Carbon-Neutral Energy Forms for Rocket Propulsion

Achieving carbon neutrality in rocket propulsion is challenging due to the high energy density required to escape Earth's gravity. However, several approaches are being explored to reduce or eliminate the carbon footprint of rocket launches. Below is an outline for the primary carbon-neutral or low-carbon energy forms, their availability, cost-effectiveness, timelines, key players, and China's role in this space.

1. Carbon-Neutral Energy Forms for Rocket Propulsion

The following are the main energy forms or fuels being considered for carbon-neutral rocket propulsion:

- Liquid Hydrogen and Liquid Oxygen (Hydrolox):

- Description: Hydrolox is a propellant combination where liquid hydrogen is burned with liquid oxygen, producing water vapor as the primary emission. It is considered environmentally friendly because it emits no carbon dioxide (CO2) during combustion, though nitrogen oxides (NOx) can form, which contribute to acid rain and nutrient depletion.

- Carbon Neutrality: Hydrolox can be carbon-neutral if the hydrogen is produced via electrolysis powered by renewable energy sources (e.g., solar, wind, or geothermal). The Sabatier process or other carbon capture methods can further enhance neutrality by recycling CO2.

- Availability: Available and used in rockets like NASA's Space Launch System (SLS) and Blue Origin’s New Shepard. However, large-scale production of green hydrogen (using renewables) is limited.

- Cost-Effectiveness: Currently expensive due to the energy-intensive process of producing and storing liquid hydrogen, which requires extreme cooling and insulation. Handling its explosive nature also increases costs.

- Timeline for Mainstream Use: Already in use for specific applications, but widespread adoption for large rockets is likely 10–20 years away due to infrastructure and cost challenges for green hydrogen production.

- Limitations: Less energy-dense than other fuels, requiring solid rocket boosters for heavy-lift rockets, which are less environmentally friendly.

- Liquid Methane and Liquid Oxygen (Methalox):

- Description: Methalox combines liquid methane with liquid oxygen, producing CO2 and water vapor upon combustion. However, methane can be synthesized via the Sabatier reaction (using CO2 and hydrogen) powered by renewable energy, making it carbon-neutral. Sourcing methane from biogas or captured emissions can even make it carbon-negative.

- Carbon Neutrality: Carbon-neutral when methane is produced using renewable energy or captured from waste (e.g., agricultural or human waste). Methane leaks during production or transport are a concern, as methane is 80 times more potent than CO2 as a greenhouse gas.

- Availability: In use by SpaceX’s Starship and planned for other rockets like Blue Origin’s New Glenn and Relativity Space’s Terran R.

- Cost-Effectiveness: More cost-effective than hydrolox due to simpler storage requirements (methane requires less extreme cooling). However, carbon-neutral methane production is not yet scaled, increasing costs.

- Timeline for Mainstream Use: Methalox is already in use, with carbon-neutral production potentially scalable within 5–15 years as renewable energy and carbon capture technologies advance.

- Advantages: Higher energy density than hydrolox, producing less soot than kerosene-based fuels.

- Biofuels (e.g., Bio-Propane, Ecosene):

- Description: Biofuels like bio-propane (used by Orbex) or Ecosene (developed by Skyrora) are derived from renewable sources such as agricultural waste or non-recyclable plastics. These fuels aim to reduce emissions by up to 86% compared to kerosene-based RP-1.

- Carbon Neutrality: Potentially carbon-neutral if produced using renewable energy and sustainable feedstocks. The entire production chain must be powered by renewables to achieve true neutrality.

- Availability: Experimental, with limited use. Orbex’s Prime rocket and Skyrora’s Ecosene are in development, with test flights conducted (e.g., bluShift Aerospace’s Stardust 1.0).

- Cost-Effectiveness: Currently not cost-competitive due to limited production scale and high development costs. Long-term potential exists as biofuel industries grow.

- Timeline for Mainstream Use: Likely 15–25 years for mainstream adoption, as biofuel production scales and costs decrease with advancements in renewable energy and waste recycling.

- Advantages: Lower soot emissions compared to kerosene, potentially recyclable feedstocks.

- Synthetic Fuels:

- Description: Synthetic fuels, such as those produced via carbon capture and renewable energy, aim to recycle atmospheric CO2 into usable rocket fuel. For example, methane or hydrocarbons can be synthesized using CO2 captured from the air and hydrogen from electrolysis.

- Carbon Neutrality: Carbon-neutral if powered by renewable energy. The process mimics a closed carbon cycle, re-emitting only the CO2 captured during production.

- Availability: In early research and development, with no operational rockets yet using fully synthetic fuels.

- Cost-Effectiveness: Highly expensive due to the energy-intensive processes and lack of scaled infrastructure. Long-term cost reductions depend on advancements in carbon capture and renewable energy.

- Timeline for Mainstream Use: Likely 20–30 years, as carbon capture, utilization, and storage (CCUS) technologies mature and renewable energy becomes cheaper.

- Advantages: High potential for scalability and integration with existing rocket designs.

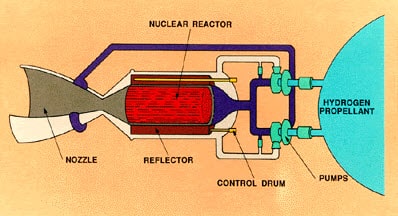

- Nuclear Propulsion (Emerging Concept):

- Description: Nuclear thermal or electric propulsion uses nuclear reactors to heat propellants or generate electricity for ion thrusters. While not a fuel in the traditional sense, it could reduce reliance on chemical propellants, offering near-zero emissions if the reactor is powered by carbon-neutral means.

- Carbon Neutrality: Potentially carbon-neutral, as nuclear energy produces no CO2 during operation. However, reactor production and fuel processing have environmental impacts.

- Availability: Not yet available for operational rockets. NASA and DARPA are exploring nuclear thermal propulsion (e.g., DRACO program), with test flights planned for 2027.

- Cost-Effectiveness: Extremely high initial costs due to complex technology and safety requirements. Long-term potential for cost savings in deep-space missions.

- Timeline for Mainstream Use: Likely 30–50 years for mainstream use, given technological and regulatory hurdles.

- Advantages: High efficiency for long-duration missions, potentially reducing the need for large chemical fuel loads.

2. Availability

- Hydrolox: Available and used in rockets like SLS and New Shepard. Green hydrogen production is limited but growing, with global capacity expected to increase as renewable energy infrastructure expands.

- Methalox: Available in SpaceX’s Starship and planned for other rockets. Carbon-neutral methane production is not yet widespread but is feasible with current technology.

- Biofuels: Experimental, with limited test flights (e.g., bluShift Aerospace). Not yet available for large-scale commercial launches.

- Synthetic Fuels: In R&D phase, not yet available for operational use.

- Nuclear Propulsion: In development, with no operational systems. Test flights are planned for the late 2020s.

3. Cost-Effectiveness

- Hydrolox: Expensive due to high energy costs for hydrogen production and storage. Green hydrogen production costs are projected to decrease by 50% by 2030 with renewable energy advancements, but it remains less cost-competitive than kerosene-based fuels.

- Methalox: More cost-effective than hydrolox due to simpler storage and higher energy density. Carbon-neutral methane production is not yet scaled, but costs could decrease with renewable energy adoption.

- Biofuels: Currently costly due to limited production infrastructure. Long-term cost-effectiveness depends on scaling biofuel industries and renewable energy.

- Synthetic Fuels: Highly expensive due to energy-intensive carbon capture and synthesis processes. Cost reductions are expected as CCUS and renewable energy improve.

- Nuclear Propulsion: Prohibitively expensive for near-term use due to R&D and safety costs. Long-term potential exists for deep-space missions.

4. Timelines for Mainstream Use

- Hydrolox: Already in use, but carbon-neutral production could become mainstream in 10–20 years as green hydrogen scales.

- Methalox: In use, with carbon-neutral production potentially mainstream in 5–15 years, driven by SpaceX and others.

- Biofuels: Likely 15–25 years, as biofuel production and rocket designs mature.

- Synthetic Fuels: Likely 20–30 years, dependent on advancements in CCUS and renewable energy.

- Nuclear Propulsion: Likely 30–50 years, given technological and regulatory challenges.

5. Top Actors in the Space

Key players developing carbon-neutral or low-carbon rocket propulsion include:

- SpaceX (USA): Leading with methalox in Starship, aiming for carbon-neutral methane production via the Sabatier process powered by renewables. SpaceX’s high launch cadence (96 launches in 2023, aiming for 150 in 2024) drives innovation.

- Blue Origin (USA): Uses hydrolox in New Shepard and plans methalox for New Glenn. Focused on sustainable fuel production.

- Orbex (UK): Developing bio-propane-fueled Prime rocket, targeting up to 86% emissions reduction compared to RP-1.

- Skyrora (UK): Experimenting with Ecosene, a fuel derived from non-recyclable plastics, aiming for 40% emissions reduction.

- ArianeGroup (Europe): Developing Ariane Next, a methalox rocket targeting carbon neutrality by 2030 using biomass-derived methane.

- NASA (USA): Exploring hydrolox for SLS and nuclear propulsion via the DRACO program with DARPA.

- bluShift Aerospace (USA): Testing solid biofuels made from agricultural waste, with a focus on small rockets.

- ISAR Aerospace (Germany): Developing light hydrocarbon fuels to reduce soot and emissions by 25–40%.

- China Aerospace Science and Technology Corporation (CASC): China’s primary space agency, discussed below.

6. China’s Role

China is a major player in space exploration but lags in carbon-neutral rocket propulsion compared to Western counterparts:

- Current Status: China’s Long March rockets (e.g., Long March 2, 3, 4) primarily use unsymmetrical dimethylhydrazine (UDMH) and nitrogen tetroxide, highly toxic propellants dubbed “devil’s venom” due to environmental damage (e.g., soil contamination in Kazakhstan). These are not carbon-neutral and are being phased out in Western countries.

- Progress Toward Carbon Neutrality: China has committed to carbon peak by 2030 and neutrality by 2060, with a focus on clean energy transitions. However, its space program has not prioritized carbon-neutral fuels as aggressively as Europe or the USA. Some research into methalox and hydrolox exists, but no operational carbon-neutral rockets are in use.

- CCUS Efforts: China is investing in carbon capture, utilization, and storage (CCUS), with projects like the Qilu Petrochemical-Shengli Oilfield (1 million tons/year CO2 capture) and Ningdong Energy’s CCUS demonstration. These could support synthetic fuel production for rockets in the future.

- Challenges: China’s space program prioritizes performance and cost over environmental impact, and its reliance on coal-heavy energy systems hinders carbon-neutral fuel production.

- Timeline: China may adopt carbon-neutral fuels like methalox or biofuels by 2035–2045, driven by global pressure and advancements in CCUS and renewable energy.

7. Number of Options

There are five primary carbon-neutral or low-carbon energy forms for rocket propulsion:

- Hydrolox (with green hydrogen)

- Methalox (with renewable or captured methane)

- Biofuels (e.g., bio-propane, Ecosene)

- Synthetic fuels (via CCUS)

- Nuclear propulsion

Additional variations (e.g., different biofuel formulations) exist, but these five represent the main categories.

8. Best Options

The “best” options depend on criteria like scalability, cost, and environmental impact:

- Methalox: Currently the most promising due to its balance of energy density, existing use (e.g., SpaceX Starship), and potential for carbon-neutral production via the Sabatier process. It is scalable within 5–15 years and cost-competitive with traditional fuels.

- Hydrolox: Ideal for small or suborbital rockets due to zero CO2 emissions during combustion, but less practical for heavy-lift rockets due to lower energy density and high costs. Best for niche applications.

- Biofuels: Promising for small rockets and long-term sustainability, but limited by production scale and cost. Best for environmentally conscious startups like Orbex.

- Synthetic Fuels: High potential for long-term carbon neutrality, but currently too expensive and underdeveloped. Best for future integration with CCUS.

- Nuclear Propulsion: Best for deep-space missions due to high efficiency, but not practical for near-term or Earth-to-orbit launches.

Recommendation: Methalox is the best near-term option due to its balance of performance, cost, and carbon-neutral potential. Biofuels and synthetic fuels are strong contenders for the medium to long term.

9. Future Outlook for Mainstream Use

- Short Term (5–15 years): Methalox will likely dominate, with SpaceX and others scaling carbon-neutral methane production. Hydrolox will remain in use for specific applications.

- Medium Term (15–25 years): Biofuels could become viable for small and medium rockets as production scales. Synthetic fuels may emerge with advancements in CCUS.

- Long Term (25–50 years): Nuclear propulsion could revolutionize deep-space travel, while synthetic fuels and biofuels become mainstream for Earth-to-orbit launches.

10. Critical Considerations

- Environmental Impact: Even carbon-neutral fuels produce water vapor, a greenhouse gas, and soot or NOx in some cases, which can affect the upper atmosphere. More research is needed to assess long-term impacts.

- Scalability: Renewable energy infrastructure (solar, wind, geothermal) must expand significantly to support carbon-neutral fuel production.

- Regulatory Pressure: No global regulations currently govern rocket emissions, but increasing launch rates (223 in 2023, projected to grow) may prompt stricter environmental standards.

- China’s Lag: While China is a space powerhouse, its focus on toxic UDMH fuels and coal-heavy energy systems delays its transition to carbon-neutral propulsion. Global collaboration could accelerate progress.

Summary

- Carbon-Neutral Options: Hydrolox, methalox, biofuels, synthetic fuels, and nuclear propulsion.

- Availability: Hydrolox and methalox are available; biofuels and synthetic fuels are experimental; nuclear is in R&D.

- Cost-Effectiveness: Methalox is the most cost-competitive; others face high production costs.

- Timelines: Methalox (5–15 years), biofuels (15–25 years), synthetic fuels (20–30 years), nuclear (30–50 years).

- Top Actors: SpaceX, Blue Origin, Orbex, Skyrora, ArianeGroup, NASA, ISAR Aerospace, CASC.

- Best Options: Methalox for near-term, biofuels/synthetic fuels for medium-term, nuclear for long-term.

- China’s Role: Lagging in carbon-neutral fuels, reliant on UDMH, but investing in CCUS with potential for future adoption by 2035–2045.