Afore Capital

Afore’s fresh $150 million fund includes a plan to standardize the pre-seed world And it’s ready to come after Y Combinator .......... Venture firm Afore Capital first splashed on the scene with the aim to institutionalize that angels, friends and family round. Now, after investing in over 80 companies over five years, the eight-person team has landed on a more specific way to do so: Offer a standard deal and raise what it claims is the largest dedicated pre-seed fund in the market. ......... Afore general partners Anamitra Banerji and Gaurav Jain tell TechCrunch that they has closed a $150 million fund fueled almost entirely, around 85% to be specific, by existing LPs. New investors account for the remainder of the capital, which brings Afore’s assets under management to $300 million. ......... Afore is launching Afore Alpha, what it’s calling a standard pre-seed deal that offers founders a $1 million lead investment via a $10 million post-money SAFE. The money, as well as resources and advice from Afore’s team, is offered in exchange for 10% ownership of a company. ......... The new standard terms will apply to any startup, regardless of geography, that gets accepted into Afore Alpha. .......... Venture firms have increasingly started launching their own in-house accelerators — take Sequoia and Andreessen Horowitz for example — but many are still investing on a deal by deal basis because of a focus on multistage, Jain thinks. ........ founders care more about investors who are focused on one stage ......... Most of Afore’s portfolio companies to date are first-time founders, a focus it plans to continue as assets under management scale. Of course, the company has experience cutting first checks, estimating that it has led more than 80% of the rounds where it has invested. Portfolio companies include BetterUp, Modern Health, Petal, Overtime, BenchSci and Neo Financial. ............... Startups in the pre-seed world don’t have revenue or hard metrics so it can be hard to value them beyond weighing supply and demand. Regardless, Afore thinks that the $2 million post-money valuation that traditional accelerators offer is just an “unfair lowball valuation in 2022.” .......... Afore Alpha puts the firm in direct competition with accelerators like Y Combinator and Techstars, or programs like A16z’s recently unveiled START. The co-founders noted that

their deal is five times more capital, and five times the valuation, compared to what other accelerators offer.

............. Afore gives the money upfront and doesn’t have any MFN clauses. ........ “We think it is very disruptive to founders. They should get a good amount of capital, and then go heads down and build the business.” ....... high valuations come with tough expectations — and startups could also buckle in trying to grow into their prescribed worth. ......... companies need $1 million to hit early milestones. ......... “In 2022, the venture community should be able to offer founders at the start of their journey a fair, transparent and meaningful deal.”https://medium.com/afore

Afore is Tripling Down on Pre-Seed With a new $150 million Fund III in hand, we’re launching a superior way for founders to raise their first funding. ...... Afore was founded just over 5 years ago to build something missing in the VC landscape: a venture firm that won’t tell founders that it’s too early — or too risky– to invest. ........ We came to VC having served as early product leaders at Twitter and Google’s Android, giving us a unique understanding of how to shape a promising idea into a world-changing product. ........ As investors with strong product backgrounds, we made a conscious choice to focus on pre-seed. We’re passionate about supporting founders in

that formative “zero to one” phase when there’s little or no product, no traction, and no revenue. Pre-everything. Pre-obvious.

......... pre-seed, where the risk and rewards are greatest. ......... To many, pre-seed is a convenient way to get an early look at promising companies; it’s a means to an end. At Afore, it’s all we do. ......... We have built an enviable portfolio of more than 80 companies, with a collective market cap that already exceeds $11.5 billion. Afore is proud to have been first –and quite often the lead– investor in breakout companies like Modern Health, BetterUp, Petal, Overtime, BenchSci, Hightouch, Flatfile, Neo Financial and Retain, among others, and to have led more than 80% of the rounds where we’ve invested. ........... Nearly 85% of Afore’s portfolio companies have gone on to raise an institutional follow-on round; 64% of them have skipped straight to a Series A. ........ nearly one-quarter of the more than $1.18 *billion* that pre-seed firms have raised since 2016 has gone just to Afore. ........Data shows more than 90% of today’s venture dollars flow to later-stage companies that have already reached product-market fit.

Accelerators and other early investors aren’t set up to provide dedicated help and are unwilling to commit meaningful money. So instead of getting the capital they need, founders are too often offered minuscule investments at comically low valuations. ......... The harsh reality is that in today’s market, and at today’s prices, accelerator-level capital barely covers the cost of getting started. With just a few months of runway, founders end up on an endless fundraising and demo-day treadmill, leaving little time to build a viable product — let alone bring it to market. The bottom line is thatyou can’t fly a rocketship with a few gallons of gas; founders need fuel, not fumes

. ............ Afore Alpha, a new product that offers founders something better. It distills everything we’ve learned since 2016 into a single, standardized product designed to increase founders’ odds of success. ........... Afore Alpha sets a new standard for what a pre-seed deal should look like in 2022 — one that gives “pre-everything” founders the runway and personalized resources they need to reach traction and raise a substantial Series A .......... Afore Alpha is available to any founder worldwide. Entrepreneurs from Latin America, Africa, the Middle East, and elsewhere are increasingly seeking the same type –and same level– of resources available to their North American peers. And rightly so. With Afore Alpha, founders will get the same generous terms, whether they’re in Singapore, South Africa, Spain, or San Francisco. ........... With Afore Alpha, founders can now raise one meaningful upfront round and spend their next year actually bringing their products to market and actually reaching traction. It’s a winning formula that has worked time and time again for our portfolio companies. .Take it to 1,000.

— Paramendra Kumar Bhagat (@paramendra) July 7, 2022

Saudi Arabia's crown prince is using its giant wealth fund to reshape the world's biggest oil exporter https://t.co/EMUUiVG8ta

— Bloomberg (@business) July 7, 2022

A Rising Tide To Lift All Boats https://t.co/BMKJN7ZZSY @elonmusk @gchahal @cz_binance @anamitra @jackmmcclelland @ekaurghar @kaylakav @venkateshkr @rileyfinch13 @gjain

— Paramendra Kumar Bhagat (@paramendra) July 7, 2022

The ‘3’ is back pic.twitter.com/5tZNulykyq

— Jason Allen (@CBS11JasonAllen) July 6, 2022

This AM I received a cold pitch from a company that says they're raising a pre-seed round.

— Elizabeth Yin (@dunkhippo33) July 7, 2022

They previously raised $11m in their last round...

Maybe Tesla should make a highly configurable Robovan for people & cargo?

— Elon Musk (@elonmusk) July 7, 2022

I hope you have big families and congrats to those who already do!

— Elon Musk (@elonmusk) July 7, 2022

BREAKING: Boris Johnson resigns as UK prime minister to join crypto startup.

— Douglas A. Boneparth (@dougboneparth) July 7, 2022

Boris Johnson is joining A16Z crypto team

— Trace Cohen (@Trace_Cohen) July 7, 2022

A short 🧵 … that became long

— George Le (@glfirerat) July 7, 2022

Founders, please remember that seeking investment is a competition. You are competing against other startups looking to raise. AND you are competing against the public market. How do you compete? I’m glad you asked, read the below for more 👇

Just read my exec coach's book "Living on Purpose"; some highlights that stood out to me:

— Gale Wilkinson @Vitalize (@galeforceVC) July 7, 2022

✨feel it out, don't figure it out

✨trust that things are always working for you

✨know that you're complete

✨stop seeking validation from others

✨focus on love, appreciation, connection

A Beginner’s Guide to Crypto: Getting Started with ETH the Ethereum network is presently one of the most engaging spaces to immerse yourself in. Most of the hype projects you see trending on Twitter are being built within the Ethereum ecosystem. ........ Bitcoin is currently *just* a currency whereas Ethereum is a system that includes its own currency, the ability to create applications using the system, and a vibrant developer ecosystem. ........ Borders are stupid! ........ Twitter, Discord, and Telegram seem to be the main social apps of choice for people involved.

जन्मसिद्धका सन्तानलाई नागरिकता दिने सहमति जुटेको छ : महतो

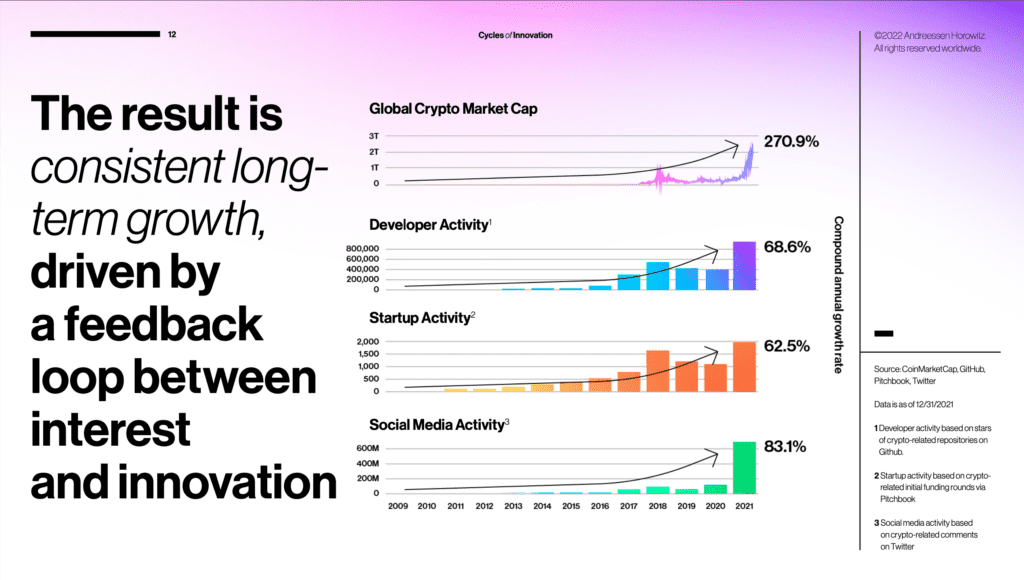

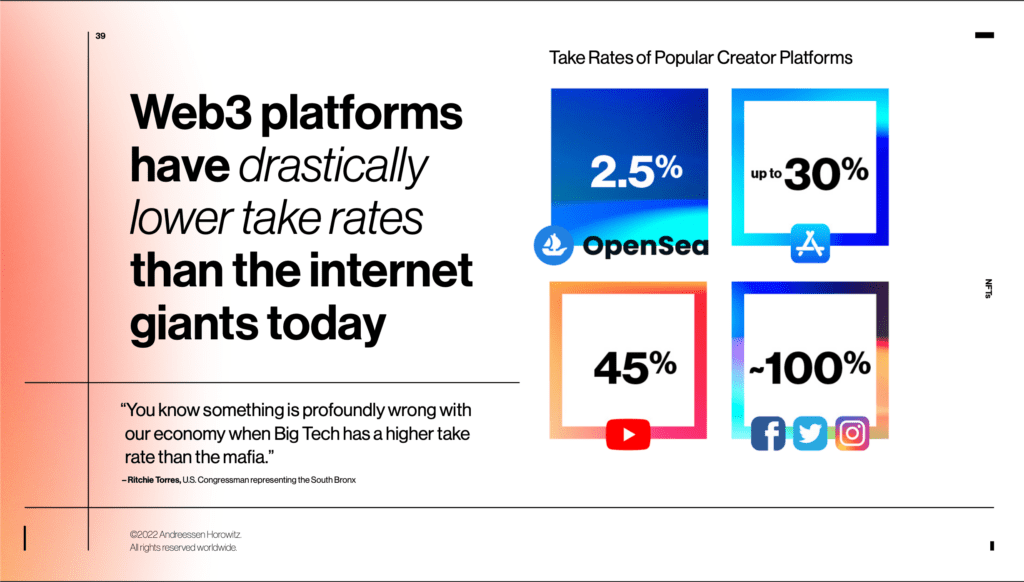

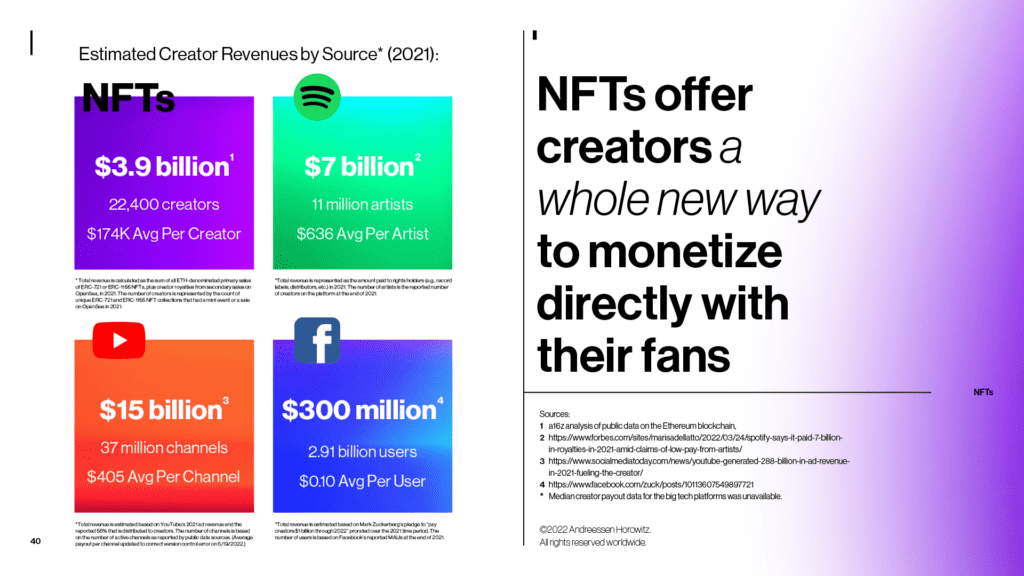

Introducing the 2022 State of Crypto Report towards a decentralized, community-owned-and-operated alternative to the centralized tech platforms of web2 ............ As legendary investor Benjamin Graham once allegorized: It’s best to pay no mind to “Mr. Market”, who frequently boomerangs from exuberance and euphoria to despair and depression. To Graham’s wisdom we add an addendum: Better to build. Consider that any prospective founders who swore off tech and the internet in the aftermath of the early-2000s dotcom crash missed the best opportunities of the decade: cloud computing, social networks, online video streaming, smartphones, etc. Now is the time to consider what the equivalent successes will be in web3. ............ Compare Meta’s nearly 100% take-rates across Facebook and Instagram to NFT marketplace OpenSea’s 2.5%. As U.S. Congressman Ritchie Torres noted in a recent op-ed, “You know something is profoundly wrong with our economy when Big Tech has a higher take rate than the mafia.” ............ web3 paid out $174,000 per creator, while Meta paid out $0.10 per user, Spotify paid out $636 per artist, and YouTube paid out $405 per channel. Web3 is tiny but mighty. ..........

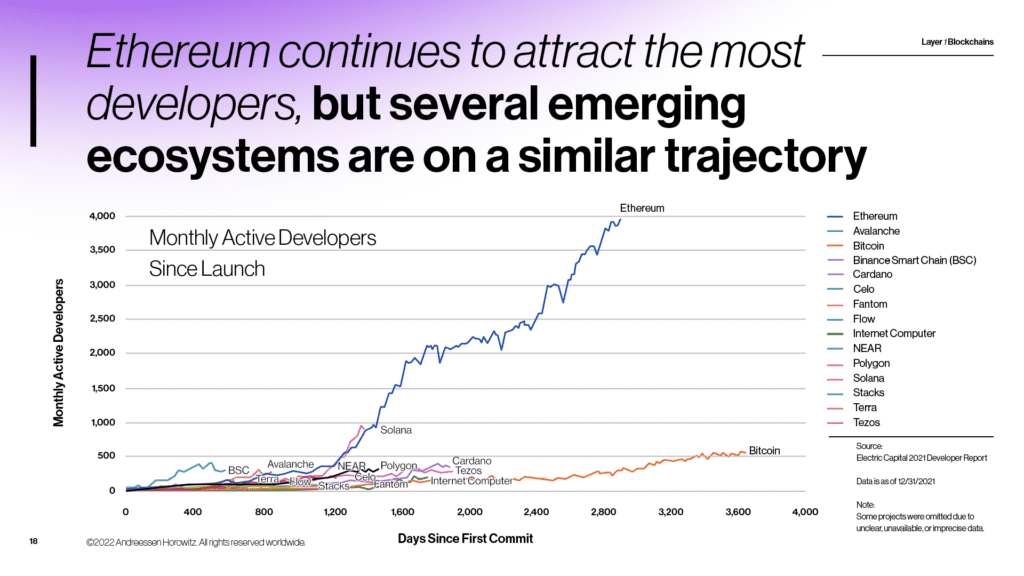

More than 1.7 billion people don’t have bank accounts

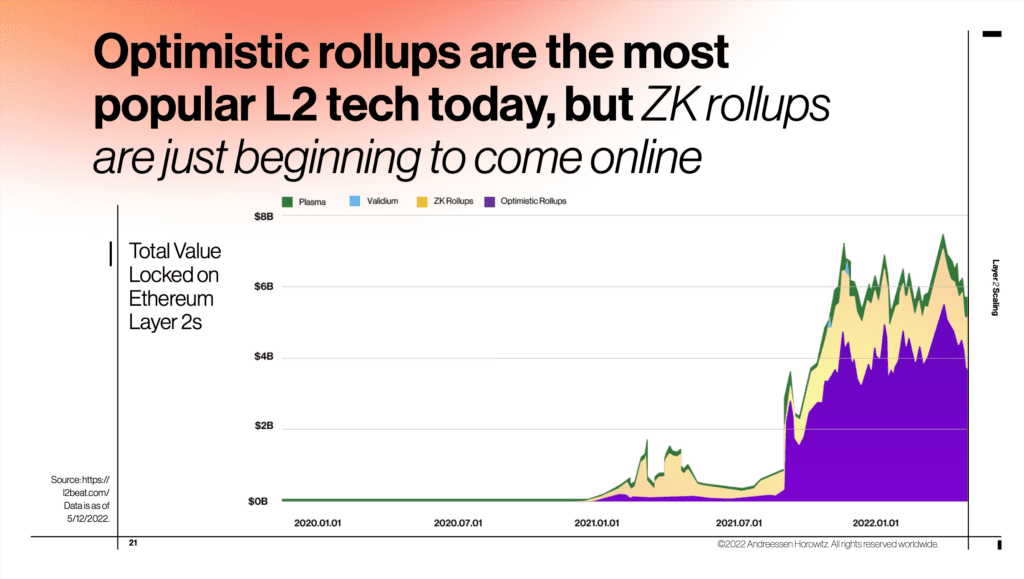

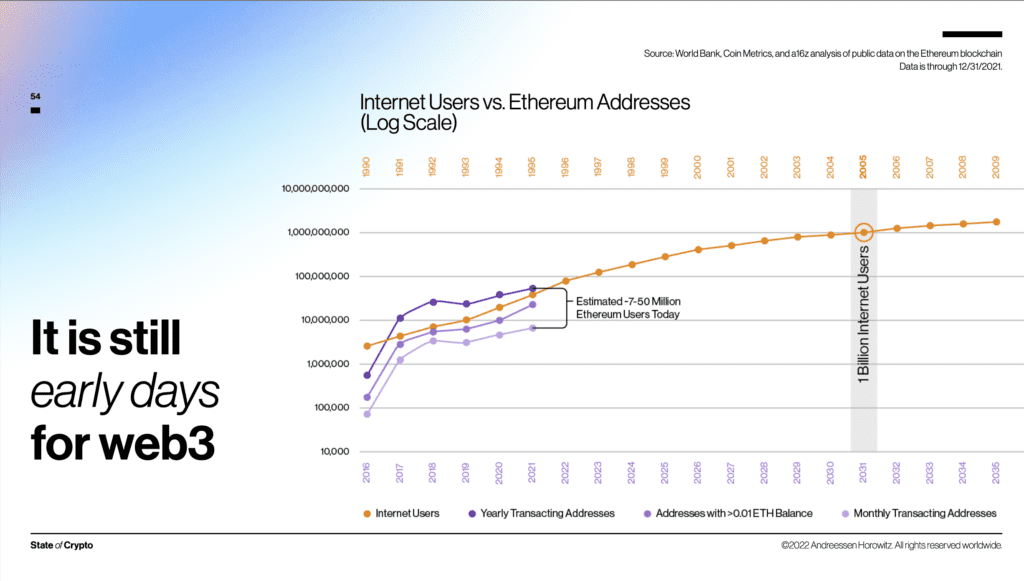

........... underserved and unbanked populations – 1 billion of whom have mobile phones – crypto offers a shot at financial inclusion. ......... Helium, a grassroots wireless network, is posing the first legitimate, decentralized challenge to entrenched telecom giants. ........... Crypto is far more than just a financial innovation – it’s a social, cultural, and technological one. ......... We’ve barely just scratched the surface of what’s possible. ......... Ethereum dominates the web3 conversation, but there are plenty of other blockchains now too. Developers of blockchains like Solana, Polygon, BNB Chain, Avalanche, and Fantom are angling for similar success. ......... Ethereum’s overwhelming mindshare helps explain why its users have been willing to pay more than $15 million in fees per day on average just to use the blockchain ......... Blockchains are the hit product of a new computing wave, just as PCs and broadband were in the ‘90s and 2000s, and as mobile phones were in the last decade. .......... We estimate there are somewhere between seven million and 50 million active Ethereum users today, based on various on-chain metrics. (See slide 54.) Analogizing to the early commercial internet,that puts us somewhere circa 1995 in terms of development

. The internet reached 1 billion users by 2005 – incidentally, right around the time web2 started taking shape amid the founding of future giants such as Facebook and YouTube.जनकपुरमा भेला गरेर ६ प्रदेशका गृहमन्त्रीहरूको माग- साउनभित्र प्रहरी समायोजन होस https://t.co/GUK2Hb249S @dipjha

— Paramendra Kumar Bhagat (@paramendra) July 7, 2022

China & Japan have awesome trains.

— Elon Musk (@elonmusk) July 7, 2022

Took bullet train from Beijing to Xi’an to see Terracotta Army of 秦始皇.

Why do you think the US does not have bullet trains? Could it be because it is waiting for Hyperloop?

— Paramendra Kumar Bhagat (@paramendra) July 7, 2022

Paying customers are the most sustainable source of funding for startups.

— Andrew Gazdecki (@agazdecki) July 7, 2022

This picture epitomized the tech scene a decade ago. Women’s funding has always been low and never broken 3%, but it’s dipping back to this level again. Is this what you want the future of tech to look like? https://t.co/J17jlGMkaH

— Sara Ledterman (@saraledterman) July 7, 2022

Q: How low can fees go?

— CZ 🔶 Binance (@cz_binance) July 7, 2022

Binance: 0

Binance Launches Zero-Fee #Bitcoin Trading.https://t.co/FP0YQ8XayV

MySQL?

— Paramendra Kumar Bhagat (@paramendra) July 7, 2022

Hire me as a P/T consultant. I can do tricks.

— Paramendra Kumar Bhagat (@paramendra) July 7, 2022

🦉 @kevinrose was once the poster boy of Web 2.0.

— Business Insider Tech (@BITech) July 6, 2022

But where his contemporaries went on to build the most successful and enduring tech companies in history, Rose's idea fell short.

Now he’s staking his redemption on a new kind of media company. ⬇️https://t.co/O5Q8xyR1uh pic.twitter.com/7l7Ba5yT9N

Not Boris.

— Paramendra Kumar Bhagat (@paramendra) July 7, 2022

I stopped wearing makeup most of the time and nobody noticed.

— startupstella 🇺🇦 (@startupstella) July 7, 2022

There are plenty of people on earth right now. Not enough have been cared for. Let's take care of those we have.

— Paramendra Kumar Bhagat (@paramendra) July 7, 2022

There is no dopamine hit larger than finally getting a reply on the 7th cold email I sent on a chain. Stand-up comedy has taught me that having no shame may be my defining skill in life.

— Eli Wachs (@EliWachs) July 7, 2022

You have a startup idea.

— Paramendra Kumar Bhagat (@paramendra) July 7, 2022

17 months ago, I co-founded my first business

— adriane schwager (@aschwags3) July 7, 2022

Today, we crossed $5,000,000 in revenue with only 5 US full-time employees. Totally bootstrapped

I’m a mom, wife, and now a first-time founder/CEO

Here are my top 11 learnings on leadership, entrepreneurship, and startups 👇🧵

Hire an executive assistant before you think you need one - and offshore

— adriane schwager (@aschwags3) July 7, 2022

When we can’t release control, we operate from a place of fear. Fear is not how you want to run your business.

By hiring an EA you’ll free up so much of your time, which is truly our most valuable asset.

Your first team members don't need to be onshore

— adriane schwager (@aschwags3) July 7, 2022

Our first 5 hires were offshore. We crossed 3 million in revenue before our first full-time US hire.

Now, we still hire at least 3 offshore for every stateside team member.

Spend 20% of your time recruiting, even when you’re not hiring

— adriane schwager (@aschwags3) July 7, 2022

Network before roles become available. When you have an open position, it will let you

1) hire faster

2) hire better

3) get more candidates referred

Actively recruiting is a growth hack.

I'm sad that this stuff is getting dug up by media through court records. Revealing details of personal family life should be a personal choice.

— vitalik.eth (@VitalikButerin) July 7, 2022

Putin wants to have a victory party for his 70th birthday on Oct 7. He wants control of Luhansk and Donetsk, to occupy and annex the south and then call for "peace" while his Western stooges go along. Every leader must denounce this as unacceptable now. https://t.co/hf6QJp6WUx

— Garry Kasparov (@Kasparov63) July 7, 2022

The occupation and false peace of 2014-15 led directly to this expanded war and thousands of Ukrainians tortured and killed. Not again. For Putin to negotiate, his war machine in Ukraine must be destroyed. For the war to end, Russia must be defeated and held accountable.

— Garry Kasparov (@Kasparov63) July 7, 2022

Twitter is like college but with relevant professors.

— Justin Welsh (@thejustinwelsh) July 7, 2022

“Get at least eight hours of beauty sleep, nine if you’re ugly.”

— Hasudi (@hasudi) July 7, 2022

~Betty White ~ pic.twitter.com/M6hkOenUL8

what if i created a dating app that is constructed from a cybersecurity professional’s point of view, requiring a more stringent background check, including safety features - like letting a loved one know when you’re going on a date - and other built-in secure features?

— meg west (@cybersecmeg) July 7, 2022

A bit out of fashion praising British politics just now, especially the Conservatives. But do consider that the upcoming race to lead the party/country will pit, among others: Rishi Sunak, Priti Patel, Suella Braverman, Nadhim Zahavi and Sajid Javid. You don't see that outside UK

— Stanley Pignal (@spignal) July 7, 2022

I’m so sick of this. https://t.co/irHNT35eMk

— Lisa Lucas (@likaluca) July 7, 2022

Super fired up for future product development with our awesome Tesla team! Such an honor to work with them.

— Elon Musk (@elonmusk) July 7, 2022

9% of the 500 unicorns founded in the US are Indian immigrants

— kriti (@kritishgl) July 7, 2022

What are the waiting for? This is "Designate the sky is blue". Putin's Russia has been a terror state for years, from the slaughter of Syrian civilians to chemical weapons and assassinations. The brutality in Ukraine is documented and ongoing. Do it. https://t.co/6tLn4XBZ9o

— Garry Kasparov (@Kasparov63) July 7, 2022

crypto is just switching between discord, telegram, and twitter for 18 hours a day

— foobar (@0xfoobar) July 7, 2022

There I was, all these years, thinking conservative Republicans were all about minimizing how much the Government should meddle in our private lives.

— Neil deGrasse Tyson (@neiltyson) July 7, 2022

Here's the thing: L1s like Bitcoin and Ethereum are slow. Bitcoin currently processes about 5 Transactions (Tx) a second. On the other hand, Visa does 24000 Tx / sec. How can crypto ever outperform traditional money? Here's how Bitcoin scales with the Lightning Network👇🧵

— Vatsal Kanakiya (@vazzupk) July 7, 2022

Let's go deeper into this with the Lightning Network and how it works in Bitcoin. First, it is important to understand that each bitcoin can be divided into 100 million parts. The lowest denomination is called a satoshi. 100,000,000 Satoshis = 1 $BTC

— Vatsal Kanakiya (@vazzupk) July 7, 2022

However, it's ridiculous to ask users to open Payment Channels with everyone they want to exchange money with. That's where the lightning network comes in. The lightning network has 20000 nodes connected by bidirectional payment channels.

— Vatsal Kanakiya (@vazzupk) July 7, 2022

That's the basics of how the Lightning Network scales Bitcoin. Next time, I'll cover how ZK Rollups help Ethereum scale. Here's the top of the thread. If you learnt something, like, retweet and follow for more crypto content. Sharing as I learnhttps://t.co/W626aUhAs8

— Vatsal Kanakiya (@vazzupk) July 7, 2022

I see the need for a Super Lightning Network already.

— Paramendra Kumar Bhagat (@paramendra) July 7, 2022

I might get on that list myself soon ..... You are like the "Intel inside" of Web 3.

— Paramendra Kumar Bhagat (@paramendra) July 7, 2022

Looks like you know how to trend yourself, Insider! :)

— Paramendra Kumar Bhagat (@paramendra) July 7, 2022

Here's a look at who might replace Boris Johnson as UK Prime Minister On Tuesday, two high profile lawmakers expected to throw their hats into the ring -- Health Secretary Sajid Javid and Chancellor of the Exchequer Rishi Sunak -- resigned over the botched handling of the resignation of Johnson's former deputy chief whip in a sexual misconduct scandal. ............ Any candidates who run for the leadership will go through rounds of voting by Conservative lawmakers until only two remain -- at which point Conservative Party members nationwide will vote. The winner will be the new party leader -- and prime minister. ....... Sunak's stock sank earlier this year after revelations that his wife had non-domicile tax status in the UK and that he held a US green card while a minister. His popularity has also taken a beating in recent weeks as Britain has suffered a cost-of-living crisis. Sunak has struggled to keep down spiraling inflation and has been criticized by opposition parties for what they call a slow and inadequate series of financial measures. But he is still among the bookmakers' odds-on favorites to take Johnson's job. ........ The MP has twice run for party leadership in the past -- in 2016, after the Brexit referendum, and in 2019, when Johnson was ultimately elected. ...... She has a formidable and dedicated team around her -- some of whom previously worked in Number 10 -- which has been producing slick videos and photos of her looking thoroughly statesmanlike. ......... Less than two days after he was appointed to chancellor, replacing Sunak, Nadhim Zahawi publicly called on Johnson to resign. "Do the right thing and go now," he said in a statement on Twitter accompanying a letter to the Prime Minister. ....... Zahawi was born in Iraq to Kurdish parents and came to the UK at 9 years old, when his family fled Saddam Hussein's regime. He is believed to be one of the richest politicians in the House of Commons, and helped found the polling company YouGov.How many do you have? Lucky you!

— Paramendra Kumar Bhagat (@paramendra) July 7, 2022

Prime Minister: this is not sustainable and it will only get worse: for you, for the Conservative Party and most importantly of all the country. You must do the right thing and go now. pic.twitter.com/F2iKT1PhvC

— Nadhim Zahawi (@nadhimzahawi) July 7, 2022

So how does any of this make Polygon "following in Solana's footsteps"? Solana is ignoring the state of its chain to build a Web3-oriented smartphone while Polygon went after an accomplished smartphone maker, and another aiming to compete directly with Apple's iPhone.

— animated (@0xanimated) July 7, 2022

The approach to spreading Web3 and crypto ethos are clearly different between these two, as Polygon is serving the future and Solana is serving itself.

— animated (@0xanimated) July 7, 2022

My DMs 👀 pic.twitter.com/kk55O2mayV

— chainyoda.eth💜☀️👻 (@chainyoda) July 6, 2022

.@0xPolygon with a more practical approach to bringing web3 to mobile.$MATIC pic.twitter.com/pLuL0OWucB

— Narb (@NarbTrading) July 5, 2022

Which cryptocurrency are you watching this week?

— Cointelegraph (@Cointelegraph) July 4, 2022

someday in future.. https://t.co/QERTE4lJ6j pic.twitter.com/2bl10j6VAg

— sourcex 💚 (@sourcex44) July 4, 2022

Everyone seems to be very excited with Web3 Mobile stuff these days.

— Sandeep | Polygon 💜🔝3️⃣ (@sandeepnailwal) July 4, 2022

Tbh feels a bit like hopium marketing.@0xPolygon is working on a different strategy by collaborating with existing Mobile heavyweights for global scale.

Sth big is coming. A trailerhttps://t.co/hJ9RtQHBSQ

I’m encouraged to see the DOJ aggressively going after NFT scammers and other Ponzi crypto schemes. It’s toxic, ruins lives, and undermines technological progress.

— Ryan Wyatt (@Fwiz) July 4, 2022

Also, everything is permanent and publicly viewable. It could not be a worse forum to conduct illegal activities. pic.twitter.com/uLVvwSzgLy

Presidential campaigns coming to Metaverse.

— Sandeep | Polygon 💜🔝3️⃣ (@sandeepnailwal) July 3, 2022

Pioneering stuff from one of the top metaverses @SomniumSpace #PoweredByPolygon https://t.co/VaCioK53xx

Do you think Elon Musk's Twitter move has been good or bad? For Twitter? For Tesla? For Elon? https://t.co/dJUCm392Ar

— Paramendra Kumar Bhagat (@paramendra) July 6, 2022

Invest in my blockchain startup like Yahoo invested in Alibaba, I will make you the featured news source for a time period (a few years).

— Paramendra Kumar Bhagat (@paramendra) July 7, 2022

We are upending social. We will be the next generation social network.

— Paramendra Kumar Bhagat (@paramendra) July 7, 2022

Two convos with >$1B AUM crypto fund managers in the past week that think good chance that coming out of this bear market ETH flips BTC

— Hunter Horsley (@HHorsley) July 7, 2022

Last year, I taught a 4-week long course about the creator economy — covering history of the industry, creators as businesses, web3, future predictions, & more.

— Li Jin (@ljin18) July 6, 2022

Now, all of the videos & materials from that course are available to everyone for free! 📚https://t.co/938CTMIi1d

Communism in China = it's transparent as they don't try to hide the fact that they're not democratic.

— Gurbaksh Singh Chahal (@gchahal) July 7, 2022

Communism in America = @Twitter, where woke-hippy keyboard warriors get to decide "policy."

I got my promotion y'all 😭💖. You're looking a freshly new Senior Software Engineer.

— Prince Wilson (@maxcell) July 6, 2022

Me: “The camp photographer took such a nice photo of you and your sister today, want to see?”

— H. Joelle Boneparth (@averagejoelle) July 6, 2022

Hazel, 6: “I know, Mom. I was there.”

I’m screwed, right?

One lesson I have learned:

— Harry Stebbings (@HarryStebbings) July 6, 2022

The single sign of greatness in a founder.

Doing something out of the ordinary/exceptional in their youth.

It could be the lemonade style, whatever side hustle it is.

Early exceptionalism is the greatest signal.

The moment has arrived - I’m about to drop my badge, Pixel phone, and the beloved 16” MacBook Pro at work. Feeling major nostalgia.

— Gabor Cselle (@gabor) July 6, 2022

Goodbye Google, goodbye Area 120, I’ll miss you. Excited for what’s next! pic.twitter.com/4b6nNqdR3K

In May I spent a week hiking and visiting the historic Dzong Monastery and the Tiji festival. One of the most exciting parts of my job is the opportunities to experience Nepal’s stunning landscapes and heritage. pic.twitter.com/a9rviNoWVs

— Ambassador Randy Berry (@USAmbNepal) July 7, 2022

What are some of the most exciting features that you would like to see in CoinDCX App? Will share the list with our product team.

— Sumit Gupta (CoinDCX) (@smtgpt) July 7, 2022

The team is super focused on building the best product for Indian crypto ecosystem so your inputs would be highly valuable here!

Who's building *fully onchain* games?

— Qiao Wang (👽, 👽) (@QwQiao) July 6, 2022

By fully onchain games I mean all game states and logic (not just currencies and NFTs) are onchain.

Animation, sound, etc. can stay off-chain.

Show us the NFT you're HODLing hardest🫂

— Coinbase NFT (@Coinbase_NFT) July 6, 2022

👇

I never talk publicly about things like this, let alone tweet about them, but today at a bar in D.C. a bouncer asked me (I was alone) where “I’m from” and tried speaking in several Asian languages to me, even when I tried to ignore him. He would not leave me alone.

— Adrienne Shih (@adrienneshih) July 6, 2022

Stop giving tasks without the why.

— Allie K. Miller - in NYC (@alliekmiller) July 6, 2022

It’s one of the fastest ways to build resentment on your team.

Two years at Spotify 💚

— Emma Bostian (@EmmaBostian) July 6, 2022

Taking this job led me to meeting my soulmate, buying a beautiful home and having a wonderful baby.

I am grateful 🥰

By toppling autocrats. @anamitra @jackmmcclelland @ekaurghar @kaylakav @venkateshkr @rileyfinch13 @gjain Doing Liberty Right https://t.co/RBgMUtYNfi #invest #angelinvesting #crowdfund #crowdfunding #liberty #ukraine #web3 #nextsocial #facebook #twitter

— Paramendra Kumar Bhagat (@paramendra) July 6, 2022

Me.

— Paramendra Kumar Bhagat (@paramendra) July 6, 2022

It is something. I went to college in KY. It speaks to me. The South IS different.

— Paramendra Kumar Bhagat (@paramendra) July 6, 2022

Today I reached 200K followers on Twitter, proving that you don’t need to be smart, good looking or talented to suffer from a debilitating addiction to social media.

— Douglas A. Boneparth (@dougboneparth) July 6, 2022

Thank you! ❤️

Last year, I taught a 4-week long course about the creator economy — covering history of the industry, creators as businesses, web3, future predictions, & more.

— Li Jin (@ljin18) July 6, 2022

Now, all of the videos & materials from that course are available to everyone for free! 📚https://t.co/938CTMIi1d

It is. Indirectly. Ask @elonmusk

— Paramendra Kumar Bhagat (@paramendra) July 6, 2022

find it hurtful to think of all the crypto people who have plagiarized others for their own gain, but find it extra hurtful that nobody's plagiarized me

— david phelps (🐮,🐮)(🃏,🃏) (@divine_economy) July 6, 2022

My parents (both retired IAS officers) started learning Indian classical music at the age of 65. They’re taking their second year exam this year and spend hours practicing. It just goes to show that there’s no age to stop learning.

— Aparna Saxena (@aparna_saxen) July 6, 2022

Welcome, Finland and Sweden, to the NATO table.

— Kaja Kallas (@kajakallas) July 6, 2022

Historic moment as Estonian parliament @Riigikogu just ratified Finland’s and Sweden’s accession to @NATO.

Estonia is among the first to seal the deal and did so with lightning speed. I count on a speedy process from all Allies. pic.twitter.com/Ty142CgoxB

And 100% of mass public shootings happen with guns.

— Governor JB Pritzker (@GovPritzker) July 6, 2022

As Governor, on behalf of the people of Highland Park — leave us the hell alone. https://t.co/biBV75pWxA

Get yourself a watering can that sparks joy. pic.twitter.com/nFGVmL6a2b

— Lisa Lucas (@likaluca) July 6, 2022

Brittney Griner’s best hope of getting out of Russian prison is likely a prisoner exchange. But the U.S. has long been wary of such exchanges—and the Justice Department reflexively opposes them. https://t.co/LRfBcx0EmH

— The Wall Street Journal (@WSJ) July 6, 2022

"It’s not time yet to negotiate an end to the Ukraine war" (@TheHillOpinion) https://t.co/NMgs0zsXhN pic.twitter.com/mMJZixqUe4

— The Hill (@thehill) July 6, 2022

Find yourself a man who looks at you the way @dougboneparth looks at his follower count! https://t.co/PPH8KZQrnq

— H. Joelle Boneparth (@averagejoelle) July 6, 2022

Nothing's wrong with you:

— David Morris (@wdmorrisjr) July 6, 2022

The world needs people to start businesses,

And the world needs people to run them.

Neither is more valuable.

Entrepreneurs dominate the landscape of social and traditional business media.

If you're not one, it's easy to feel defective.

You're not.

Most builders are bad operators:

— David Morris (@wdmorrisjr) July 6, 2022

Entrepreneurs rarely admit it, but they're typically bad at running the business.

Many are wired as visionaries and risk takers,

Who can't stand to get stuck in the weeds of day-to-day operations.

They need your help to succeed.

How good are you as COO? Are you available? :)

— Paramendra Kumar Bhagat (@paramendra) July 6, 2022

Working for entrepreneurs will spark personal growth:

— David Morris (@wdmorrisjr) July 6, 2022

If struggle is the catalyst of personal growth,

Find an entrepreneur to work for.

Then fasten your seat belt.

They'll inspire, energize, and empower you...then frustrate, exhaust, and impede you.

All in the same day.

For much of my career, I believed that founders were the *real* superstars.

— David Morris (@wdmorrisjr) July 6, 2022

And judged myself because I wasn't one.

Then I found my perfect spot -

As an entrepreneur's right hand.

If you're not wired for starting a startup,

That's okay.

The business world still needs you.

😮Would you ever visit a floating city? This is everything we know about the Maldives’ latest project… https://t.co/Ls43AxQcdw

— Condé Nast Traveller (@cntraveller) July 6, 2022

💦The Maldives Floating City has just been green-lit for construction: 5,000 housing units that are linked together and tethered to the floor of a 500-acre lagoon, designed to preserve and enhance its natural and cultural ecosystem. pic.twitter.com/quqmb7ICcO

— Condé Nast Traveller (@cntraveller) July 6, 2022

🌊The project relies on floating technology from the Netherlands, which has a centuries-old engagement in designing architecture to withstand floods. pic.twitter.com/Vq14bhfVtt

— Condé Nast Traveller (@cntraveller) July 6, 2022

The Maldives is building the world’s first floating city . The first homes are slated to open to public viewing in August ......... .

You have not checked my DM. Come in before my 1M arrival. Can't come after.

— Paramendra Kumar Bhagat (@paramendra) July 6, 2022

Moon brought us together in ‘69,

— Elon Musk (@elonmusk) July 6, 2022

Mars can do that in the future

What about you build this in the South China Sea? https://t.co/45y9sEz9FX

— Paramendra Kumar Bhagat (@paramendra) July 6, 2022

Zelensky Or Putin?

— Paramendra Kumar Bhagat (@paramendra) July 5, 2022

Today's my last day of employment at Google after 6 years. Heading into SF shortly to return my laptop, phone, and badge.

— Gabor Cselle (@gabor) July 6, 2022

Tomorrow I'll be entering the idea maze for my next startup. I think it's going to be fun.

I just wish people who work in tech would read more books about philosophy of technology and less books about productivity

— Lara Mendonça (@laraisuncool) July 6, 2022

I sold my car to go all-in on a coin at the start of 2022 - I now have no car and walk to work.

— Coinfessions (@coinfessions) July 6, 2022

For context, here's the 100-year graph of US home prices pic.twitter.com/YhmJIYrmEn

— Nik Shah 🏡 (@NikhaarShah) July 6, 2022

Not encouraging. Build, baby, build! https://t.co/HAb7Jik1D3

— Paramendra Kumar Bhagat (@paramendra) July 6, 2022

Millennials are not fragile. It is a generation that is overwhelmed by several, overlapping, systemic crises and given patronizing advice like "skip the lattes and avocado toast" while under the weight of student loans, rising housing costs, stagnant wages, and a climate crisis.

— Karen K. Ho (@karenkho) July 5, 2022

You cannot give an entire generation of Millennials several large sacks of potatoes and then find it confusing most of those people find it extremely difficult to run marathons or climb up mountains for most of their lives. But this framing happens all the time.

— Karen K. Ho (@karenkho) July 5, 2022

Millennials who are also women, not white, disabled, LGBTQ+, or other minority groups are also not fragile for identifying how systems are designed to basically repeatedly hurt, punish, and/or exclude them on a repeated basis. There is literal Census data on how this happens.

— Karen K. Ho (@karenkho) July 5, 2022

— brandi dandy (@msbrandidandy) July 5, 2022

— Nobody, don't worry about it. (@cnotej) July 5, 2022

We were also the first ones to have to apply for jobs online. You can't call anyone for a status nor make an impression. My parents would always say "Why don't you call them?". Call who?

— Steve Perry (@jerwix3) July 5, 2022

I spent a LOT of time calling to follow up my applications after I graduated. Every book on finding a job says employers admire "initiative." Left so many messages on so many voice mails. No one ever called back/took my call. IDK what employers want but it sure isn't initiative.

— V. R. Craft (@vrcraftauthor) July 6, 2022

I just want to own a couple acres, grow my own food, work from home, and have my kids be safe. And that is like seriously a fucking pipe dream and it angers me

— Jackie 🇺🇸 (@aguirre120404) July 5, 2022

Kidults' drive a bump in toy sales Child's play is big business, but not entirely because of kids. Adults buying for themselves are helping drive toy sales, which jumped 37% to $28.6 billion in 2021 ...... So-called "kidults" are snapping up building sets, games and more, a trend that gained steam during the pandemic as all ages sought a little escapism. Companies including Lego and Razor are leaning in with increasingly adult-friendly products, which seems like a no-brainer: An industry survey from 2021 found that 58% of grown-ups are buying for themselves. .

No comments:

Post a Comment