From Zero to One to Ten Thousand: Invention, Scaling, and the Stages of Exponential Growth

Summary of Zero to One

Peter Thiel’s Zero to One is a foundational text in startup and innovation circles. At its core, the book argues that progress comes not from copying what works (going from 1 to n), but from doing something entirely new (going from 0 to 1). Thiel emphasizes that true innovation is vertical—creating novel solutions, technologies, or businesses—whereas globalization is horizontal—spreading existing models more widely.

Key themes include:

-

Monopoly over competition: Thiel advocates for creating monopolies through unique, defensible products, rather than competing in crowded markets.

-

Secrets: Great companies discover and exploit secrets—truths unknown or undervalued by the rest of the world.

-

Founders and vision: Strong, mission-driven founders are essential; startups need visionary leadership.

-

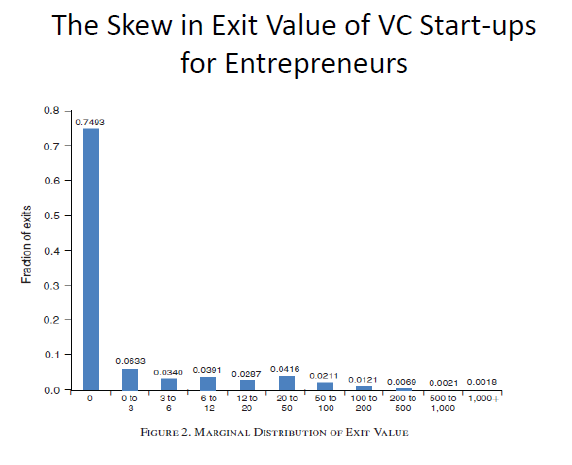

Power law thinking: A few startups generate most returns—this truth must guide investment and energy allocation.

-

Definite optimism: Believing in a planned, engineered future is more productive than trusting randomness or market forces.

Thiel stresses that building a great startup means finding singular opportunities and scaling them intelligently—but his focus stops short of discussing how to scale innovation beyond the startup phase.

From Zero to One to Ten Thousand: Scaling in Stages

Invention is only the beginning. Once a company, idea, or technology moves from zero to one, the next challenge is growth—not just growing, but scaling wisely, sustainably, and strategically. Let’s explore what it means to scale from 1 to 10, then 10 to 100, and so on up to 10,000.

Stage 1: 1 to 10 — From Prototype to Product-Market Fit

-

Challenge: Refinement and repeatability.

-

Focus: Validate the innovation with early adopters. Build a minimum viable product (MVP), iterate based on feedback, and find a small but passionate user base.

-

Team: Founders + a small team. Everyone wears multiple hats.

-

Pitfalls:

-

Chasing growth before product-market fit.

-

Overbuilding or perfectionism instead of iterating rapidly.

-

Lesson: Prove that people want what you’ve invented. Create an early tribe who evangelize it.

Stage 2: 10 to 100 — From Product-Market Fit to Early Scale

-

Challenge: Building systems and beginning to delegate.

-

Focus: Grow the customer base, systematize operations, and secure initial funding rounds (Seed to Series A/B). Begin defining company culture and metrics.

-

Team: Specialized hires begin to enter. The founder starts managing managers.

-

Pitfalls:

-

Scaling a broken process.

-

Hiring too fast or diluting culture.

-

Losing sight of core users.

-

Lesson: This is where “doing things that don’t scale” becomes “building things that can.” Repeatability meets resilience.

Stage 3: 100 to 1,000 — From Startup to Company

-

Challenge: Complexity management and process optimization.

-

Focus: Transition from informal to formal. Develop playbooks, middle management, HR systems, and data-driven decision-making.

-

Team: Now includes multiple departments, with org charts and KPIs.

-

Pitfalls:

-

Bureaucracy creep.

-

Mission drift.

-

Internal politics emerging.

-

Platform instability under user load.

-

Lesson: Scaling isn’t just growth—it's about building robustness. Your startup must now run without founder intervention in every decision.

Stage 4: 1,000 to 10,000 — Becoming a Scaled Institution

-

Challenge: Institutionalization without stagnation.

-

Focus: Going global. Platformization. Developing a mature brand. Ensuring resilience in financials, operations, and leadership transitions. Scaling culture.

-

Team: Thousands of employees across functions, geographies, and legal structures.

-

Pitfalls:

-

Losing innovation culture.

-

Analysis paralysis.

-

Overregulation of internal experimentation.

-

Talent drain due to mission dilution.

-

Lesson: At this stage, companies risk becoming the incumbents they once disrupted. The challenge is to keep the spark alive—to remain entrepreneurial while being industrial.

The Scaling Paradox

Each stage multiplies opportunity but also risk. Scaling brings:

-

More users – but also more expectations.

-

More capital – but also pressure to hit returns.

-

More talent – but more chances for misalignment.

-

More structure – but a risk of creative suffocation.

The founders who scale well either evolve into builders of organizations (like Jeff Bezos or Brian Chesky), or they bring in complementary leaders (like Google with Eric Schmidt).

Scaling Secrets: Beyond Zero to One

To scale from 1 to 10,000:

-

Build Compounding Systems: Growth should not be linear—your code, teams, or marketing should compound with time.

-

Stay Rooted in the Founding Insight: Don’t forget the secret that got you to 1 in the first place.

-

Institutionalize Innovation: Encourage internal entrepreneurship through skunkworks, hackathons, or venture studios.

-

Design for Adaptability: Today's great products are ecosystems. Open APIs, modular architecture, and feedback loops keep you evolving.

Final Thoughts: From Zero to One to Infinity

Thiel’s message is timeless: creating new value is more important than copying. But innovation must also scale—and each leap (1→10, 10→100, etc.) is a transformation of identity, not just size.

As you grow, the risk is not just failure—it’s mediocrity through stagnation. The truly legendary companies not only invent—they reinvent continuously at every level of scale.

Going from Zero to One is rare. Going from One to Ten Thousand is even rarer. But those who do both define the future.

If you liked this post and want more deep dives on startups, innovation, and strategy, stay tuned or reach out for tailored insights.

Zero to One से दस हज़ार तक — आविष्कार से लेकर स्केलिंग तक की यात्रा

Zero to One का सारांश

पीटर थील की Zero to One इनोवेशन और स्टार्टअप की दुनिया में एक प्रतिष्ठित पुस्तक मानी जाती है। इसका मुख्य तर्क यह है कि वास्तविक प्रगति तब होती है जब हम कुछ बिल्कुल नया करते हैं (0 से 1), न कि केवल पुराने मॉडल की नकल करते हैं (1 से n)। थील कहते हैं कि इनोवेशन ऊर्ध्वगामी होता है (कुछ नया बनाना), जबकि वैश्वीकरण क्षैतिज होता है (मौजूदा चीज़ों को फैलाना)।

मुख्य विचार:

-

प्रतिस्पर्धा नहीं, एकाधिकार बनाओ: भीड़भाड़ वाले बाजारों में प्रतिस्पर्धा करने के बजाय, अनोखे और रक्षात्मक उत्पाद बनाकर एकाधिकार स्थापित करना बेहतर है।

-

गुप्त सत्य: महान कंपनियाँ ऐसे 'सीक्रेट्स' खोजती हैं जिन्हें बाकी दुनिया नहीं देख पाती या महत्व नहीं देती।

-

संस्थापक और दृष्टिकोण: मिशन-ड्रिवन संस्थापक अनिवार्य हैं; स्टार्टअप्स को स्पष्ट नेतृत्व चाहिए।

-

पावर लॉ मानसिकता: कुछ ही स्टार्टअप्स अधिकांश रिटर्न लाते हैं—इसलिए निवेश और प्रयास इन्हीं पर केंद्रित होने चाहिए।

-

सुनिश्चित आशावाद: भविष्य को यादृच्छिकता पर नहीं, बल्कि योजना और निर्माण के भरोसे पर बनाना चाहिए।

थील इनोवेशन के शुरुआती चरण (0 से 1) पर जोर देते हैं, लेकिन उनके विचार का विस्तार करना जरूरी है: वास्तविक चुनौती है उस नवाचार को बड़े पैमाने पर ले जाना।

Zero to One से लेकर 10,000 तक: स्केलिंग के चरण

आविष्कार शुरुआत है। परंतु असली काम है—उस इनोवेशन को विभिन्न स्तरों पर स्केल करना, और हर स्तर पर अलग चुनौतियाँ होती हैं। चलिए इन चरणों का विश्लेषण करें:

चरण 1: 1 से 10 — प्रोटोटाइप से प्रोडक्ट-मार्केट फिट तक

-

चुनौती: दोहराने योग्य मॉडल खोजना।

-

फोकस: MVP (मिनिमम वायबल प्रोडक्ट) बनाएं, शुरुआती उपयोगकर्ताओं से फीडबैक लें, और अपनी मुख्य उपयोगकर्ता श्रेणी खोजें।

-

टीम: संस्थापक + छोटी टीम। सभी कई भूमिकाएं निभाते हैं।

-

गलतियाँ:

-

PMF से पहले ग्रोथ पर ध्यान देना।

-

अत्यधिक निर्माण या परफेक्शनिज्म।

-

सबक: पहले यह सिद्ध करो कि लोग वास्तव में तुम्हारे उत्पाद को चाहते हैं।

चरण 2: 10 से 100 — प्रारंभिक स्केलिंग

-

चुनौती: सिस्टम बनाना और टीम का विस्तार करना।

-

फोकस: ग्राहकों की संख्या बढ़ाना, संचालन सुव्यवस्थित करना, और निवेश (सीड से सीरीज A/B) जुटाना।

-

टीम: विशेष भूमिकाओं की शुरुआत। संस्थापक अब प्रबंधन भूमिका निभाता है।

-

गलतियाँ:

-

टूटे सिस्टम को स्केल करना।

-

जल्दी हायरिंग और संस्कृति का नुकसान।

-

सबक: अब "जो चीज़ें स्केल नहीं करतीं" वो "स्केलेबल सिस्टम" में बदलनी चाहिए।

चरण 3: 100 से 1,000 — स्टार्टअप से कंपनी बनने की प्रक्रिया

-

चुनौती: बढ़ती जटिलता को प्रबंधित करना।

-

फोकस: प्रक्रियाओं को औपचारिक बनाना, HR सिस्टम, डेटा आधारित निर्णय, और मिड-लेवल मैनेजमेंट तैयार करना।

-

टीम: अब विभिन्न विभाग और संरचनाएं बन चुकी हैं।

-

गलतियाँ:

-

नौकरशाही का उदय।

-

मिशन से विचलन।

-

आंतरिक राजनीति।

-

सबक: संस्थापक के बिना भी कंपनी को सुचारू रूप से चलना चाहिए।

चरण 4: 1,000 से 10,000 — संस्था बनना

-

चुनौती: संस्था बनने के साथ-साथ नवाचार को जीवित रखना।

-

फोकस: वैश्विक विस्तार, ब्रांड परिपक्वता, नेतृत्व में उत्तराधिकार, और संस्कृति का संरक्षण।

-

टीम: हजारों कर्मचारी, विभिन्न देशों और विभागों में।

-

गलतियाँ:

-

नवाचार संस्कृति का क्षय।

-

निर्णय प्रक्रिया में सुस्ती।

-

मिशन का कमजोर होना।

-

सबक: अब जोखिम केवल असफलता नहीं, बल्कि औसतपन और जड़ता है।

स्केलिंग का विरोधाभास

हर स्तर पर स्केलिंग:

-

अधिक उपयोगकर्ता लाता है — पर अपेक्षाएँ भी बढ़ती हैं।

-

अधिक पूंजी लाता है — लेकिन रिटर्न का दबाव भी।

-

अधिक प्रतिभा लाता है — पर मिसअलाइमेंट की आशंका भी।

-

अधिक संरचना लाता है — लेकिन रचनात्मकता का गला भी घोंट सकता है।

सफल संस्थापक या तो खुद विकसित होते हैं (जैसे जेफ बेजोस), या उपयुक्त लीडर लाते हैं (जैसे गूगल में एरिक श्मिट)।

स्केलिंग के राज: Zero से Infinity तक

-

कंपाउंडिंग सिस्टम बनाएँ: ग्रोथ रेखीय नहीं, गुणात्मक होनी चाहिए।

-

मूल विचार न भूलें: जो ‘सीक्रेट’ आपको 1 तक लाया, वही 10,000 तक ले जाएगा।

-

इन-हाउस इनोवेशन को बढ़ावा दें: हैकाथॉन, स्कंकवर्क्स, या इनोवेशन लैब्स।

-

अनुकूलनशीलता डिजाइन करें: मॉड्यूलरिटी और API से जुड़ी सोच।

अंतिम विचार: Zero to One से लेकर अनंत तक

थील का संदेश है—नई चीज़ें बनाना कॉपी करने से कहीं बेहतर है। लेकिन असली विजेता वे होते हैं जो उसे 10,000 तक स्केल कर सकें। हर स्तर पर फिर से आविष्कार करने की जरूरत होती है।

Zero to One जाना मुश्किल है। One से Ten Thousand जाना उससे भी कठिन। लेकिन जो दोनों कर पाते हैं—वे ही भविष्य का निर्माण करते हैं।

अगर आपको यह पोस्ट पसंद आई हो और आप इनोवेशन, रणनीति और स्केलिंग पर और गहराई से पढ़ना चाहते हैं, तो जुड़े रहें या संपर्क करें।

How Google Went from Zero to One — and Then to Ten Thousand Without Losing Its Innovation Spark

Google is one of the rarest examples in modern business history: a company that not only went from Zero to One by inventing a revolutionary new product—PageRank search—but also managed to scale to 10,000 and beyond, all while remaining a powerhouse of innovation. Few companies have succeeded in being both a startup disruptor and a lasting global institution.

Let’s walk through how Google made each stage of this journey possible—and what made it exceptional at every level.

🧠 Zero to One: Reinventing Search

In the late 1990s, search engines were primitive and mostly ranked websites based on how often keywords appeared. Larry Page and Sergey Brin, two Stanford PhD students, introduced PageRank, which ranked pages based on how many other pages linked to them—a signal of trust and authority.

💡 Innovation Insight: Instead of asking “what’s on this page?” they asked “who vouches for this page?”

This insight was so radical that it shifted search from being a cluttered, ad-heavy mess into a clean, fast, and shockingly relevant tool.

Cultural Ingredients:

-

Deep academic rigor

-

Focus on solving “big problems”

-

A disdain for incrementalism

🔟 1 to 10: Building the Product, Not Just the Tech

Between 1998 and 2002, Google moved from a prototype to a full-fledged product. They:

-

Recruited world-class engineers

-

Built a lightning-fast backend

-

Created a business model (AdWords) that didn’t compromise the product

🚀 This was the most critical leap: proving that search could make money—without paywalls or display ads.

Cultural Traits:

-

“Don’t be evil” ethos

-

Engineering-first decision making

-

Obsession with user experience

💯 10 to 100: Creating a Platform, Not Just a Product

Now came growth. Google:

-

Scaled to global markets

-

Built data centers worldwide

-

Added products like Gmail, News, and Maps—all free, fast, and useful

-

Innovated in infrastructure: they built their own servers and file systems (e.g., BigTable, MapReduce)

🔧 They didn’t buy their infrastructure—they reinvented it.

Culture Drivers:

-

20% time: Engineers could use 20% of their time on personal projects

-

“Smart creatives”: Blending engineering, product, and business thinking

-

Hiring for IQ and curiosity, not just credentials

Leadership Magic:

-

Eric Schmidt brought adult supervision without killing innovation

-

Brin and Page stayed involved in product vision

-

They institutionalized moonshots without losing focus

1️⃣0️⃣0️⃣0️⃣ 100 to 1,000: Becoming a System

Google at this stage turned into a galaxy of projects:

-

Android acquisition (2005) → mobile dominance

-

YouTube acquisition (2006) → video revolution

-

Chrome (2008) → reshaped the browser

-

Google Translate, Earth, Street View—complex, massive products

And yet, innovation didn’t stop. Instead, they:

-

Created Google X: a semi-secret lab for moonshot ideas (self-driving cars, Project Loon, etc.)

-

Launched Google Brain: making AI core to every product

-

Formalized internal APIs so teams could move fast independently

How? Culture of scale-as-sandbox:

-

Innovation was institutionalized, not ad hoc

-

Teams operated like startups, but had access to Google's resources

-

Constant reorgs to match emerging priorities

Leadership Acumen:

-

Emphasis on transparency (TGIF meetings)

-

Founders as “Chief Product Philosophers”

-

Hiring Sundar Pichai to lead Chrome → later CEO → symbol of calm, competent stewardship

🔟,000+ 1,000 to 10,000+: Becoming Alphabet Without Becoming IBM

As Google crossed 10,000 employees and $100 billion in revenue, many expected them to ossify.

Instead, they created Alphabet Inc. in 2015:

-

A radical reorg where “Google” became one subsidiary

-

Other projects (Waymo, Verily, DeepMind, etc.) became their own companies under the Alphabet umbrella

🧬 This was corporate mitosis: split before sclerosis.

Why This Worked:

-

Prevented bureaucratic bloat

-

Created autonomy for moonshots

-

Allowed CEOs to lead individual "bets" like in a venture firm

Innovation Playbook at Scale:

-

Internal incubators (Area 120)

-

AI-first mindset: embedding ML across Search, Ads, Docs, Translate

-

Radical bets still welcome: quantum computing, brain-computer interfaces, etc.

Leadership Masterstroke:

-

Sundar Pichai promoted to CEO of both Google & Alphabet—balancing business, innovation, and global trust

-

Ruth Porat (CFO) brought financial discipline without suffocating R&D

🔑 Key Takeaways: What Makes Google Sustain Innovation?

1. Founder Philosophy Never Left

Even after stepping back, Larry and Sergey embedded a product-first, curiosity-driven culture that lives on.

2. Innovation Is a System, Not an Accident

From 20% time to X to Area 120, they’ve designed infrastructure for creativity.

3. They Reinvent Themselves Before the Market Forces Them

-

Mobile? Android.

-

Cloud? Google Cloud.

-

AI? DeepMind + Gemini.

-

Regulatory pressure? Alphabet reorg.

4. Leadership That Evolves

Every leader at Google has been a bridge between what it was and what it’s becoming. From Eric Schmidt to Sundar Pichai, their leadership has embraced change and clarity.

✨ Final Word

Most companies can do Zero to One. A few can go 1 to 10. Almost none can go to 10,000 and still remain a laboratory for the future.

Google did it because it understood a fundamental truth:

Scale isn’t the enemy of innovation—bureaucracy is.

So they scaled without becoming stale. And that’s why they remain one of the most important innovation engines in human history.

Curious how your company can scale without losing innovation? Ask how we can help you build a culture like Google’s.

कैसे Google ने Zero to One से लेकर 10,000 तक की यात्रा की—और हर चरण में इनोवेटिव बना रहा

Google आधुनिक व्यापार इतिहास का एक अनोखा उदाहरण है: एक ऐसी कंपनी जिसने Zero to One का सफर तय किया—एक पूरी तरह नया प्रोडक्ट (PageRank सर्च इंजन) बनाकर—और फिर 1 से 10, 100, 1,000 और 10,000 तक सफलतापूर्वक स्केल किया। और इस दौरान, उसने इनोवेशन की अपनी संस्कृति को कभी खोने नहीं दिया।

चलिए समझते हैं कि Google ने यह कैसे किया—हर चरण में क्या विशेष था, उनकी संस्कृति कैसी रही, और नेतृत्व की क्या भूमिका रही।

🧠 Zero to One: सर्च को फिर से परिभाषित करना

1990 के दशक के अंत में, सर्च इंजन बहुत ही बुनियादी थे और सिर्फ कीवर्ड्स गिनकर पेज रैंक करते थे। लेकिन Larry Page और Sergey Brin—स्टैनफोर्ड के दो PhD छात्र—ने PageRank एल्गोरिदम बनाया, जो किसी पेज को इस आधार पर रैंक करता था कि कितने अन्य पेज उस पर लिंक कर रहे हैं—जो विश्वास और प्रासंगिकता का संकेत था।

💡 नवाचार की दृष्टि: उन्होंने यह नहीं पूछा "इस पेज पर क्या है?" बल्कि पूछा "कौन इस पेज की गवाही दे रहा है?"

यह दृष्टिकोण इतना क्रांतिकारी था कि इसने सर्च को धीमे और अव्यवस्थित सिस्टम से बदलकर तेज़, साफ और प्रासंगिक बना दिया।

संस्कृति की विशेषताएं:

-

अकादमिक गहराई और बौद्धिक ईमानदारी

-

"बड़े" समस्याओं को हल करने पर फोकस

-

सतही सुधारों की बजाय मूलभूत नवाचार

🔟 1 से 10: प्रोटोटाइप से प्रोडक्ट तक

1998 से 2002 तक Google ने प्रोटोटाइप को स्केलेबल प्रोडक्ट में बदला:

-

बेहतरीन इंजीनियरिंग टीम बनाई

-

फास्ट और स्केलेबल बैकएंड तैयार किया

-

एक ऐसा बिज़नेस मॉडल (AdWords) तैयार किया जो उपयोगकर्ता अनुभव से समझौता नहीं करता

🚀 यह सबसे अहम मोड़ था: यह साबित करना कि सर्च से पैसे कमाए जा सकते हैं—बिना उपयोगकर्ता को परेशान किए।

संस्कृति की विशेषताएं:

-

“Don’t be evil” सिद्धांत

-

इंजीनियरिंग-प्रथम निर्णय प्रणाली

-

उपयोगकर्ता अनुभव पर गहरा ध्यान

💯 10 से 100: प्रोडक्ट से प्लेटफॉर्म तक

अब शुरू हुआ विस्तार:

-

वैश्विक बाज़ारों में प्रवेश

-

गूगल न्यूज़, मैप्स, जीमेल जैसे नए प्रोडक्ट्स जोड़े

-

खुद की डाटा सेंटर और सर्वर टेक्नोलॉजी विकसित की (BigTable, MapReduce)

🔧 इन्फ्रास्ट्रक्चर खरीदा नहीं, खुद बनाया।

संस्कृति के इंजन:

-

20% टाइम: इंजीनियर अपनी पसंद के प्रोजेक्ट्स पर काम कर सकते थे

-

“स्मार्ट क्रिएटिव्स”: टेक्निकल, बिज़नेस और प्रोडक्ट की सोच को मिलाना

-

जिज्ञासा और क्षमता के आधार पर हायरिंग

लीडरशिप कमाल:

-

Eric Schmidt ने स्केलेबिलिटी लाई बिना इनोवेशन खत्म किए

-

Larry और Sergey ने विजन और प्रोडक्ट फोकस बनाए रखा

1️⃣0️⃣0️⃣0️⃣ 100 से 1,000: स्टार्टअप से सिस्टम बनने की ओर

अब Google एक गैलेक्सी बन गया:

-

Android का अधिग्रहण (2005)

-

YouTube का अधिग्रहण (2006)

-

Chrome ब्राउज़र (2008)

-

Google Translate, Earth, Street View जैसे विशाल प्रोडक्ट्स

लेकिन इसके बावजूद इनोवेशन रुका नहीं:

-

Google X बनाया: जहां से सेल्फ-ड्राइविंग कार, प्रोजेक्ट लून जैसे प्रोजेक्ट निकले

-

Google Brain: AI को हर प्रोडक्ट में एम्बेड करने का प्रयास

संस्कृति का रहस्य:

-

इनोवेशन संस्थागत स्तर पर हुआ, अनौपचारिक नहीं

-

टीमें स्टार्टअप जैसी आज़ादी के साथ काम करती थीं

-

आंतरिक APIs से टीमें स्वतंत्र रूप से तेजी से काम कर सकती थीं

नेतृत्व की कुशलता:

-

TGIF जैसी मीटिंग्स से पारदर्शिता बनाए रखी

-

संस्थापक "चीफ़ प्रोडक्ट दार्शनिक" की तरह सक्रिय रहे

-

Sundar Pichai जैसे लीडर्स को प्रमोट करना जो तकनीक और नेतृत्व दोनों में माहिर हों

🔟,000+ 1,000 से 10,000+: Alphabet बनना, IBM नहीं

2015 में Google ने खुद को Alphabet Inc. के रूप में पुनर्गठित किया:

-

Google अब एक सब्सिडियरी बन गया

-

अन्य प्रोजेक्ट्स (Waymo, Verily, DeepMind) को स्वतंत्र कंपनियों का रूप दिया गया

🧬 यह कॉर्पोरेट 'माइटोसिस' था—स्केले से पहले खुद को विभाजित करना।

क्यों यह काम कर गया:

-

नौकरशाही से बचाव

-

नवाचार के लिए स्वायत्तता

-

बड़े स्तर पर प्रयोग की अनुमति

इनोवेशन के टूल्स:

-

Area 120 जैसे आंतरिक स्टार्टअप इनक्यूबेटर

-

AI-First संस्कृति

-

क्वांटम कंप्यूटिंग और न्यूरो-टेक्नोलॉजी जैसे नए मोर्चों पर काम

लीडरशिप की उत्कृष्टता:

-

Sundar Pichai को Google और Alphabet दोनों का CEO बनाना: स्थिरता + दृष्टि

-

CFO Ruth Porat ने वित्तीय अनुशासन और R&D संतुलन साधा

🔑 मुख्य सबक: Google कैसे बना बना इनोवेशन मशीन

1. संस्थापक की सोच अब भी ज़िंदा है

Larry और Sergey भले सक्रिय न हों, पर उनका "प्रोडक्ट पहले" और "बड़ा सोचो" दृष्टिकोण कंपनी के डीएनए में है।

2. इनोवेशन एक सिस्टम है, संयोग नहीं

20% टाइम से लेकर Google X और Area 120 तक, उन्होंने इनोवेशन के लिए एक संरचना बनाई है।

3. वे खुद को फिर से बनाते हैं

-

मोबाइल? Android।

-

क्लाउड? Google Cloud।

-

AI? DeepMind + Gemini।

-

रेगुलेशन? Alphabet Reorg।

4. नेतृत्व जो समय के साथ बदलता है

हर लीडर ने कंपनी को उसके भविष्य के लिए तैयार किया—Schmidt से लेकर Pichai तक।

✨ अंतिम विचार

अधिकांश कंपनियां Zero to One तो कर लेती हैं। कुछ 1 से 10 तक पहुंचती हैं। बहुत ही कम 10,000 तक पहुंच पाती हैं—और फिर भी एक इनोवेशन प्रयोगशाला बनी रहती हैं।

Google ने यह कर दिखाया क्योंकि वह समझता है:

"स्केल इनोवेशन का दुश्मन नहीं है—ब्यूरोक्रेसी है।"

Google ने खुद को स्केल किया, लेकिन कभी थमा नहीं। और यही वजह है कि वह आज भी विश्व के सबसे प्रभावशाली इनोवेशन इंजन में से एक है।

क्या आप चाहते हैं कि आपकी कंपनी भी Google जैसी इनोवेशन संस्कृति बनाए? संपर्क करें और हम आपकी यात्रा में मदद करेंगे।

🚀 How Google Scaled Without Becoming a Bureaucracy

1. Innovation as a System, Not an Exception

Most large organizations treat innovation as a side activity. Google made it part of the system.

-

20% Time: Engineers could spend 20% of their time on projects they were passionate about. Gmail, AdSense, and Google News emerged from this.

-

Area 120: An internal startup incubator where Googlers can pitch, build, and launch new ideas with company backing—like a venture studio within the company.

-

Google X (now X, the Moonshot Factory): Separate from core Google, it incubates radical ideas like self-driving cars (Waymo) and Project Loon.

💡 Lesson: Bureaucracy kills innovation when there’s no room to experiment. Google built protected innovation zones within its walls.

2. The Founders Engineered the Culture Before the Bureaucracy Could Set In

-

Larry Page and Sergey Brin codified their principles early on—user focus, data-driven decision-making, bold bets.

-

They hired smart generalists, not just specialists—people capable of thinking across domains.

-

They resisted titles and hierarchy in the early days and tried to preserve this flatness as long as possible.

📜 “Don’t be evil” wasn’t just a slogan—it reflected a non-bureaucratic ethos that empowered individuals and teams.

3. “Smart Creatives” + Decentralized Autonomy

Eric Schmidt (CEO 2001–2011) introduced the idea of “smart creatives”—people who blend:

-

Engineering skills

-

Product intuition

-

Business awareness

Google empowered these individuals through small, agile teams that owned their products. Teams operated like mini-startups, with:

-

Autonomy to make product decisions

-

Direct access to user data

-

Freedom to ship and iterate quickly

🧠 Scaling is easier when you decentralize control but centralize mission.

4. Internal Platforms and Modular Architecture

Google built shared tools, APIs, and infrastructure that allowed teams to operate independently but cohesively. Examples:

-

Borg (Google’s internal container orchestration system, a predecessor to Kubernetes)

-

BigTable, MapReduce, and later TensorFlow

-

A/B testing platforms and analytics dashboards

This allowed small teams to build huge things without waiting on permission or coordination from dozens of departments.

5. Transparent Communication and Weekly Rituals

-

TGIF (Thank God It’s Friday) all-hands meetings: Larry, Sergey, and later Sundar Pichai would answer direct questions from employees across the world.

-

Internal discussion boards and mailing lists fostered open debate.

-

Decision-making and strategy were shared widely, reducing the opacity that bureaucracy thrives on.

🗣️ Bureaucracies grow in silence. Google scaled in the open.

6. Alphabet Structure: Bureaucracy Firewall

In 2015, Google became a subsidiary of Alphabet Inc., a holding company. This strategic move:

-

Isolated Google's core business from long-term bets (like Verily, Waymo, and DeepMind)

-

Gave leaders of other bets full CEO-level autonomy

-

Kept Google from getting bogged down in internal cross-functional warfare

🧱 Alphabet wasn’t just a rebrand—it was a structural innovation to stop bureaucracy before it spread.

7. Leadership That Reinvented Itself

-

Eric Schmidt: Brought business discipline without crushing innovation

-

Larry Page (as CEO again): Drove moonshots and the Alphabet vision

-

Sundar Pichai: Scaled with empathy, diplomacy, and calm leadership while navigating antitrust and regulatory challenges

Throughout, Google made leadership transitions not out of crisis but in anticipation of growth challenges—a rarity in corporate history.

8. Metrics Over Politics

Decisions at Google are (largely) data-driven:

-

Product ideas are validated via experiments, not executive opinions

-

OKRs (Objectives and Key Results) are used company-wide to align goals transparently

-

Performance and impact are valued more than time served or status

📊 Bureaucracies reward tenure and process. Google rewards impact and iteration.

9. Failing Fast, Learning Faster

Many Google products have failed: Google+, Google Wave, Google Glass (consumer version), etc.

But that’s the point—they were allowed to fail. Google tolerates failure in the pursuit of breakthrough ideas, provided it learns fast.

🧪 Bureaucracies fear failure. Innovators budget for it.

🔑 The Core Formula

Google scaled without becoming a bureaucracy because it invested in:

✅ Autonomy at the team level

✅ Shared infrastructure for scale

✅ Open communication

✅ Experimentation culture

✅ Bold, principle-driven leadership

✅ Strategic reorganization before stagnation

💬 Final Thought

"Scale isn’t the enemy of innovation—bureaucracy is."

Google understood that growth brings complexity. But instead of controlling that complexity with rigid rules and slow approvals, they designed systems and cultures that empowered creative, fast-moving, self-directed teams.

And that is why, even at over 100,000 employees, Google can still ship features like Gemini, launch products like Bard, and bet on the future through quantum computing, robotics, and AI.

It's not magic. It’s architected agility.

कैसे Google ने स्केल किया बिना ब्यूरोक्रेसी बने — और आज भी इनोवेशन में अग्रणी बना रहा

"स्केल इनोवेशन का दुश्मन नहीं है—ब्यूरोक्रेसी है।"

🚀 Google ने स्केल कैसे किया लेकिन कभी नौकरशाही में नहीं फंसा?

Google ने जानबूझकर ऐसे सांस्कृतिक, संरचनात्मक और रणनीतिक निर्णय लिए जिससे वह तेजी से स्केल कर सका लेकिन बिना पारंपरिक सरकारी जैसी व्यवस्था (ब्यूरोक्रेसी) में फंसे। आइए समझते हैं उन्होंने ऐसा कैसे किया:

1. इनवेशन को सिस्टम बनाया, संयोग नहीं

जहाँ ज़्यादातर बड़ी कंपनियाँ इनोवेशन को "साइड प्रोजेक्ट" मानती हैं, Google ने इसे मुख्य धारा का हिस्सा बना दिया।

-

20% टाइम: इंजीनियर अपने कुल समय का 20% किसी भी पसंदीदा आइडिया पर काम कर सकते थे। Gmail, AdSense, और Google News इसी से निकले।

-

Area 120: एक आंतरिक स्टार्टअप इनक्यूबेटर जहां गूग्लर्स नई आइडिया पिच करते हैं और उसे बनाकर लॉन्च करते हैं।

-

Google X (अब X, The Moonshot Factory): गूगल की भविष्य की प्रयोगशाला—जहां से Waymo (सेल्फ ड्राइविंग कार), Project Loon जैसे प्रयोग हुए।

💡 सीख: जब प्रयोग के लिए जगह नहीं होती, तब ब्यूरोक्रेसी बढ़ती है। Google ने इनोवेशन के लिए संरक्षित ज़ोन बनाए।

2. संस्थापकों ने संस्कृति पहले सेट की, नियमबाजी बाद में

-

Larry Page और Sergey Brin ने शुरू से ही स्पष्ट मूल्यों को सेट किया—उपयोगकर्ता-केंद्रितता, डेटा से निर्णय लेना, और बड़े विचारों पर काम करना।

-

उन्होंने सामान्य सोच वाले, जिज्ञासु लोग हायर किए, केवल विशेषज्ञ नहीं।

-

लंबे समय तक उन्होंने शीर्षक और पदों को टालकर फ्लैट संगठन बनाए रखा।

📜 "Don’t be evil" केवल नारा नहीं था—बल्कि स्वतंत्रता और जवाबदेही का मूल दर्शन था।

3. "Smart Creatives" + विकेन्द्रीकृत स्वायत्तता

Eric Schmidt ने "स्मार्ट क्रिएटिव्स" का विचार दिया:

-

जो इंजीनियरिंग, प्रोडक्ट और बिज़नेस की समझ एक साथ रखते हैं

Google ने इन लोगों को छोटी, स्वतंत्र टीमों में रखा, जिन्हें:

-

निर्णय लेने की आज़ादी थी

-

उपयोगकर्ता डेटा तक सीधी पहुंच थी

-

जल्दी प्रोटोटाइप और लॉन्च करने की स्वतंत्रता थी

🧠 स्केलिंग आसान होती है जब आप नियंत्रण विकेंद्रित करते हैं, पर मिशन केंद्रित रखते हैं।

4. आंतरिक प्लेटफॉर्म और मॉड्यूलर आर्किटेक्चर

Google ने ऐसी साझा तकनीकें बनाईं जिससे टीमें स्वतंत्र रूप से तेजी से काम कर सकें:

-

Borg (Google का इंटरनल कंटेनर सिस्टम, Kubernetes का पूर्वज)

-

BigTable, MapReduce, बाद में TensorFlow

-

A/B टेस्टिंग टूल्स और डेटा डैशबोर्ड

⚙️ हर टीम को अपने लिए सब कुछ नहीं बनाना पड़ा—सिस्टम पहले से मौजूद थे।

5. पारदर्शी संवाद और साप्ताहिक बैठकें

-

TGIF मीटिंग्स: संस्थापक सीधे दुनिया भर के कर्मचारियों से सवाल लेते थे

-

आंतरिक चर्चा मंच और ईमेल लिस्ट्स

-

रणनीति और निर्णय प्रक्रिया में खुलापन

🗣️ ब्यूरोक्रेसी चुप्पी में पनपती है। Google खुली बातचीत से स्केल हुआ।

6. Alphabet संरचना: ब्यूरोक्रेसी के खिलाफ दीवार

2015 में Google ने खुद को Alphabet Inc. के तहत पुनर्गठित किया:

-

Google केवल एक डिवीजन बना

-

बाकी प्रयोगात्मक प्रोजेक्ट (Waymo, Verily, DeepMind) स्वतंत्र कंपनियाँ बन गए

🧱 Alphabet एक ब्रांड बदलाव नहीं, बल्कि संरचनात्मक नवाचार था—ब्यूरोक्रेसी रोकने के लिए।

7. नेतृत्व जो समय के साथ खुद को बदलता रहा

-

Eric Schmidt: स्केलेबिलिटी और व्यवसायिक अनुशासन लाए, पर इनोवेशन नहीं रोका

-

Larry Page (फिर से CEO): Moonshots और Alphabet की दिशा तय की

-

Sundar Pichai: शांत, संतुलित, कुशल नेतृत्व—Google और Alphabet दोनों के CEO बने

🌍 हर चरण में नेतृत्व भविष्य की तैयारी के साथ बदला गया—संकट के समय नहीं, बल्कि अवसर के लिए।

8. राजनीति नहीं, मेट्रिक्स से निर्णय

-

हर निर्णय डेटा पर आधारित होता है

-

पूरे संगठन में OKRs (Objectives and Key Results) से सभी लक्ष्य स्पष्ट रहते हैं

-

प्रदर्शन और प्रभाव को ज्यादा महत्व दिया जाता है, न कि वरिष्ठता को

📊 ब्यूरोक्रेसी वरिष्ठता देखती है, Google असर देखता है।

9. तेज़ी से विफल होना, जल्दी सीखना

Google ने कई बार विफलता झेली: Google+, Wave, Glass (कंज़्यूमर वर्ज़न) आदि।

लेकिन यही ताकत है—वो विफलता को स्वीकारता है, अगर उससे सीखा जाए।

🧪 ब्यूरोक्रेसी विफलता से डरती है, Google उसमें अवसर देखता है।

🔑 गूगल का सूत्र

Google ने स्केल किया बिना ब्यूरोक्रेसी बने, क्योंकि उसने:

✅ टीमों को स्वायत्तता दी

✅ साझा तकनीकी ढांचा बनाया

✅ संवाद को पारदर्शी रखा

✅ प्रयोगशील संस्कृति को प्रोत्साहन दिया

✅ स्पष्ट नेतृत्व में बदलाव किया

✅ समय रहते ढांचा फिर से बनाया

💬 अंतिम विचार

"स्केल इनोवेशन का दुश्मन नहीं है—ब्यूरोक्रेसी है।"

Google ने समझा कि ग्रोथ से जटिलता आती है। लेकिन उन्होंने इसे नियमों और स्वीकृति प्रक्रिया से नहीं, बल्कि ऐसे सिस्टम बनाकर नियंत्रित किया जो स्वतंत्रता और नवाचार को बढ़ावा देते हैं।

इसलिए, आज 100,000+ कर्मचारियों के साथ भी, Google नए फीचर्स (Gemini), नए प्रोडक्ट (Bard), और भविष्य की टेक्नोलॉजी (Quantum, Robotics, AI) पर दांव लगा सकता है।

यह जादू नहीं है—यह है आर्किटेक्चर किया गया एगिलिटी।