My Real Estate Tech Startup Has A Loan Investment

Jassim Mohammed Al Seddiqi: Renaissance Man In The Gulf

Getting To Know Mustafa Kheriba

This is more sophisticated than the emails from "Nigerian princes," but still very much fraud.

7 Signs of a Personal Loan Scam Reputable lenders do not require you to pay a penny before you receive your loan. If you come across a personal loan lender that demands a processing, insurance or origination fee before they can approve you, walk away fast. The lender is likely a scammer hoping to make a quick buck off of you........ While legitimate lenders may charge application, appraisal and credit report fees, these are typically deducted from the amount you borrow.

Loans to Avoid There was a 10% decrease in complaints about loan scams and fraud in 2017, but the cost to American consumers still went up, reaching nearly $1 trillion....... consumers reported losing $905 million to scams in 2017, $63 million more than in 2016. The FTC credited education, awareness and enforcement for the positive trend in fewer complaints, but even with all that, consumers are still being taken for millions of dollars in fraudulent loan scams....... Financial scammers have never been more prevalent and they often prey on individuals who previously have been denied a loan. ...... About one-in-three adults is a victim of financial scammers ....... seniors are easy targets .......... nearly 33% of 1,260 respondents indicated they had been exposed to financial scams during the past five years, while one-third said that outsiders had used (or attempted to use) their accounts without permission. ........ 40% of Americans in their 20s who reported fraud in 2017 said they lost money, with a median loss of $400. That was a much higher rate than senior victims of financial fraud where only 18% of the 70-and-older group reported losing money. ....... The world has changed. Now there’s online banking and brokerage accounts, payday lenders, borrowing from your 401(k), Exchange-Traded Funds (ETFs), variable rate and adjustable mortgages … and seemingly, just as many complex financial scams designed to dupe consumers...... Upfront Fees — The lender might disguise these as application fees or document fees or some other name, but they all mean: “Send me some money before I perform any service.” Think about this: You are being asked to send money in order to be loaned money. That’s a scam. Legitimate lenders must disclose all their fees. Typically, they are rolled into the cost of the loan, not paid for in advance. ....... Wire Transfers — If the lender wants you to wire money for any fees, it’s a big cause for concern. Never wire money to an individual. Always ask for the lender’s physical address. Then contact the Attorney General or Financial Regulations office in that state to verify it’s a legitimate business. ........ Personal Information — Never give out your social security number, date of birth, bank account number or other important personal information unless you are convinced you’re dealing with a responsible lending institution. Personal information can be used for identity theft or stealing from your bank account. ....... Reviews — Online reviews have become influential when it comes to restaurants, museums and movies. They can also help you pick a reputable lender. You can simply Google the company or person’s name ......... Be wary if you’re offered a free period (like a year with no payments) before the loan must be repaid.

How fraudsters are gaming online lenders Online lenders’ advantage in speed has exposed them to a growing problem: a type of fraud called loan stacking........ People are taking advantage of the quick loan approval times online lenders offer to game the system by applying for multiple online loans in a short time before credit files update to reflect the increased debt load. By doing so, they are able to get more money than they would typically qualify for in any one loan.

How to avoid a personal loan scam If you’re faced with an “urgent offer,” you’ve likely found a scam. Legitimate lenders offer steady rates that depend on your credit. Pressure tactics are designed to drive you to act quickly, before you’re able to spot a scam in progress. ....... Loans demanding “processing,” “insurance” or even “origination” fees before approval are a scam. A lender asking for payment before it’s processed your application is a scammer looking for a quick buck. ...... Legit lenders generally never charge anything until you receive your loan — though some might deduct an origination fee from the funds before it shows up in your bank account.

The Rise Of Mortgage Fraud: How To Spot Common Schemes

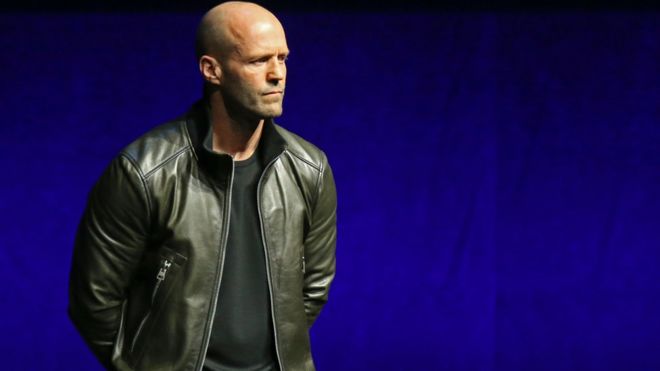

Fraudster poses as Jason Statham to steal victim's money

A fraudster posing as Hollywood actor Jason Statham cheated a British woman out of hundreds of thousands using an online scam ......... police warn such crimes are at "epidemic" levels, with Greater Manchester Police (GMP) receiving reports of about 1,000 victims a month. ....... Detectives fear the true figure may be up to 10 times higher as many fraud victims never come forward.........

"It's the volume crime of the 21st Century." ....... A recent estimate put the total lost to fraud each year in the UK at about £110bn.

...... One victim from the North West of England told BBC Radio Manchester she had lost a fortune after being targeted by a fraudster who has "just got no feelings at all"...... The woman, who asked not to be named, said she was targeted at a vulnerable time following the deaths of both her mother and fiancé.......... "I'm quite a strong person but obviously certain things get to you and you let your guard down," she said......... The woman said she was first contacted online by someone posing as Mr Statham while she was on a Facebook page dedicated to the Fast and Furious star. ...... "I thought 'Oh, that's nice of him, talking to his fans'......... There were an estimated 3.6 million fraud offences in England and Wales in 2018...... it is "much more likely for an adult…to experience fraud than a violent offence". ...... 6.6% of adults, just over 3 million people, had experienced some form of fraud in the year ending December 2018. .....GMP was unable to prosecute anyone over the fraud, with the person responsible believed to be operating from overseas.

'Britain's oldest scam victim': 103-year-old loses £60,000 in 10-year catalogue fraud Elderly widower ends up with 'house full of incredibly overpriced products' after ending up on a 'suckers' list'

This name and this picture are obviously pure fiction: Yahya Al-Wazna. Dubai Police, please take note.

Deleted original tweet. Times thinks it may have been a scam. Anyway, will have more security in future

— Paul Krugman (@paulkrugman) January 9, 2020