for helping me better understand VC and more importantly myself, and others

— jack mcclelland (@jackmmcclelland) April 15, 2022

i continued to intern with startups and vc’s through college –

— jack mcclelland (@jackmmcclelland) April 15, 2022

grateful for @geri_kirilova at @LaconiaCapital and @jcorsello at @acadianventures for sharing their insights and teaching me how funds work, for @bquazz at @Accel for supporting my deep dives, and others

That is the question I am asking you NOW ----- or will do so again in a week! :)

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

i'll also continue to code, working on internal software projects for afore (in addition to investing)

— jack mcclelland (@jackmmcclelland) April 15, 2022

and super eager to learn from the afore partners @anamitra and @gjain as well as my teammates @RileyFinch13 @venkateshkr @ekaurghar @kaylakav about supporting pre-seed founders

Move to the Valley. #Hudson

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

Neutrals always love the underdog, in sport and business. ALWAYS.

— anamitra (@anamitra) April 14, 2022

YC is like Windows 95 in the years 2005. They stopped updating a long time ago.

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

I was featured in the same BBC article as @paulg one time. But it was not a forum. So I did not get to share any thoughts, before or after. The Boldest Of Them All: Afore https://t.co/GcBafbPaiA

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

LOL

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

The best 4/1 tweet. Even though I am coming to it late.

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

Twitter forgot to scale and monetize. Repeatedly. It is its own Craig's List. (Love both ........ $$$ is not everything.)

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

I really do need an explanation. Calcutta, you must know, has a thriving soccer scene. That one city alone should be able to win the World Cup. @MamataOfficial

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

Welcome aboard @kaylakav and welcome to San Francisco. Here’s to doing amazing things together 🎉 https://t.co/gwZeJYGeVF

— anamitra (@anamitra) March 16, 2022

This is unsurprising. The top company of 2000 is not the top company of 2005 is not the top company of 2010. Where is Yahooooooooo?

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

Quick lil life update! Excited to share that I've joined the investment team @AforeVC 🍾. I'm stoked to have the opportunity to learn from some of the best investors in the biz: @gjain and @anamitra. Here's the quick version of my VC journey so far...(ty for inspo @ekaurghar)

— Kayla Kavanaugh (@kaylakav) March 16, 2022

What do you think of NYC? It seems to have an unparalleled collection/sample of the global population.

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

Excellent positioning. The Boldest Of Them All: Afore https://t.co/GcBafbPaiA

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

The Very Best. The Boldest Of Them All: Afore https://t.co/GcBafbPaiA

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

Best I wrote this week. The Boldest Of Them All: Afore https://t.co/GcBafbPaiA

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

I am in the Jeff Bezos camp on this one. Memos, not PPTs.

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

Marketing yourself is a superpower.

— Justin Welsh (@thejustinwelsh) July 9, 2022

Learn it and you're an unstoppable force.

Use these 9 powerful threads to master marketing in 15 minutes.

🧵

By the end of this thread, you'll learn 9 lessons:

— Justin Welsh (@thejustinwelsh) July 9, 2022

1. Formulas for virality

2. Brand strategy

3. How to gain trust

4. An SEO primer

5. Using stories

6. Psychology vs. marketing

7. Principles of online marketing

8. Insights from a successful CEO

9. Systems for productivity

Lots of talk about @elonmusk as an Austin associated business leader, but @LisaSu is by FAR one of the most underrated biz leaders in the US and has been in Austin far longer. https://t.co/tb9i6W04GR

— Henry Yoshida, CFP® (@henryyoshida) July 9, 2022

Me. And I am looking for a 20-100K bridge investment this weekend before my impending 1M raise in a week or two. Are you in? Details upon ask. Invest 20M now harvest 20M in 10 years.

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

I would be surprised if he did not have some idea of these numbers six months ago. Why even make an offer? He just created a distraction from the bad news on Tesla. But your study does not give any hint on bots, his pet peeve.

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

I am sorry but you seem to have fallen for the caricature. Woke is about facing the fact of the traditionally marginalized. And bringing them on board. Getting them to participate. Breaking the glass walls and ceilings that hold them down. People of all backgrounds want a seat.

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

What are the "non-negotiables" in your life?

— Justin Gordon (@justingordon212) July 9, 2022

Having worked at BlackBerry in its heyday (early 2000s), I see a lot of parallels to what Zoom is going through. Of course, that story did not have a happy ending, so I wanted to share a few thoughts 👇👇

— Gaurav Jain (@gjain) June 29, 2020

As Zoom-ing into a video meeting or a classroom is today, so too was pulling out your BlackBerry to fire off an email or check your stocks, circa 2002.

— Gaurav Jain (@gjain) June 29, 2020

1- focus on building the best human-to-human virtual interaction experience. Only a small subset of human interactions are work meetings. Don't get bogged down in being a platform for business meetings. What got you here won't be enough in the future. Complacency kills!

— Gaurav Jain (@gjain) June 29, 2020

Question for Zoom is whether it can innovate fast enough to be *that* product. BlackBerry went from relative obscurity to a global phenomenon to a relic in the same decade. Consumer preferences can shift seemingly overnight. Don't get caught sleeping at the wheel.

— Gaurav Jain (@gjain) June 29, 2020

Zoom/Tesla/Facebook/Search/OS/JPMorgan/RepublicanParty/America/NATO

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

When the iPhone was released, many people within BlackBerry rightly pointed out that we had a technical leg up on Apple in many areas important to business and enterprise users (not to mention the physical keyboard for quickly cranking out emails)… but how much did that advantage matter in the end? If there is serious market pull, the rest eventually gets figured out… a lesson I learned from my time at BlackBerry that I was lucky enough to be able to immediately apply when I joined Google to work on Android. .......... At BlackBerry, we would hear stories of

customers “accidentally” dropping their devices into the toilet

to force their IT team for an upgrade. It was hard to imagine in the mid-2000s that by the end of the decade carrying a BlackBerry would become “uncool.” ........... When BlackBerry tried to force fit the enterprise product for the consumer market with devices like the BlackBerry Curve, Storm, and Tour, and it didn’t work. .......... I had the opportunity to learn from our mistakes when I became one of the first Product Managers on the Android team. At Android, we were maniacally obsessed about the product experience, not the “Google experience.” .........along these lines, somebody once mentioned a one-legged prostitute neighbor ---- but that was on the West Side, so you are ok (for now)

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

the comedian in the glue that will hold it all together

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

A Next-Generation Social Network https://t.co/q9VL1F1f3p @Hadley

— Paramendra Kumar Bhagat (@paramendra) July 9, 2022

Sri Lankan President Gotabaya Rajapaksa will step down on July 13, after a dramatic day that saw tens of thousands of protesters storming the presidential office and residence and the prime minister’s home being set on fire. https://t.co/eQbuvYJBUn

— The Washington Post (@washingtonpost) July 9, 2022

A comedian was critiquing David Chappelle, pointing out he was no longer 'hip' but 'square.'

— Paul Griffiths (@paul_griffiths) July 9, 2022

That is, he had aged into conservatism the way Bob Hope had. (Hope's reputation had tarnished by his death at 100).

I see this 'squareness' in venture capital too, a 🧵