The Blockchain People

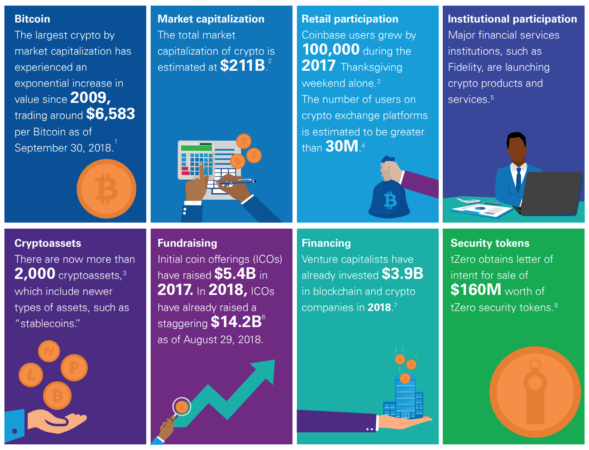

The dot com boom happened on Nasdaq. The crypto boom is not there. The crypto boom is happening in the fact that there are more than 2,000 cryptocurrencies in play right now. This is crazy.

Crypto was supposed to simplify things. In the old world, we have about 200 national currencies. In the new crypto world, we have more than 2,000. This is not simpler.

When a cryptocurrency crashes, everyone who bought into it with real money will stand to lose that money. Most of these more than 2,000 will crash and burn. A lot of people will lose a lot of money.

This seems to happen with every new technology. When cars first showed up, there were thousands of car companies. Most of them went out of business. A handful survived.

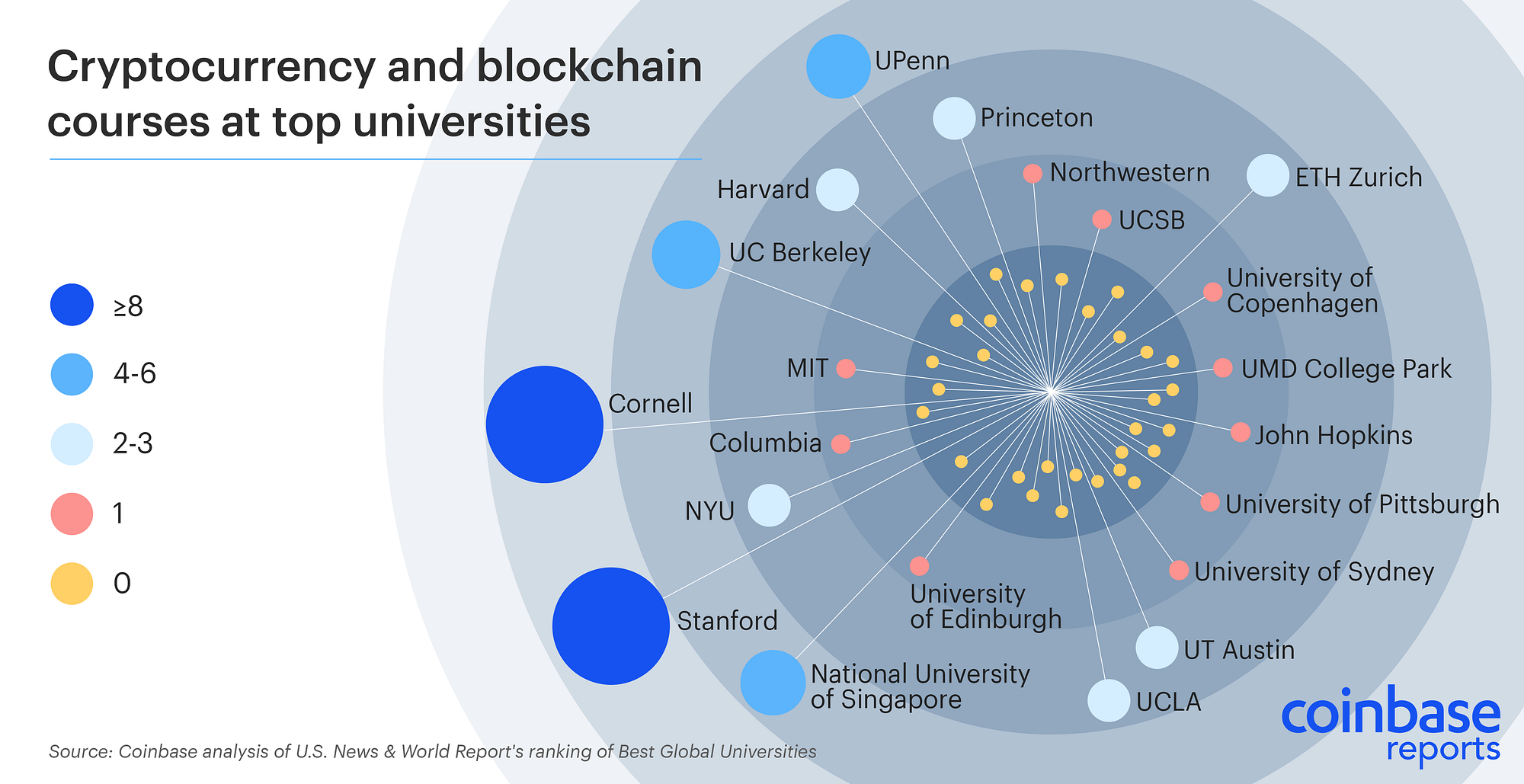

Less than five of the more than 2,000 cryptocurrencies might survive. Three of them might be Bitcoin, Ethereum and Libra.

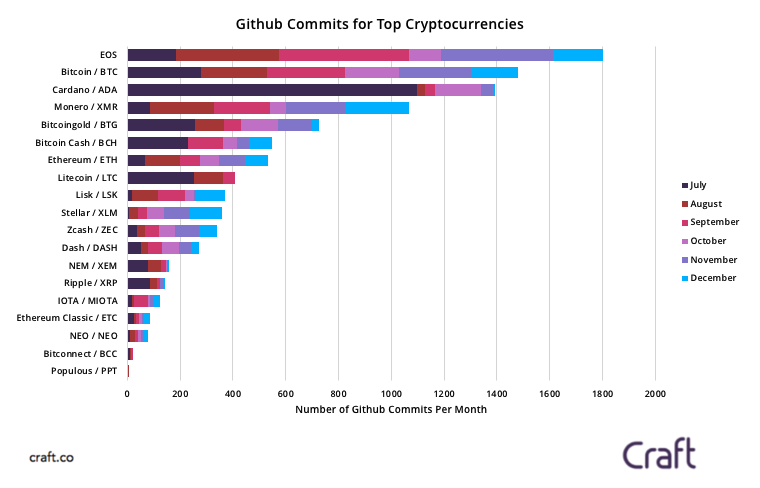

How will a cryptocurrency blow up? Loss of computing power is one way. A cryptocurrency needs hardware, it needs electricity, it needs computing power. When you are no longer growing, you start shrinking, and when you start shrinking, the end is near.

Another way would be for the founders to simply disappear. These would be fraudulent people who always meant to create a frenzy and cash out before anyone found out what was going on.

As to when the clean-up might happen is anyone's guess. It might be five years. Who knows?

One form of the crypto crash would be where the vast majority of the more than 2,000 cryptocurrencies are no longer around. 1990 gone, 10 still around kind of scenario.

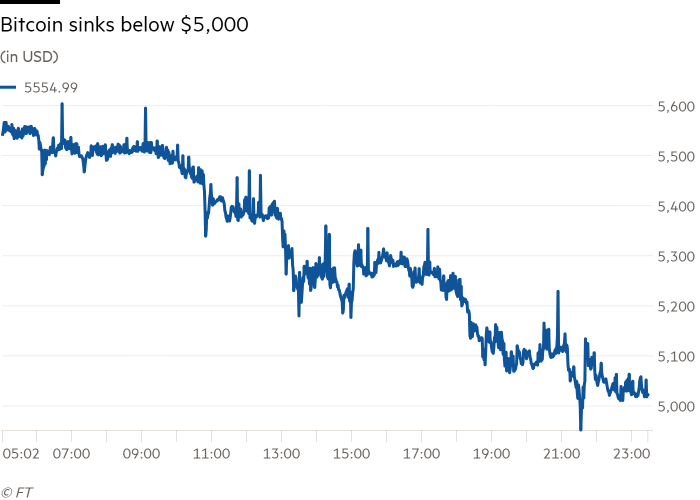

Another form of the crash would be where say Bitcoin loses 90% of its value. So Bitcoin is still around. But it has lost most of its value. And then it starts its slow climb up. It was always real. And it will stick around. But its dollar value was way up than it needed to be. "Miners" get rewarded for computing power. If the next generation of computers is vastly more powerful and vastly cheaper, that might impact the Bitcoin price. Or not. If the use of Bitcoin just keeps getting larger and larger as computers and electricity get cheaper and cheaper, that dramatic crash might not even happen.

The Bitcoin is an incentive to build the Blockchain, the ledger. People are being rewarded for building the Blockchain.

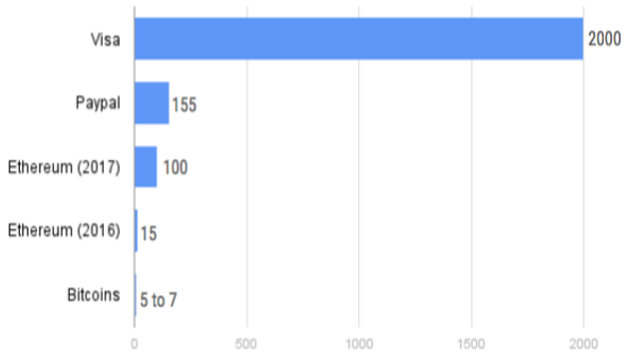

Could the major cryptocurrencies talk to each other? The way your Gmail talks to Yahoo Mail and to Hotmail? They have to. If all the cryptocurrencies will talk to the real world currencies like the dollar, then obviously they also have to talk to each other. That might bring some stability.

Market corrections will inevitably happen. As to when and what forms they will talk is anyone's guess.

:max_bytes(150000):strip_icc()/GettyImages-1032766138-e733cb1dbaf7492fa25ac474f7529534.jpg)

:max_bytes(150000):strip_icc()/cryptocurrency-3423264_960_720-5c29b06a46e0fb0001cd3086.jpg)